Share price of IndusInd Bank Ltd. plunged nearly 20% Friday— the worst session since March 2020—after the lender's profit was hit by a 73% sequential increase in its provision on account of rising bad loans.

The lender's bottom line stood at Rs 1,325 crore on a standalone basis during the July-September period, as compared to Rs 2,181 crore in the year-ago quarter.

That came after its provisions for the quarter rose 73% quarter-on-quarter to Rs 1,820 crore. On a yearly basis, provisions rose by 87%.

The bank holds contingent provisions worth Rs 1,525 crore outside its provision coverage ratio due to the challenging business environment, according to Sumant Kathpalia, managing director and chief executive officer, IndusInd Bank.

Total gross non-performing assets were at 2.11% versus 2.02% in the previous quarter.

Outstanding slippages on the microfinance book stood at Rs 2,259 crore, higher than Rs 1,988 crore in the June quarter. Delinquencies in the microfinance book are predominantly from Bihar, Jharkhand and Maharashtra.

The lender received target price cuts from brokerages who cited near-term weakness in operations after the lender’s net profit took a beating. As microfinance institutions’ stress is likely to be high even in third quarter and fee income is running slow for two quarters, Nuvama Institutional Equities reckons that the stock shall underperform, even after the sharp price correction.

Stock Market Live: Nifty Falls Around 2,000 Points From All-Time High; IndusInd Bank Falls 18%

IndusInd Bank Share Price Today

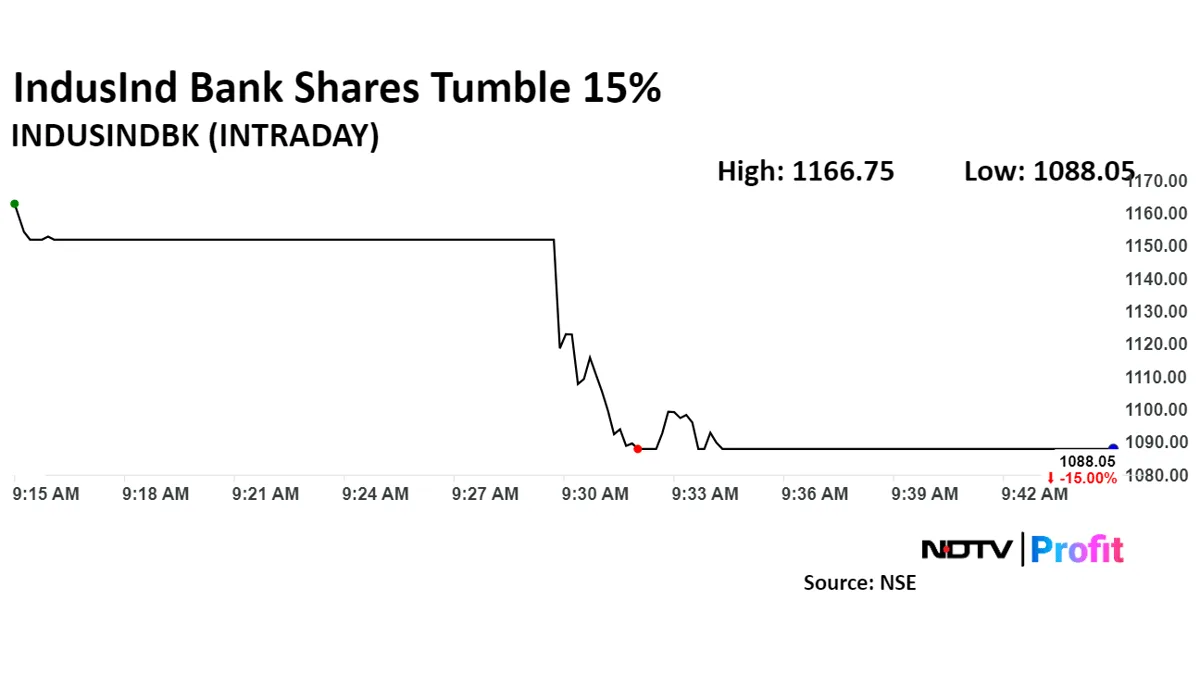

IndusInd Bank's stock fell as much as 19.22% during the day to the lower circuit of Rs 1,034 apiece on NSE, after the 10% and 15% lower circuit was revised. It was trading 17.8% lower at Rs 1,051 apiece, compared to a 0.91% decline in the benchmark Nifty 50 as of 11:25 a.m.

It has declined 21% during the last 12 months and has fallen by 31% on a year-to-date basis. Total traded volume so far in the day stood at 69 times its 30-day average. The relative strength index was at 13, implying the stocks is oversold.

Of the 50 analysts tracking the company, 41 have a 'buy' rating on the stock, eight suggest a 'hold' and one has a 'sell', according to Bloomberg data. The average of 12-month analysts' price targets implies a potential upside of 40%.

ITC Share Price Gains After Q2 Profit Rise. Read more on Markets by NDTV Profit.