The larger market texture is bullish but buying on dips and selling on rallies will be the ideal strategy for day traders, according to analysts.

With a bullish candle, the Nifty has filled its bearish gap zone and is now heading towards 24,870—the target of range breakout—with the downside being shifted higher to 24,590, according to Aditya Gaggar, director at Progressive Share Brokers.

For day traders now, 24,650/80,600 and 24,575/80,300 are the key support zones for the Nifty, while 24,800/81,000 and 24,835/81,200 will be the crucial resistance areas. However, below 24,575/80,300, traders may prefer to exit long positions, according to Shrikant Chouhan, head of equity research at Kotak Securities.

In intraday charts, the index is holding a "higher-high and higher-low series formation, which supports a further uptrend from the current levels," Chouhan said. "We are of the view that the larger market texture is bullish, but buying on dips and selling on rallies would be the ideal strategy for day traders."

"This week’s Japan inflation data and FOMC minutes will provide insights into future interest-rate trajectories and market trends," Vinod Nair, head of research at Geojit Financial Services, said.

Market Recap

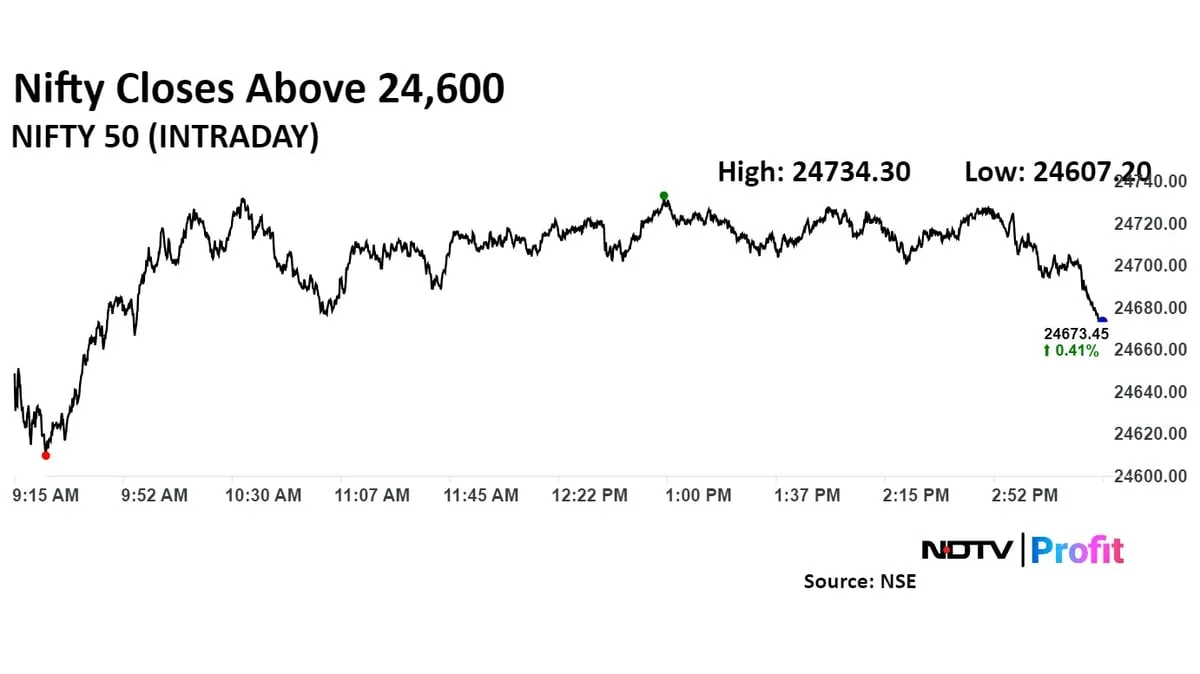

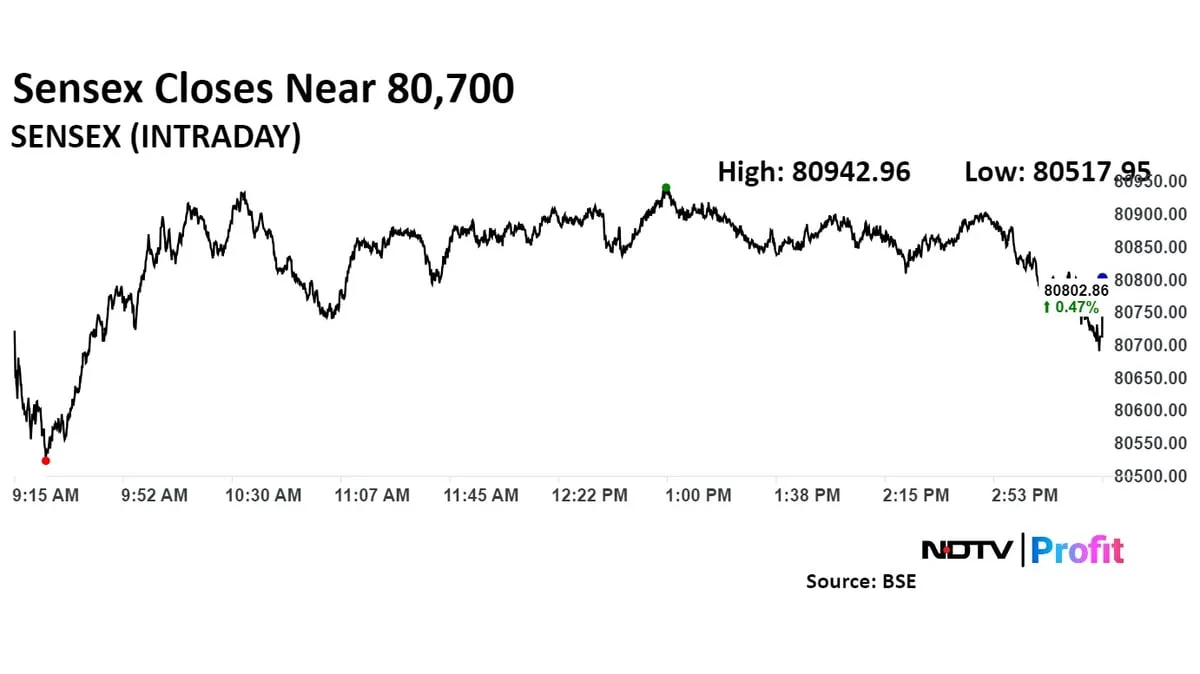

The NSE Nifty 50 extended its gains for a fourth consecutive session and the S&P BSE Sensex continued its rally after a one-day blip to record their highest closing since Aug. 2, as shares of finance and IT companies led the gains.

The Nifty ended 126.20 points or 0.51%, higher at 24,698.85 and the Sensex was 378.18 points or 0.47%, up at 80,802.86. During the day, the Nifty and the Sensex rose as much as 0.6% to 24,734.30 and 80,942.96, respectively.

Shares of Reliance Industries Ltd., Larsen & Toubro Ltd., Axis Bank Ltd., Kotak Mahindra Bank Ltd. and SBI Life Insurance Co. contributed the most to the gains in the Nifty.

Bharti Airtel Ltd., ITC Ltd., Oil & Natural Gas Corp., Adani Enterprises Ltd. and Apollo Hospitals Enterprises Ltd. weighed on the index the most.

Money Market

The Indian rupee closed stronger on Tuesday as the US dollar index and crude oil prices fell.

The currency appreciated 8 paise to close at Rs 83.79 after opening flat at 83.87 against the US dollar, according to Bloomberg data. It closed at 83.87 on Monday.

Foreign Inflows Into Indian Debt Tops Rs 1 Lakh Crore, Equity Lags On Valuation Concerns. Read more on Markets by NDTV Profit.