(Bloomberg) — Stocks in Asia rose Friday after robust US jobs and spending data eased recession concerns, fueling a rally in stocks and sending bonds tumbling.

Equity benchmarks in Japan climbed over 2% at the open, while shares in Australia increased alongside those in South Korea. US futures contracts edged higher after the S&P 500 and tech-heavy Nasdaq 100 both rose, as retail sales data beat estimates and jobless claims hit the lowest since early July.

The Wall Street gains reflected an easing of worries that the US economy is heading into a recession. Global stocks have largely erased the losses seen last week on signs that the Federal Reserve is considering rate cuts.

The “stronger-than-expected retail sales figure quiets some of the fears the US may be slipping into a recession,” said Bret Kenwell at eToro. “Investors and consumers want inflation to go lower — but not at the expense of the economy.”

Treasuries in Asia were steady after a Thursday slump that tracked expectations for less aggressive Fed easing. Swaps market pricing now has three 25 basis point cuts priced in across the Fed’s remaining 2024 meetings, down from the four expected earlier in the week.

The surge in Treasury yields was led by shorter maturities, while 10-year yields rose eight basis points to 3.91%. An index of dollar strength was steady Thursday. The yen was also flat Friday after weakening against the greenback in the prior session to levels last seen at the start of the month.

Elsewhere in Asia, China’s central bank chief pledged further steps to support the country’s economic recovery, while cautioning that it won’t adopt “drastic” measures.

Meanwhile, Australian sovereign bond yields climbed Friday, partly tracking the move in Treasuries and as the nation’s central bank governor said the Reserve Bank of Australia remains some way off easing monetary policy.

Investors will also be focused on Alibaba Group Holding Ltd., which posted an anemic 4% rise in revenue after its Chinese commerce business shrank, and JD.com Inc, which beat net profit estimates in results released late Thursday.

US Rally

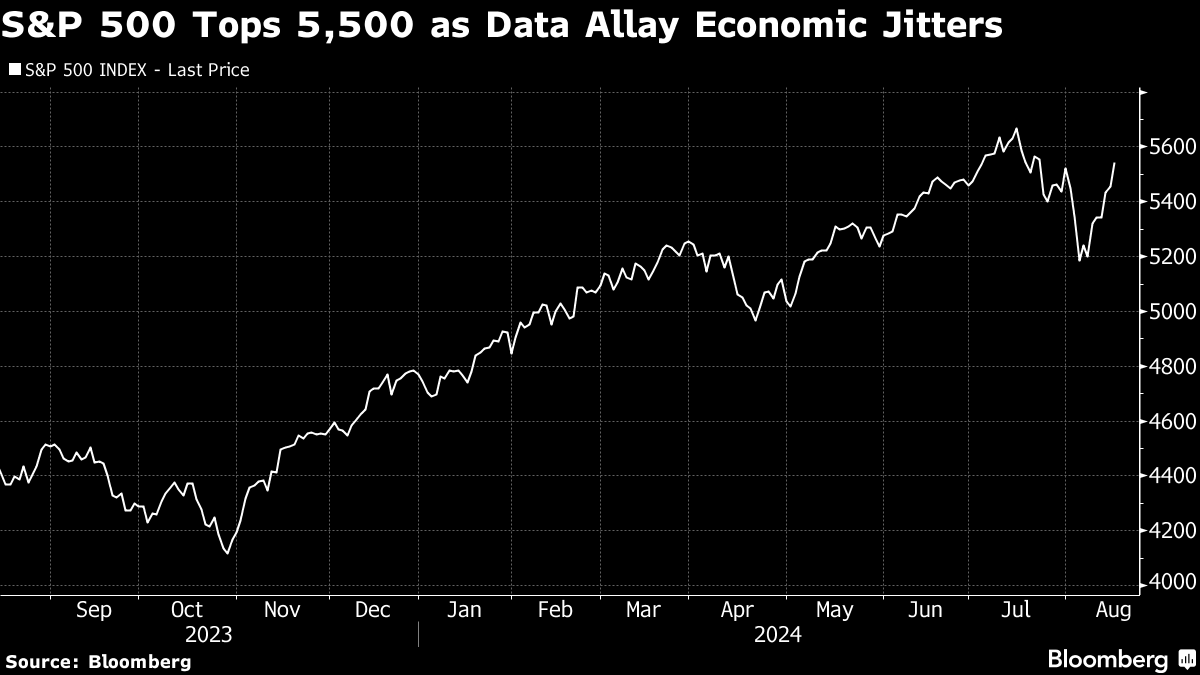

The S&P 500 extended a six-day rally to 6.6% on Thursday — the best performance in such a span since November 2022. The Russell 2000 index of smaller firms climbed 2.5%. Wall Street’s “fear gauge” – the VIX – dropped to around 15. The rebound for US stocks from the heavy selling last week indicates trend-following quant funds may return, adding further support to stocks.

Walmart Inc. — a barometer of growth — jumped on a solid outlook. Applied Materials Inc., the largest US maker of chip-manufacturing equipment, gave a sales forecast in late US hours that met estimates.

US officials have been trying to use higher rates to ease inflation without causing the economy to contract — a scenario known as a “soft landing.” Fed Bank of St. Louis President Alberto Musalem said the time is approaching when it will be appropriate to cut rates. His Atlanta counterpart Raphael Bostic told the Financial Times he’s “open” to a reduction in September.

“A soft landing is no longer a hope. It’s becoming a reality,” said David Russell at TradeStation,. “These numbers also suggest that recent market volatility wasn’t really a growth scare. It was just normal summer seasonality amplified by moves in the currency market.”

In commodities, gold was steady early Friday at around $2,456 per ounce, while oil edged lower following Thursday’s gains.

Key events this week:

- Japan tertiary index, Friday

- US housing starts, University of Michigan consumer sentiment, Friday

- Fed’s Austan Goolsbee speaks, Friday

- Canada housing starts, Friday

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 9:09 a.m. Tokyo time

- Hang Seng futures rose 1.1%

- Japan’s Topix rose 2.2%

- Australia’s S&P/ASX 200 rose 0.8%

- Euro Stoxx 50 futures rose 1.9%

Currencies

- The Bloomberg Dollar Spot Index was little changed

- The euro was little changed at $1.0974

- The Japanese yen was little changed at 149.16 per dollar

- The offshore yuan was little changed at 7.1812 per dollar

- The Australian dollar was little changed at $0.6613

Cryptocurrencies

- Bitcoin rose 1.4% to $57,477.68

- Ether rose 0.8% to $2,570.67

Bonds

- The yield on 10-year Treasuries was little changed at 3.92%

- Japan’s 10-year yield advanced 1.5 basis points to 0.830%

- Australia’s 10-year yield advanced eight basis points to 3.96%

Commodities

- West Texas Intermediate crude fell 0.4% to $77.88 a barrel

- Spot gold was little changed

This story was produced with the assistance of Bloomberg Automation.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

. Read more on Markets by NDTV Profit.