Shares of Indian Overseas Bank jumped over 3% in the final hour of trading on Wednesday after the public sector lender declared its financial results for the quarter ended Sept. 30, 2024.

The bank's standalone net profit during this period rose 24% to Rs 777 crore, compared to Rs 625 crore in the year-ago period.

The net interest income—the difference of interest earned and interest paid—came in at Rs 2,538 crore. This marked a jump of 8% as against Rs 2,346 crore in the corresponding quarter of the previous fiscal.

IOB's asset quality also improved during the quarter under review, with the gross non-performing assets ratio declining to 2.72% from 2.89% in the April-June period. In absolute terms, the gross NPA slipped to Rs 6,249 crore from Rs 6,648 crore in the first quarter.

The net NPA ratio also improved by 40 basis points to 0.47% from 0.51% in the preceding quarter. In absolute terms, the net NPA slipped to Rs 1,059 crore from Rs 1,154 crore.

In the June quarter, IOB had logged a 26% year-on-year jump in its net profit at Rs 633 crore. Its net interest income during the period climbed 28.64% YoY to Rs 1,033 crore.

Indian Overseas Bank Raises MCLR By Five Basis Points

Indian Overseas Bank Share Price

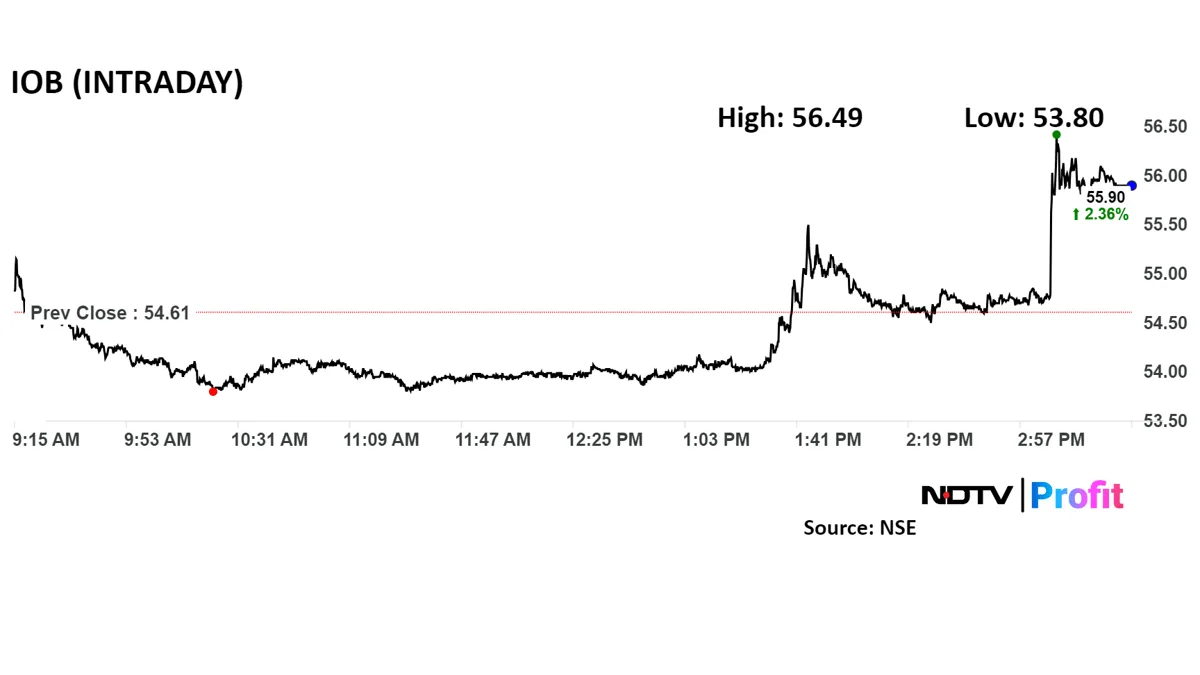

Shares of IOB, which were nearly flat before the second quarter results were declared, witnessed a sharp spike after the financial performance was disclosed. The scrip jumped to an intraday high of Rs 56.49 apiece on the NSE, up 3.44% against the previous day's close.

At close of the market hours, IOB shares pared some of the gains to settle 2.36% higher at Rs 55.9 apiece on the NSE. In comparison, the benchmark Nifty declined by 0.88%.

The stock is up by 29.1% over the past 12 months, and 26.1% on a year-to-date basis.

Q2 Results Today: Infosys, Wipro, Axis Bank, Havells And Polycab Earnings To Be In Focus On Oct. 17. Read more on Markets by NDTV Profit.