Shares of ITC Ltd. rose over 3% after the diversified conglomerate released its financial results for the quarter ending Sept. 30, 2024. The company reported a net profit of Rs 5,078.34 crore for Q2 FY25, a 3% rise year-on-year.

Despite the profit growth, ITC’s operating margin came under pressure, hitting its lowest level in nearly three years. The company’s operating margin contracted by 470 basis points to 32.8%, missing analysts’ expectations by approximately 4 percentage points. This margin decline is the lowest recorded since Q2 of the financial year ending March 2022, when it stood at 32.5%, according to data compiled by NDTV Profit via Bloomberg.

ITC attributed these challenges to a combination of factors, including subdued demand conditions, unusually heavy rainfall in various parts of the country, high food inflation, and a sharp increase in certain input costs.

Even as the net profit rose in the July-September period, it fell short of the Rs 5,154-crore consensus estimate of Bloomberg analysts.

Revenue increased by 16% year-on-year to Rs 19,327.7 crore, compared to Rs 16,550 crore in the same quarter last year. That included a 6.79% increase in cigarette revenue, which rose to Rs 8,177 crore from Rs 7,657 crore a year ago.

Revenue from FMCG, excluding cigarettes, increased by 5.4% to Rs 5,577 crore from Rs 5,291 crore in the corresponding period last year. The Bloomberg analysts had pegged the top line at Rs 18,068 crore.

ITC Q2 Results Review – Margins Fails To Impress; Reduce; Buy On Dips, Says Dolat Capital

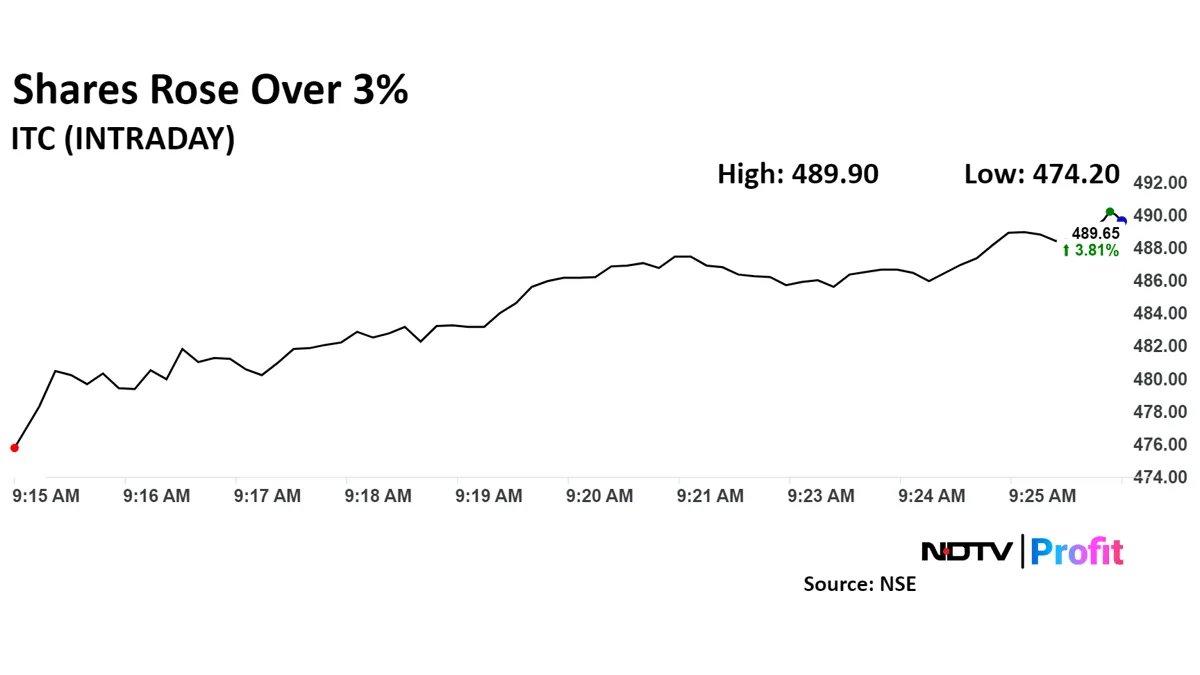

ITC Share Price Today

Share price of ITC rose as much as 3.12% to Rs 486.40 apiece. It pared some gains to trade 3.05% higher at Rs 486.10 apiece as of 09:22 a.m., compared to a 0.01% advance in the NSE Nifty 50.

The stock has risen 12.42% in the last 12 months. Total traded volume so far in the day stood at 0.21 times its 30-day average. The relative strength index was at 42.

Out of 39 analysts tracking the company, 34 maintain a 'buy' rating, three recommend a 'hold' and two suggest 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 13%.

Stock Market Live: Nifty Falls Around 2,000 Points From All-Time High; IndusInd Bank Falls 18%. Read more on Markets by NDTV Profit.