Table of Contents

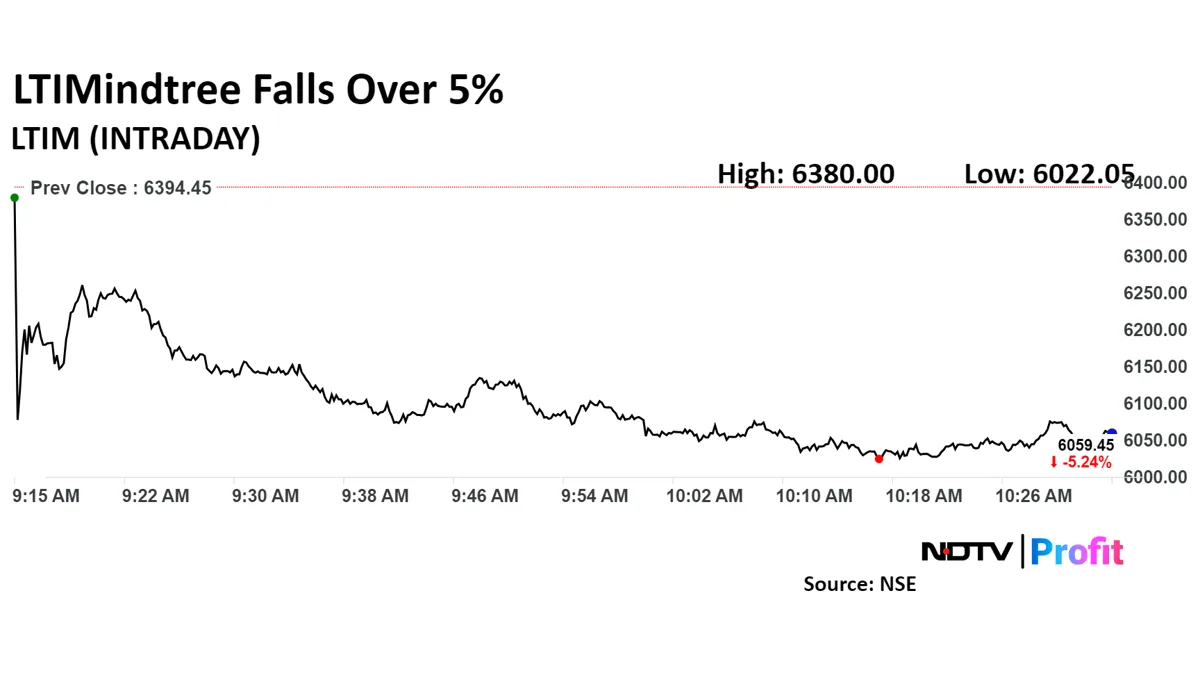

LTIMindtree Falls The Most Since January After Q2 Results As Brokerages Concerned On Margins

LTIMindtree Ltd. recorded their worst fall since January a day after detailing its Sept. quarter results as several brokerages raised concerns over the company's margins.

LTIMindtree declined 5.24% down at Rs 6.059.45.

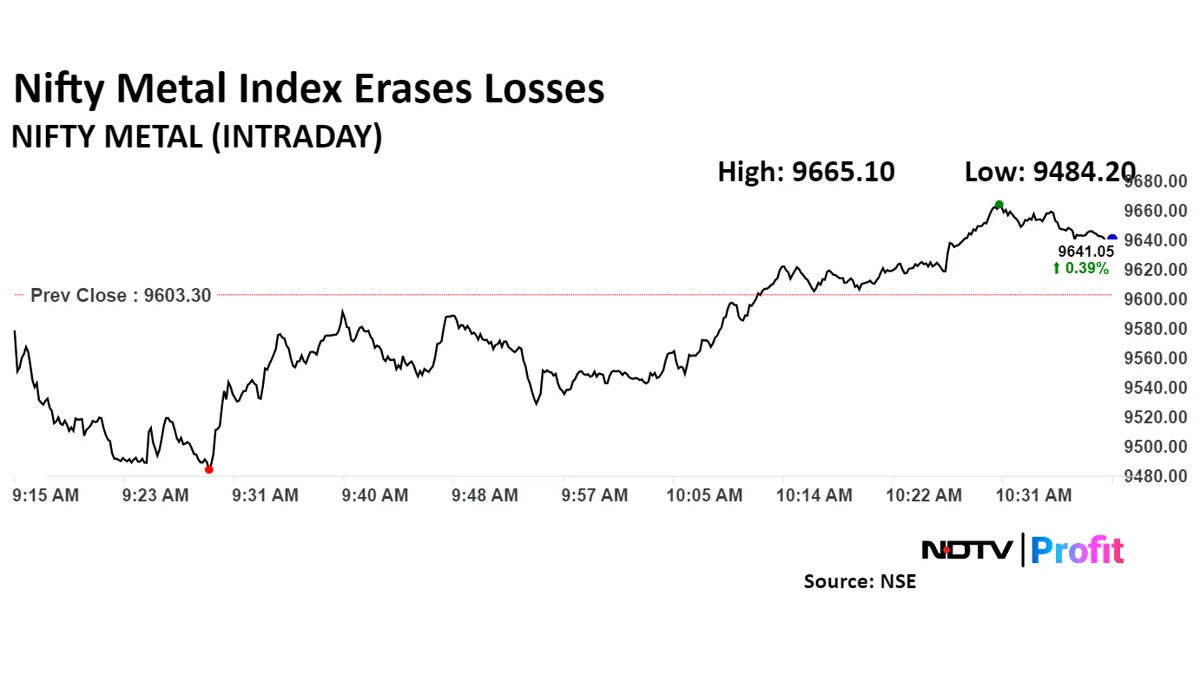

The NSE Nifty Metal index erased losses as Tata Steel Ltd. and JSW Steel share prices rose. The index also draw support for improved sentiment for metal companies after the China's economy showed signs of recovery.

The Nifty Metal index declined as much as 1.24% to 9,484.20 earlier in the day. The index was trading 0.64% higher at 9,665.30 as of 10:45 a.m.

China reported 4.6% GDP growth in the third quarter compared to 4.5% estimate by a Bloomberg survey. Moreover, data showed China's industrial output grew 5.4% on an annualised basis compared to 4.6% rise estimated, as reported by Bloomberg.

The Nifty Metal index was trading 0.39% higher at 9,641.05.

Quick Heal Tech Q2 Earnings Key Highlights

-

Revenue from operations down 6% at Rs 73.5 crore versus Rs 78.4 crore

-

Ebitda down 73% at Rs 3.1 crore versus Rs 11 crore

-

Margins at 4.2% versus 14%

-

PAT down 68% at Rs 4.1 crore versus Rs 12.9 crore

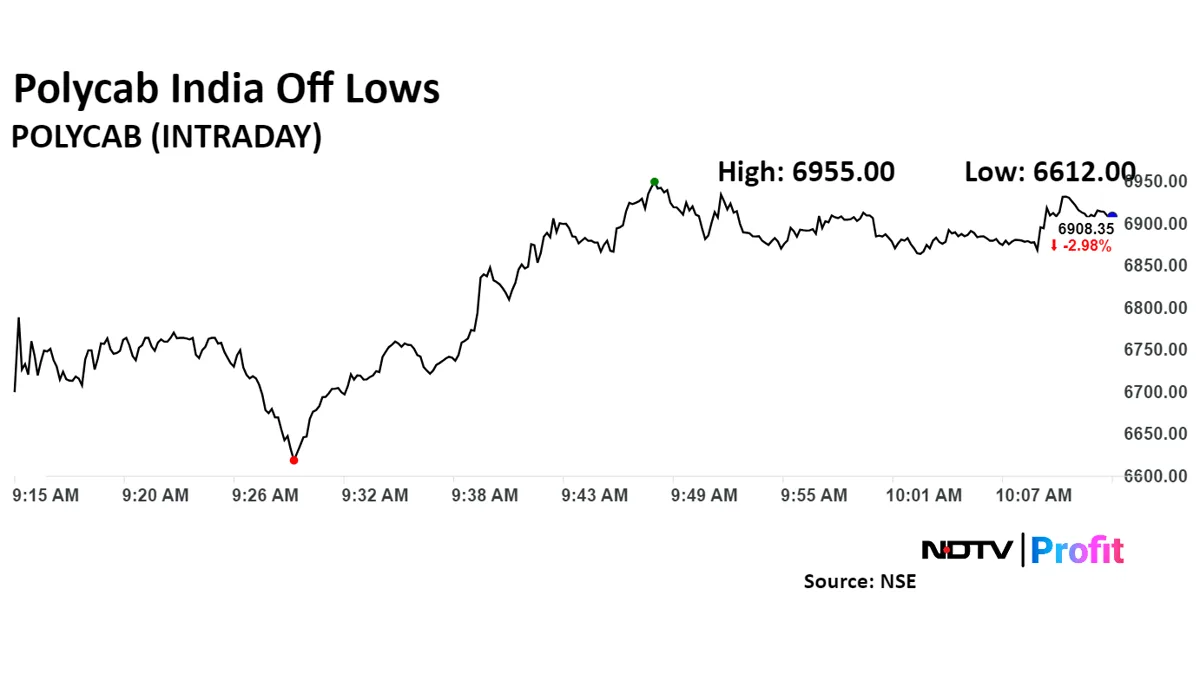

Polycab India Ltd. share price fell over 7% on Friday as the company's operating profit margin fell more than expected due to its weak cable and wire segment. Cable and wire margin was dragged high competition and lower contribution from domestic distribution, and mix change Jefferies said in a note Thursday.

Polycab India share price declined 2.98% to Rs 6,908.35.

Polycab India Q2 Results: Profit Up 4%, Revenue Jumps 30%

Stock Market Live: Gold Futures Hit Record For Second Day

Gold future prices rose to record high for second session in a row on Friday as investors flocked towards the safe–haven asset due to uncertainty over US election, tension in middle east.

The Bloomberg spot gold rose 0.72% to a record high of $2,711.99 an ounce. It was trading 0.65% higher at $2,710.09 an ounce s of 09:59 a.m. IST., according to data from Bloomberg.

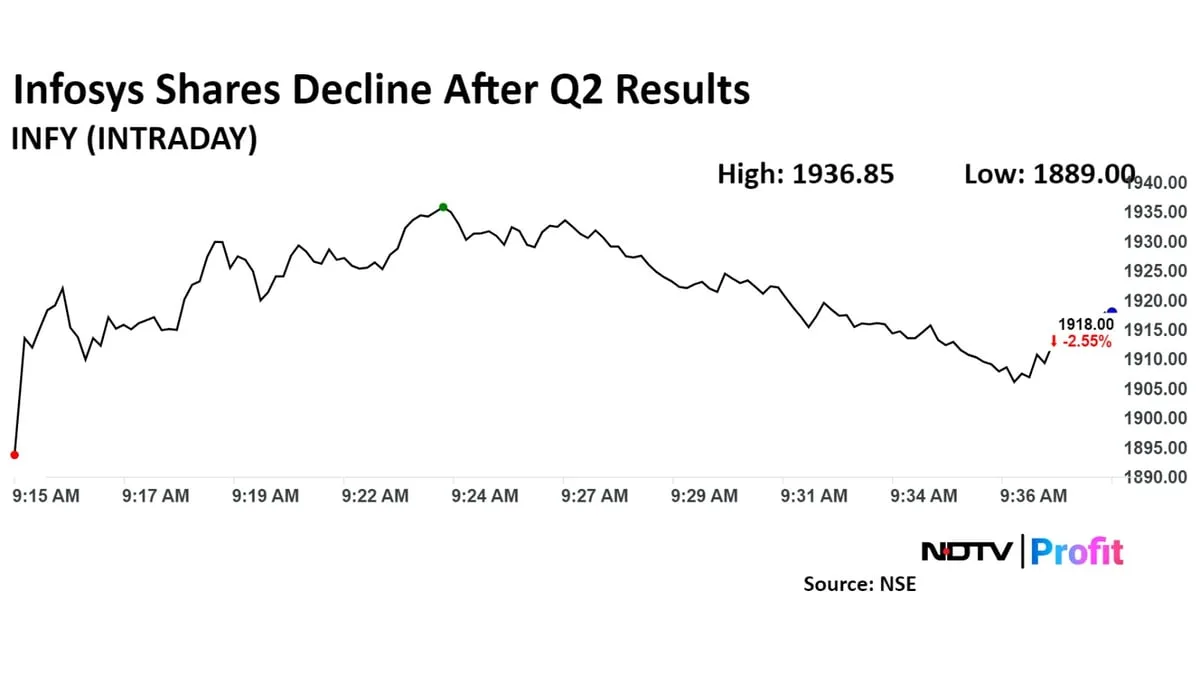

Infosys Ltd. share price declined over 4% on market open on Friday as the company's second quarter results announced a day prior failed to enthuse investors.

Infosys share price declined 2.55% to Rs. 1,936.85.

Infosys Share Price Declines After Q2 Results, Guidance Cues

Sensex, Nifty Open Lower As HDFC Bank, M&M Drag: Opening Bell

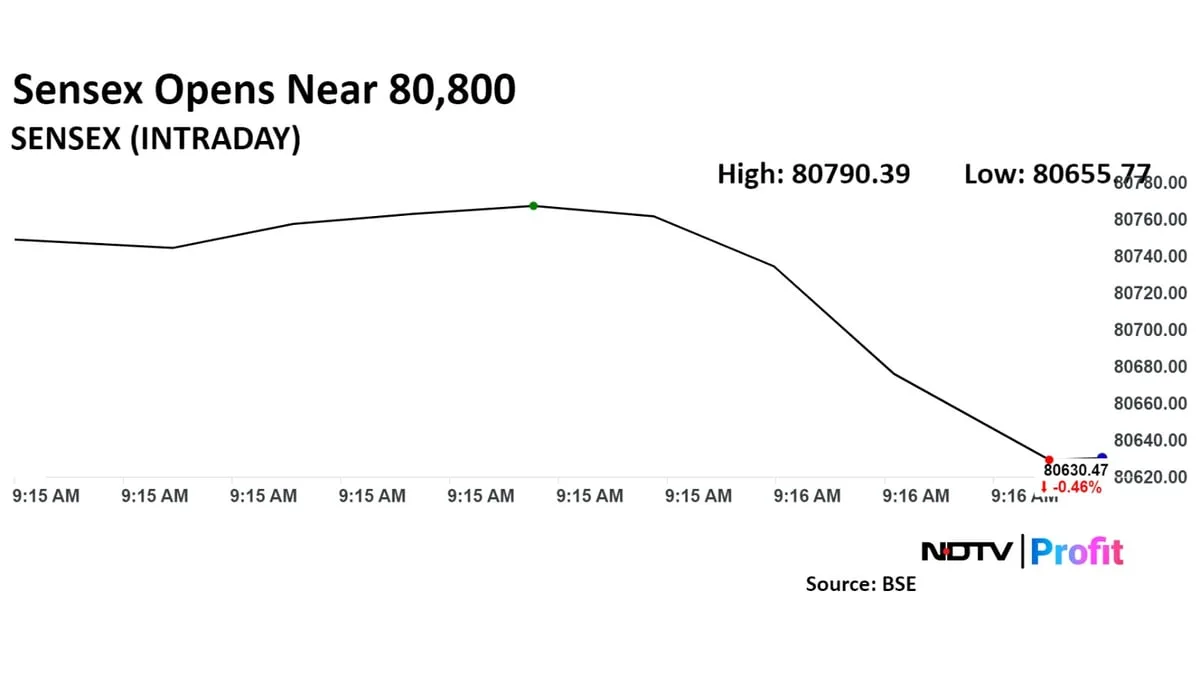

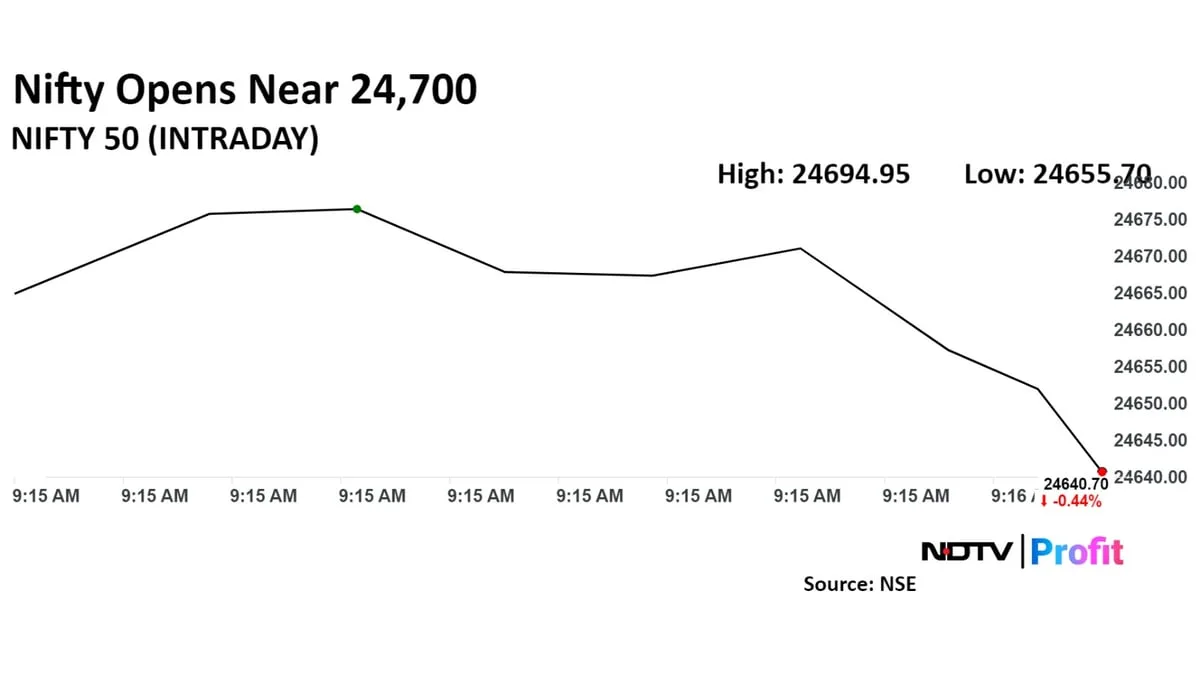

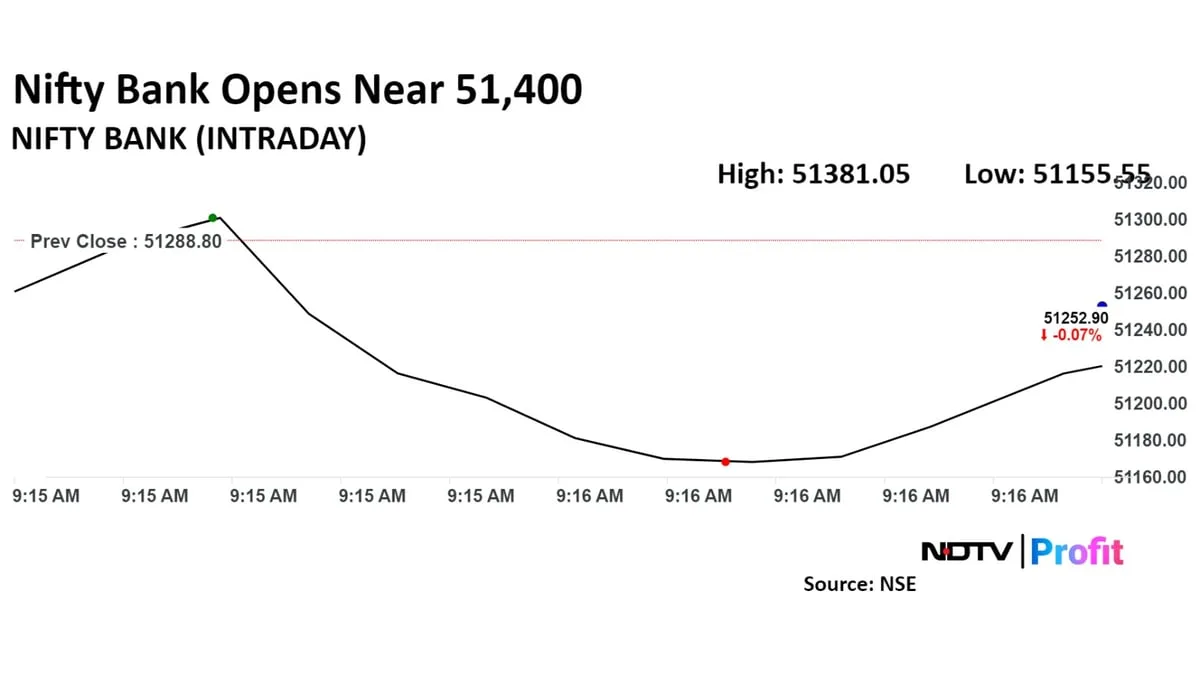

The NSE Nifty 50 and BSE Sensex opened lower on Friday, stretching the losing streak from last three days tracking losses in HDFC Bank Ltd., Mahindra & Mahindra Ltd. share prices. As of 09:17 a.m., the Nifty 50 was trading 117.60 points or 0.48% down at 24,632.25, and the Sensex was 412.26 points or 0.51% down at 80,594.35.

As selling pressure intensified, the Nifty 50 index continued to trend downward, closing in the lower quartile of the trading range, near the critical support level of 24,750, with no signs of recovery during the day, Ameya Ranadive, a senior technical analyst, StoxBox. The zone of 24,750-24,650 acts as a crucial support zone and sustenance above it will be crucial to attracting bullish strength, Ranadive added.

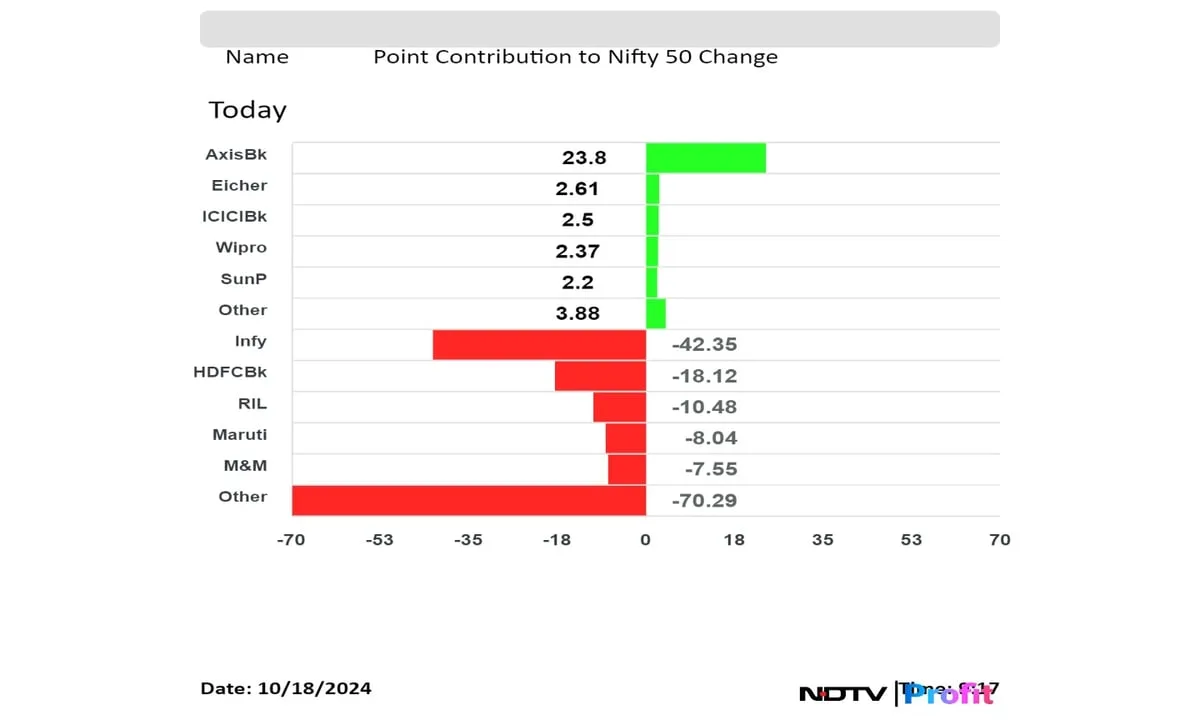

Axis Bank Ltd., Eicher Motors Ltd., ICICI Bank Ltd., Wipro Ltd., and Sun Pharmaceutical Industries added to the NSE Nifty 50 index.

HDFC Bank Ltd., Reliance Industries Ltd., Maruti Suzuki India Ltd., and Mahindra & Mahindra Ltd. weighed on the index.

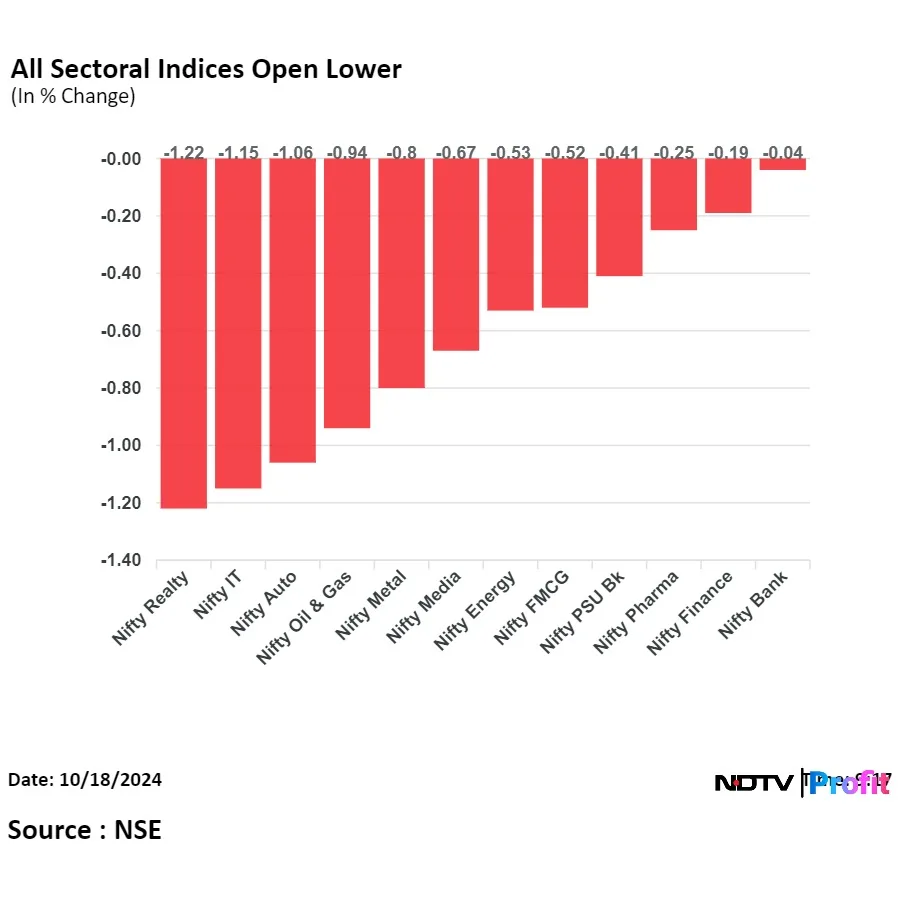

All 12 sectors opened lower on NSE. The NSE Nifty Realty declined the most among other sectoral indices.

Broader markets underperformed benchmark indices. The BSE Midcap and BSE Smallcap indices were trading 1.09% and 1.88% lower, respectively.

On BSE, 19 sectors slumped at open while one was able to trade with marginal gain out of 20. The BSE Consumer Durables declined the most.

Market breadth was skewed in favour of sellers. Around 2,221 stocks declined, 609 stocks advanced, and 111 stocks remained unchanged on BSE.

Stock Market Live: Nifty, Sensex Trade Lower At Pre–Open

At pre–open the NSE Nifty 50 was trading 84.90 points or 0.34% down at 24,664.95, and the BSE Sensex was 494.75 points or 0.61% down at 81,006.61

Yield On The 10-Year Bond Opens Flat

The yield on the 10-year bond opened 1 basis points higher at 6.79%. It closed at 6.78% on Thursday, according to data on Bloomberg.

Rupee Strengthens Against US Dollar

The local currency opened 2 paise higher against the US dollar at 84.05 on Friday. On Thursday, the Indian unit closed at 84.07 a dollar, according to data on Bloomberg

Stock Market Live Updates Today: JSW Energy's Unit In PPA Agreement With MSEDCL

JSW Energy Ltd.'s step-down subsidiaries signed power purchase agreement for 1,200 MW solar-wind hybrid capacity with MSEDCL, the company said in an exchange filing

-

Alert: MSEDCL Stands For Maharashtra State Electricity Distribution Company

The Reserve Bank of India barred Asirvad Microfinance, a subsidiary of Manappuram Finance Ltd. from disbursing loans from Oct 21. Analysts said that this move from the regulator will likely hurt Manappuram Finance's earnings.

RBI has barred total four non–banking financial lenders—Asirvad Micro Finance, Navi Finserv, Arohan Financial Services, and DMI Finance— from disbursing loans. Read More.

Brokerages On Manappuram Finance

Jefferies Downgrades

RBI restrictions on subsidiary Asirvad Microfinance should hurt earnings

Asirvad accounts for 27% of consolidated assets under management

Parent may have to infuse capital if subsidiary’s networth is eroded

Remedial measures and removal of restrictions could take 6 months

Jefferies cut FY25-27 EPS by 11-19%

Morgan Stanley

-

Downgrade to Equal Weight with a target price Rs 170 from 262 earlier, which implied a 4% downside.

-

RBI embargo to hurt profit materially for longer

-

Short tenured loan book to shrink rapidly

-

Credit costs already elevated, funding costs could rise

-

Cut consol earnings forecasts by 20% for FY25, 30% across FY26-27

-

Value at 1x FY27E standalone BV

Morgan Stanley On Tata Chemicals

-

Rated Underweight with target price of Rs 881 potential downside 18%

-

In line earnings but slightly below estimates.

-

Indian margins suffered from adverse weather; US on target, Kenya exceeded expectations.

-

Basic Chemistry EBITDA/ton fell 10% qoq.

-

Rising Chinese production may limit margin growth despite balanced market.

-

Weather issues cut Mithapur output by 30,000 tons of soda ash and 40,000 tons of salt.

-

Weak container glass and lithium carbonate demand offset by strong solar glass; Indian demand stable.

Asia FX Update: Currencies Rise As Dollar Index Eases

Asian currencies rose against the greenback in early trade Friday as the dollar index eased in Asian trade. The index rose on Thursday after US retail sales came higher than expected and jobless claim data fell, which affirmed the expectation the Federal Reserve doesn't need to go aggressive with the monetary easing.

The Thai Baht declined the most against the US dollar to become the worst performing currency on Friday so far. It was trading 0.30% lower at 33.11 a dollar as of 08:13 a.m.

The Japanese yen rose 0.18% to 149.94 a dollar as of 08:13 a.m., according to data on Bloomberg.

Stock Market Live Updates Today: Oil Future Prices Inch Towards $75

Crude oil prices continued to rise Friday as supply outlook bleakened following tenison spiked in the West Asia. The geopolitical tension renewed after Hamas leader Yahya Sinwar's death.

The crude oil was trading 0.27% higher at $74.65 a barrel as of 08:00 a.m.

Bernstein On Infosys

-

Maintain Outperform, Target: Rs 2,270, (earlier Rs 2100), upside 15%

-

Revenue was a beat, Margins in line

-

Continue to see up cycle in large caps IT services

-

Infosys expected to be growth leader driven by improved macro and BFSI

-

Infosys maintained leadership (+2.3% QoQ organic)

-

It grew ahead of TCS and HCLT

US Treasury Yield Jumps On Robust US Economic Data

The yield on the benchmark 10–year US Treasury rose following robust US retail sales data and less than expected jobless claim. The strong data point nudged the expectation of the Federal Reserve going slow with the rate cuts.

The yield on the 10–year US treasury note was trading at 4.093% as of 7:21 a.m. IST.

Stock Market Live Updates Today: Gold Prices Touch Fresh High

Gold prices scaled a fresh high on Thursday as the geo-political tension the West Asia continued to force investors to buy the safe–haven asset.

The Bloomberg spot gold was trading 0.50% higher at $2,706.10 an ounce as of 7:24 a.m.

Stock Market Live: Wipro's Share Price Likely To React As It Delivers Better Than Expected Profit

Wipro Ltd. share price is likely to react in Friday's session as it reported better than expected net profit for July–September. Wipro's net profit rose 6 sequentially to Rs 3,227 crore in the second quarter, against Rs 3,009 crore Bloomberg estimated. To know more about Wipro's second quarter result click here.

Asia Market Update: Most Markets Rise As Traders Assess Japan CPI Data

Most markets in Asia–Pacific rose on Friday as traders assessed latest inflation print from Japan. Japan's CPI for September came at 2.5%, while core CPI at 2.4%.

The Nikkei 225 was 0.21% higher at 38,993.36, while the S&P ASX 200 was 0.72% down at 8,295.60. The KOSPI was was flat at 2,609.25 as of 7:11 a.m.

Stock Market Live: Most US Stocks End Little Change

Most US stocks ended with little change on Thursday following strong US retail sales and jobless claim data, which affirmed underlying resilience of the world's largest economy.

The Dow Jones Industrial Average and Nasdaq Composite indices ended 0.37% and 0.04% higher, respectively. The S&P 500 ended 0.02% down.

The GIFT Nifty was trading near 24,700 on Friday morning. Axis Bank Ltd., Infosys Ltd., and Wipro Ltd. share prices are expected to react because of their earning numbers for July–September quarter. Further, Reliance Industries Ltd., Adani Enterprises Ltd., and Zomato Ltd. share prices will likely move because of the news flow.

The GIFT Nifty was trading 0.43% or 106.50 points lower at 24,753.50 as of 06:30 a.m.

Extending their losses to a third session, NSE Nifty 50 and BSE Sensex ended near two–month low on Thursday. HDFC Bank Ltd., and Bajaj Auto Ltd. share prices declined, which weighed on the indices.

At close, Nifty fell 0.89% or 221.45 points, to 24,749.8 and Sensex ended 0.6% or 494.75 points, lower at 81,006.61. Intraday, the Nifty fell 0.97%, and the Sensex fell 0.7%.

"Looking forward, the market is expected to remain range-bound due to mixed global cues and a lack of domestic triggers," said Siddhartha Khemka, head, Research, Wealth Management, Motilal Oswal Financial Services Ltd.

Nifty, Sensex End Near Two-Month Low; Bajaj Auto, Shriram Finance Top Losers: Market Wrap. Read more on Markets by NDTV Profit.