Table of Contents

Jefferies Preview On India Midcaps Q2

Jefferies estimates a modest Q2FY25 for our SMID coverage, with 13% year-on-year PAT growth. It said that while B2C & rural offtake is likely weak, B2B traction seems steady. The brokerage estimates healthy volumes in Polycab, Finolex cables, Supreme Industries and Astral and strong year-on-year traction in Kaynes and Dixon led by strong order book and customer adds.

For Crompton, it has estimated 6% YoY sales growth due to higher B2C mix and Pidilite on likely price rollbacks. Festive demand will be key to watch out for, it said.

Bernstein Downgrades India To 'Underweight'

Bernstein has downgraded India to 'Underweight' on higher valuations and potential market vulnerability. The brokerage also noted that the pace of rating & earnings downgrades are increasing and said only utilities, tech, and energy are showing some rise in rating & earnings upgrades. The brokerage said that it finds SIP flow showing signed of moderation

Strategy for Indian markets

The brokerage prefers quality, low volatility, and large caps and suggests reducing exposure towards high volatility stocks along with reducing exposure towards small and mid caps. The brokerage firm believes earnings cycle heading towards downgrade.

Ratan Tata, Former Tata Group Chairman, Passes Away At 86

Ratan Tata, the Indian business leader who served as chairman of the Tata Group from 1991 to 2012, has passed away on Wednesday. He was 86. Born on Dec. 28, 1937, in Bombay (now Mumbai), Tata graduated from Cornell University in 1962 with a degree in architecture and later attended Harvard Business School.

Maharashtra Chief Minister Eknath Shinde on Wednesday said industrialist Ratan Tata will be accorded a state funeral. Talking to reporters, Shinde said Tata's relatives have informed that his mortal remains will be kept at the NCPA in south Mumbai from 10 am to 4 pm on Thursday for people to pay respect.

Click here to read more.

Stocks To Watch Thursday

Bharat Petroleum Corp‘s stock is expected to rise after the announcement of Andhra Pradesh Chief Minister N. Chandrababu Naidu regarding investment of Rs 85,000 crore on a refinery in the state. Adani Enterprises share price will react to the fund raise news. While Star Health and Allied Insurance Co is likely to fall after data breach issue. Britannia Industries will rise on opening cheese factory in Ranjangaon, Maharashtra, dedicated to producing The Laughing Cow products and GR Infraprojects will rise on the news of order win.

Click here to read more.

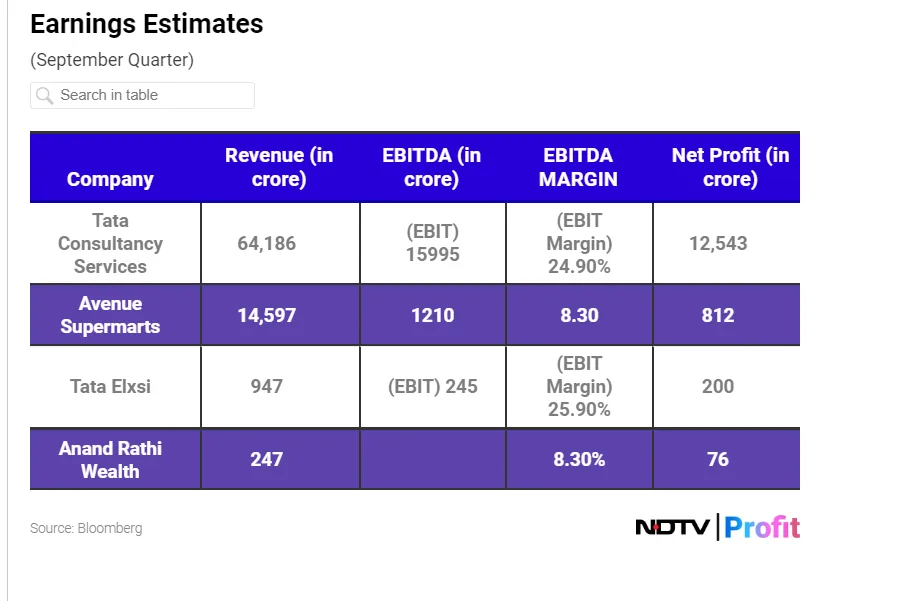

Quarterly Earnings Begin: TCS, Avenue Supermarts In Focus

Tata Consultancy Services Ltd., DMart-parent Avenue Supermarts Ltd., Tata Elxsi Ltd. and Anand Rathi Wealth will kick-start the earnings season for the second quarter.

Earnings Post Market Hours On Wednesday

GTPL Hathway- Q2FY25 (Consolidated, YoY)

-

Revenue at up 9.8% Rs 855.56 crore vs Rs 779.20 crore

-

Ebitda down 13.64% at Rs 107.37 crore vs Rs 124.32 crore

-

Margin at 12.55% vs 15.95% down 340 bps

-

Net profit down 61.69% at Rs 13.74 crore vs Rs 35.87 crore

Western Carriers Q1FY25 (Consolidated, YoY)

-

Revenue up 5.26% at Rs 422.71 crore vs Rs 401.57 crore

-

Ebitda up 13.22% at Rs 35.46 crore vs Rs 31.32 crore

-

Margin at 8.38% vs 7.79% up 58 bps

-

Net profit up 8.24% at Rs 18.9 crore vs Rs 17.46 crore

GTPL Hathway Q2 Results: Net Profit Plunges Nearly 62%

Gold Price Update: Trades Flat After Falling For Six Sessions

Comex Gold December futures contract traded flat at $2,626.60after it fell for the sixth straight session Wednesday amid advancing dollar and less expectations for a larger rate cut in November.

Macquaire's Preview On Q2 Earnings

Macquarie continues to see earnings expectations fatigue and downside to the consensus forecast and sees more misses than beats in 2Q, particularly in sectors including consumer discretionary, materials and financials. It said it continues to forecast a 15% two-year EPS CAGR for MSCI India. On revenue side it sees limited potential for positive surprises following sharp upward revisions and on margins side it sees upside potential in IT. Margins side concerns about the operating leverage gains assumed for Autos and Industrials, it said.

Oil Price Update: Brent Crude Trades Higher

November futures contract of the WTI Crude traded 0.4% higher at 7:32 a.m. at $73.53 a barrel and Brent Crude December futures rose 0.4% to $76.88 a barrel.

On Wednesday, it had closed lower amid uncertainty over the middle east conflict, which has been driving the rally in prices.

RIL’s Q2 Earnings To See Rough Weather On High Crude Oil Supply, Says Morgan Stanley

Asia Market Open: Indices Higher Ahead Of US CPI

Indices in the Asia were higher at open tracking record closing of the Wall Street as investors await US CPI data. At 7:18 a.m., Japan's Nikkei was 0.5% higher, Hong Kong's Hang Seng rose more than 2%, and Australia's ASX 200 was 0.64% higher.

Asian Stocks Advance As Wall Street Soars To Record Ahead Of CPI Data

US Market Close: S&P 500, Dow Jones End At Records

Indices in the US ended higher Wednesday as traders prepared for inflation data. On Wednesday, the S&P 500 at 5,792.04 and Dow Jones Industrial Average settled 1.03% higher at 42,512, there highest close. Nasdaq Composite ended 0.71% up. The US September’s CPI report, due Thursday, will provide clues for Fed action.

GIFT Nifty Trades Above 25,200; BPCL, Star Health, Vedanta In Focus: Stock Market Live

GIFT Nifty was trading at 25,206.50 up by 18 points or 0.1% as of 06:31 a.m. and share prices of BPCL, Star Health, Vedanta, and Britannia India will be in focus tracking news flow.

On Wednesday, India's benchmark equity indices were back in the red after one session of ending higher as they erased gains in the last hour to close near Wednesday's lowest levels.

Intraday, the indices had risen as much as around 1.2% after the RBI's monetary policy meeting changed the liquidity stance to 'neutral' from 'withdrawal of accommodation earlier, signalling a potential rate cut. The weekly futures contract of Nifty Bank closed flat on expiry day.

The Nifty ended 0.12% or 31.20 points lower at 24,981.95 and Sensex lost 0.21% or 167.7 points down at 81,467.10.

Overseas investors remained net sellers of Indian equities for the eighth consecutive session on Wednesday, while domestic institutional investors bought stocks worth Rs 3,508.61 crore.

According to provisional data from the National Stock Exchange, FPIs offloaded stocks worth Rs 4,562.71 crore.

The Indian rupee closed flat at 83.96 against the US dollar.

. Read more on Markets by NDTV Profit.