IPO-bound Swiggy is four to six quarters behind peer Zomato Ltd., as highlighted by key metrics in the food delivery and quick commerce businesses, Macquarie has said.

Swiggy's Gross Order Value is approximately 26.5% lower than Zomato's, with Swiggy recording a GOV of $820 million in the first quarter of fiscal 2025, compared to Zomato's $1,116 million during the same period in the food delivery segment.

While Swiggy has a monthly transacting user base of 14 million, Zomato leads with 20 million users, according to the brokerage report. Despite this, both platforms show similar order frequency and Swiggy's average order value is slightly higher. Swiggy's contribution margin is lower than Zomato due to higher discounts.

In terms of quick commerce, Blinkit (owned by Zomato) has outperformed Swiggy's Instamart, with a monthly transacting user base of 7.6 million compared to Instamart's 5.2 million. Blinkit has also reached adjusted Ebitda margin breakeven, while Instamart remains loss-making, the brokerage noted.

Swiggy Versus Zomato – Sizing Up The Giants: Motilal Oswal

As Swiggy prepares for its public listing in November 2024, it faces the challenge of improving its metrics to close the gap with Zomato.

The company has submitted an updated draft red herring prospectus to the Securities and Exchange Board of India for review and public comment. It is aiming for a valuation of approximately Rs 83,365 crore, or nearly $10 billion.

Following the conversion of all preference shares issued to investors prior to the draft filings, Swiggy will have a total of 222.30 crore equity shares, each with a face value of Re 1.

Just days before the filing, investors transferred shares at prices ranging from Rs 330 to Rs 375 per share, which values the company between Rs 73,811 crore and Rs 83,365 crore. The initial public offering size is projected to be between Rs 9,864 crore and Rs 10,700 crore.

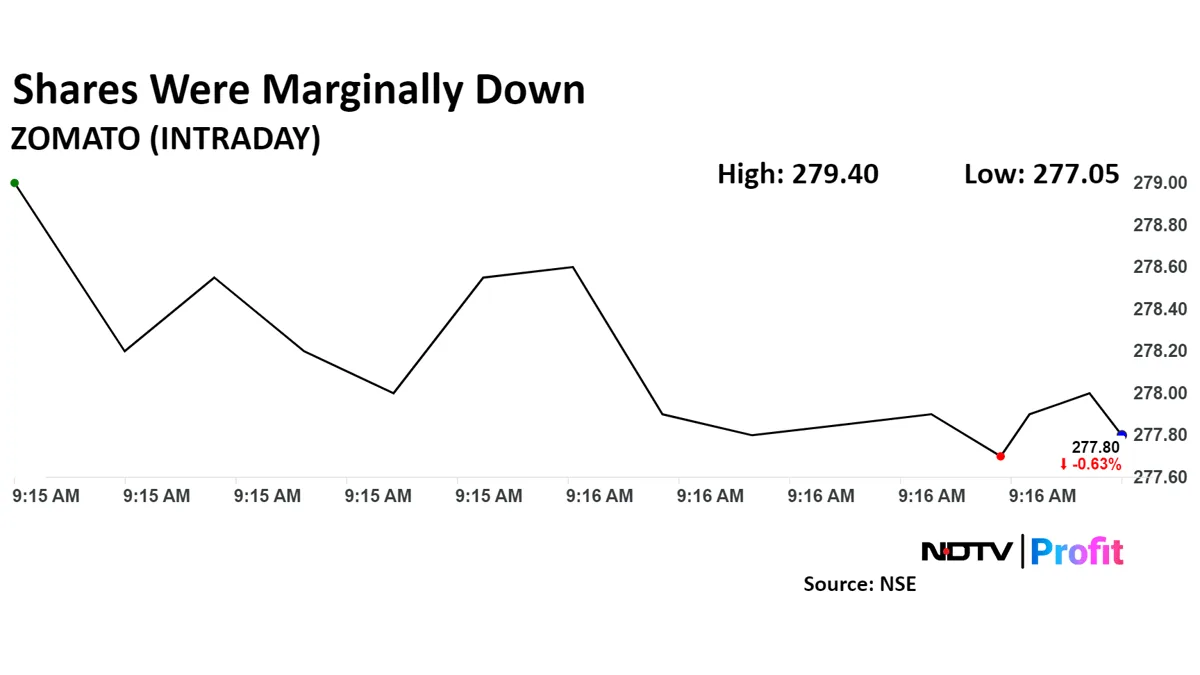

Meanwhile, shares of Zomato opened lower on Wednesday.

Swiggy Vs Zomato: How The Food Delivery Giants Stack Up Against Each Other

Zomato Share Price Today

Zomato's share price fell as much as 0.89% before paring loss to trade 0.55% lower at Rs 278 apiece, as of 09:19 a.m. This compares to a 0.13% decline in the NSE Nifty 50.

The stock has risen 149.33% in the last 12 months. Total traded volume so far in the day stood at 0.03 times its 30-day average. The relative strength index was at 53.

Out of 27 analysts tracking the company, 24 maintain a 'buy' rating and three suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 2.7%.

Stock Market Live: Nifty, Sensex Extend Fall As Infosys, Nestle Share Prices Decline. Read more on Markets by NDTV Profit.