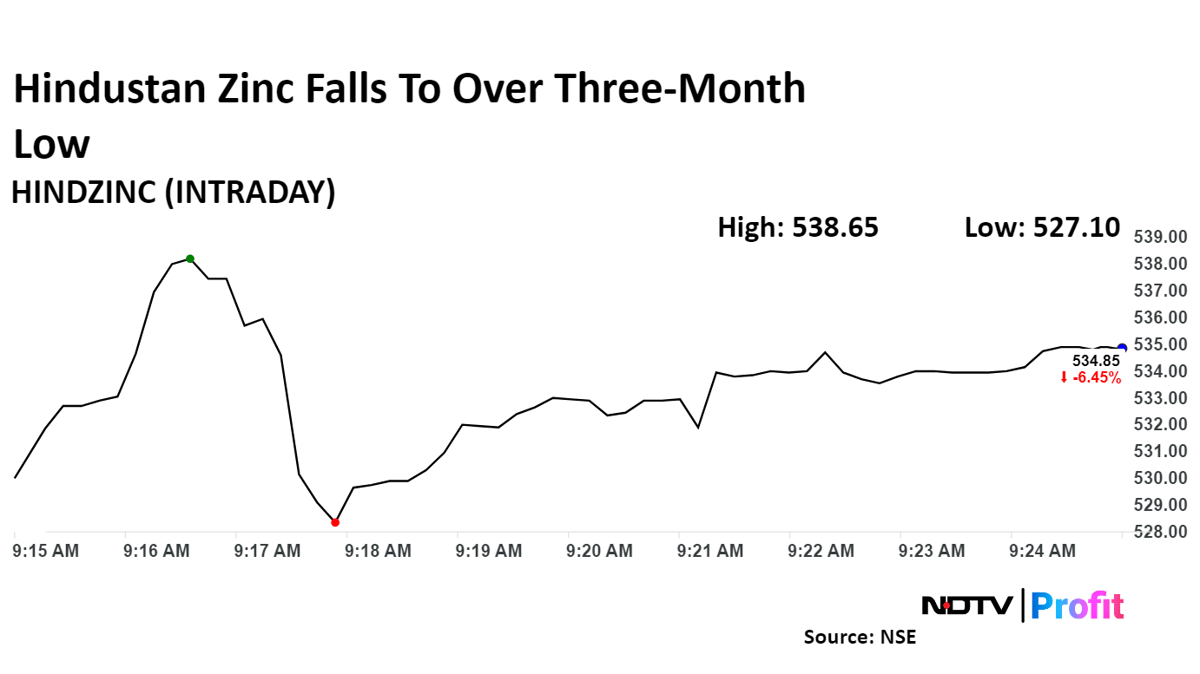

Shares of Hindustan Zinc Ltd. dropped to their lowest level in over three months on Friday after Vedanta Ltd. plans to sell a 3.31% stake in the company through an offer-for-sale.

Vedanta will sell up to 13.37 crore shares of its subsidiary Hindustan Zinc via offer sale at a floor price of Rs 486 apiece, the companies said in an exchange filing on Wednesday.

The offer will be open on Friday and Monday. Non-retail investors will place their bids on Friday, and retail investors can place their bids on Monday, Hindustan Zinc said.

As of June 30, Vedanta owns 64.92% of equity in Hindustan Zinc, according to data on the National Stock Exchange's website. Hindustan Zinc has a total of 4,22.53 crore of outstanding shares.

Vedanta Approves Increase In Stake Sale Of Hindustan Zinc Via OFS

Shares of Hindustan Zinc declined 7.81% to Rs 423.25, the lowest level since May 13. It pared losses to trade 5.76% lower at Rs 538.80 as of 10:09 a.m., compared to 0.63% advance in the NSE Nifty 50 index.

The stock gained 71.48% in the last 12 months and 69.16% on year to date basis. Total traded volume so far in the day stood at 14 times its 30-day average. The relative strength index was at 29.42, which implied the stock is oversold.

Out of 12 analysts tracking the company, one maintains a 'buy' rating, two recommend a 'hold,' and nine suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies a downside of 27.0%.

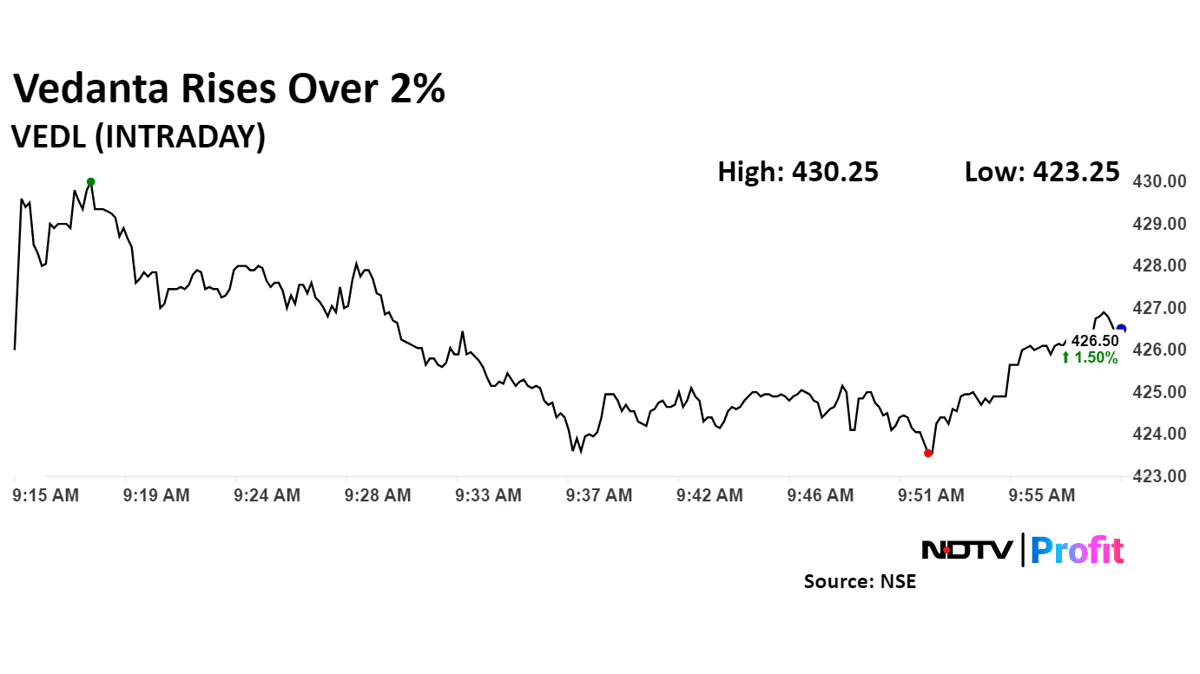

Vedanta Ltd. rose 2.39% to Rs 430.25, the highest level since Aug 14. It was trading 1.11% higher at Rs 424.80 as of 10:13 a.m., compared to 0.61% advance in the NSE Nifty 50 index.

The stock gained 79.47% in 12 moths and 64.2% on year to date basis. Total traded volume so far in the day stood at X.X times its 30-day average. The relative strength index was at 43.97.

Out of 13 analysts tracking the company, seven maintain a 'buy' rating, five recommend a 'hold,' and one suggests a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 11.8%.

Stock Market Live: Nifty, Sensex Up 1% As Banks, IT Stocks Lead Gains. Read more on Markets by NDTV Profit.