The benchmark indices Nifty & Sensex settled at over two–month low on Thursday for a third consecutive session, as earnings reported failed to uplift investors’ sentiment. Moreover, a decline in Asian markets and overnight cues from Wall Street also pressured our market.

Market Recap

The Nifty 50 ended 0.15 per cent down at 24,399.40, while the Sensex ended 0.02 per cent lower at 80,065.16.

In Thursday’s choppy session, the benchmark indices recovered briefly. Intraday, Nifty rose 0.18 per cent and Sensex rose 0.22 per cent while Intraday, Nifty fell 0.39 per cent and Sensex declined 0.34 per cent .

The lacklustre weekly expiry trade ended on a negative note and among the sectors, banking indices were the top performers, while correction continued in the FMCG sector, down over 2 per cent in Thursday’s trade and registered as a major laggard, followed by the realty sector.

Disparity was seen in the broader markets where midcaps underperformed while smallcaps more or less moved in tandem with the benchmark indices.

Nasdaq Recovers After Decline; Dow Jones Continues To Be In Red Amid Uncertainties

In terms of support level, nothing has changed, which continues to be at 24,370; and on the flip side, the resistance has shifted lower to 24,560-24,600 points. In case of a breakdown, the index is likely to test the level of 24,200, while a break above the mentioned resistance point will push the index higher to 24,670 levels.

Shares of HDFC Bank, Mahindra & Mahindra, State Bank of India, UltraTech Cement, and ICICI Bank Ltd. supported the Nifty, while those of Hindustan Unilever, ITC, Hindalco Industries, SBI Life Insurance Co, and Infosys weighed on the benchmark indices.

On NSE, six sectors declined, and six sectors advanced. The Nifty FMCG declined the most, and on the contrary, the Nifty PSU Bank rose the most in Thursday’s trading session.

Ashneer Grover Withdraws Plea From NCLT After Settlement With BharatPe

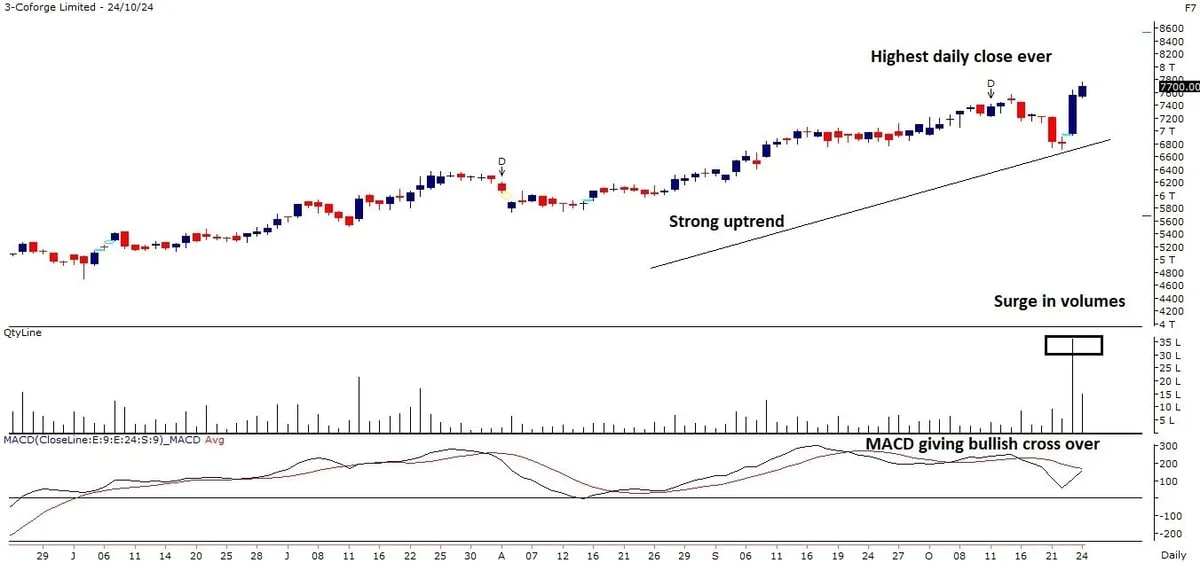

COFORGE – TECHNICAL CALL OF THE DAY

Stock has given a trend line breakout at ATH levels with massive buying interest which suggests a strong upward trend. It is respecting its 20DEMA with slight dips being brought into.

The MACD indicator has given a bullish crossover which could support the upward momentum.

Buy COFORGE CMP 7699 SL 7445 TGT 8190

Hyundai Motor India Stocks Settle Over 4% Higher; Market Valuation Surges ₹1,824 Crore

Top 5 Stocks To Watch Out For October 25

ITC:

-

ITC reported resilient performance amidst a challenging operating environment. The company reported record strong gross revenue growth, which was up 16 per cent on a YoY basis, led by Agribusiness and Hotels.

-

It reported EBITDA growth of 5 per cent on a YoY basis; ex-paper it would have been up by 6.3 per cent YoY. Cigarettes net segment revenue is up 7.3 per cent YoY, while segmental PBIT was up 5.1 per cent YoY.

Privi Speciality Chemicals:

-

The company has registered its best ever quarterly performance, registering a 16 per cent revenue growth on YoY basis crossing Rs 500 crore mark for the first time.

-

Over the past six quarters, the performance has steadily improved, driven by steady demand, operational efficiencies and a better product mix, resulting in 20 per cent + margins. Net profit was up 48 per cent YoY to Rs 44.84 crore during Q2FY25.

GMR Airports:

-

Total income increased to Rs 1,379 crore, up by 10 per cent YoY from Rs 1,254 crore in Q2 FY24. Total income increased by 8.8 per cent YoY to Rs 2,667 crore in H1FY25. EBITDA was at Rs 398 crore in Q2 FY25, down by 0.7 per cent YoY from Rs 401 crore in Q2 FY24.

-

This was driven by revenue share on dividend income declared by DIAL JVs as well as increased employee benefit expense (annual increment). For H1FY25, EBITDA was up 1.5 per cent YoY to Rs 791 crore.

-

Pax traffic increased to 19 million , up by 7.6 per cent YoY from 17.7 million in Q2FY24. Domestic traffic increased by 5.8 per cent YoY while international traffic increased significantly by 12.7 per cent YoY in Q2FY25. In H1FY25, it reached 38.3 million passengers, which was up 7.4 per cent YoY, witnessing highest ever half-yearly traffic in H1FY25.

Oracle Financial Services:

-

Oracle Financial Services revenue for the Quarter stood at Rs 1,674 crore, up 16 per cent YoY while Net Income was Rs 578 crore up 38 per cent YoY. Operating income for the quarter was Rs 724 crore reflecting a jump of 36 per cent YoY.

-

The products business of the company posted a revenue of Rs 1,518 crore, up 17 per cent YoY while the Services business posted revenue of Rs. 156 crore reflecting an uptick of 7 per cent YoY.

Glenmark Lifesciences:

-

Glenmark Life Sciences reports revenue of Rs 506.9 crore for Q2FY25 with Gross margins of 55.6 per cent , up 450 bps on QoQ basis. For H1FY25, the company registered a revenue of Rs 1095.5 crore, a de-growth of 6.7 per cent YoY.

-

EBITDA for H1FY25 was at Rs 307.9 crore, a de-growth of 16.2 per cent YoY while EBITDA margins stood at 28.1 per cent . For Q2FY25, EBITDA was at Rs 142.9 crore and EBITDA margins were at 28.2 per cent , up 20 bps QoQ.

-

PAT for H1FY25 was at Rs 206.8 crore, whereas for the quarter it stood at Rs. 95.3 crore.

Disclaimer: The Free Press Journal assumes no liability for loss or damage, including, but not limited to, lost profits, that may result directly or indirectly from the use or reliance on the opinions, news, investigations, analyses, prices or other information offered in this article.