Options traders are betting the US election will trigger a wild move in the Indian stock market.

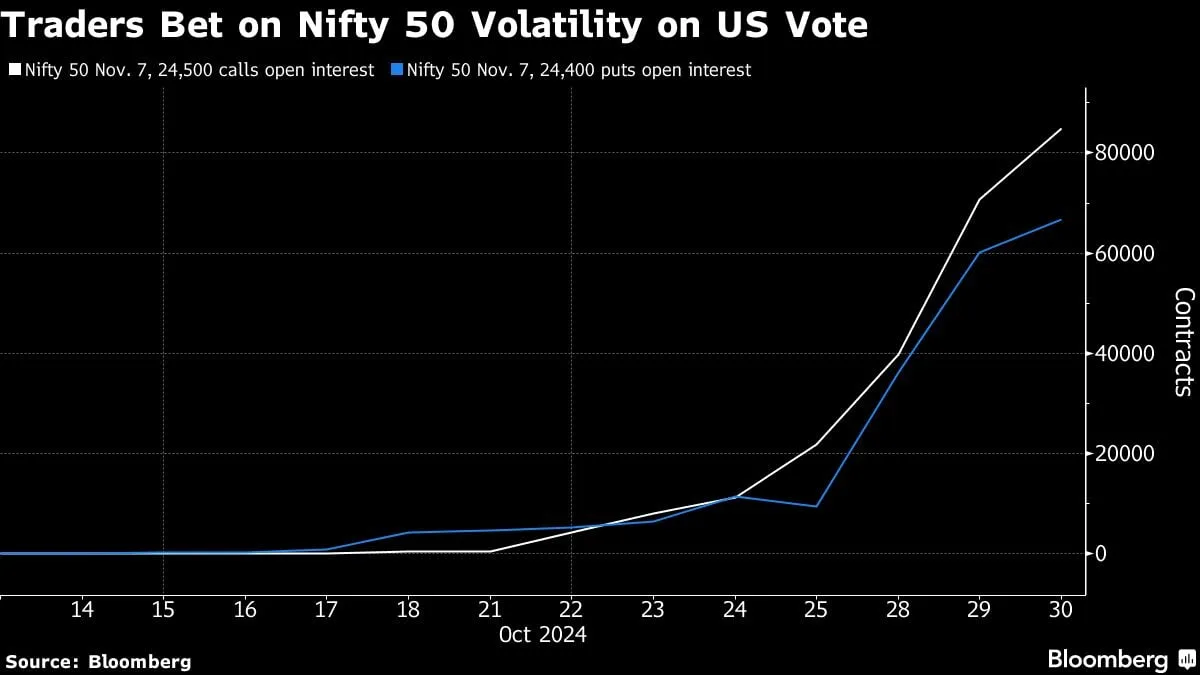

Among the NSE Nifty 50 Index options expiring next week after the vote, calls with an exercise level of 24,500 and 24,400 puts have added more than 60,000 contracts each in the past week, becoming some of the most owned, data compiled by the local exchange and Bloomberg show. This means market players are likely buying strangles — a strategy to wager on volatility — as they position for a “sharp move on either side,” according to Avani Bhatt, senior vice president at JM Financial.

Indian Stocks Headed For Worst Month Since March 2020 Amid Record Exit By Global Funds

The Nifty 50 has slipped more than 7% from its record high last month on concerns over earnings growth at India’s companies, whose reporting season is underway. Meanwhile, a gauge tracking its volatility has climbed 2.7 points this month, the most since May, as traders await the results of the presidential election in the US, India’s biggest trade partner. Most polls show Democratic candidate Kamala Harris running neck and neck with former President Donald Trump.

In a strangle, a trader buys both puts and calls with different strikes but the same expiration date. The fact that the bullish and bearish sides of the current popular trade have similar strikes — 24,500 and 24,400, with the index closing at 24,340.85 on Wednesday — is unusual at this point in the options’ lifespan. It suggests traders don’t have great conviction on the direction the market will take after the US vote.

As the options’ prices have increased with implied volatility rising recently, the contracts will need only a slightly larger move in swings to become profitable.

October First Setback In Six Months In Big Year For Indian Bonds. Read more on Markets by NDTV Profit.