Table of Contents

Consumer companies in India making everything from soaps to cars are sounding the alarm: the urban middle class spending has been languishing for over a year as inflation and unemployment weigh on sentiment.

At least seven of India’s largest companies, including Reliance Industries Ltd.’s retail arm and consumer bellwether Hindustan Unilever Ltd., have flagged softer consumption demand and a challenging operating environment in their earnings for the July to September period.

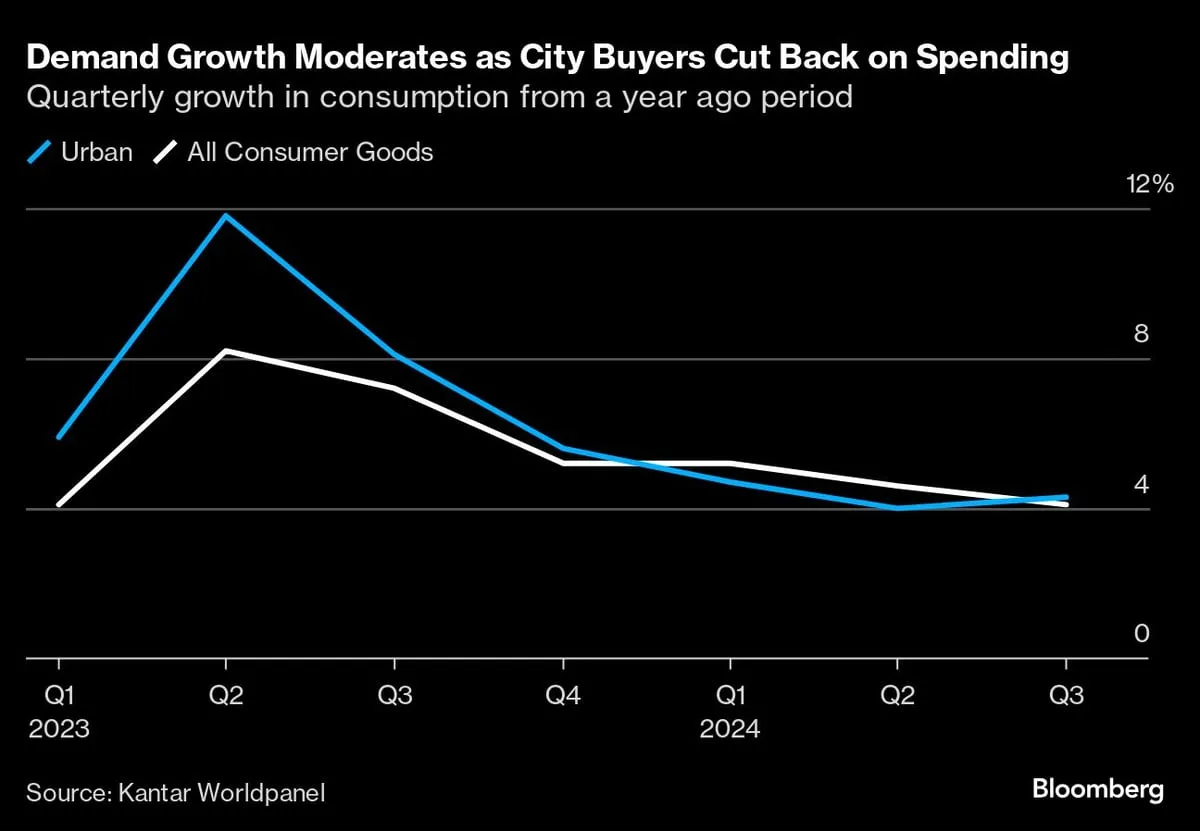

Urban demand growth has been trending down for five quarters, data from Kantar Worldpanel shows. And the sense of unease around this is spreading.

With post-pandemic euphoria fizzling out, higher interest rates, muted wage growth and poor job prospects are hurting urban demand. While India’s rural consumers are showing signs of spending more thanks to a good monsoon season that boosted incomes in the countryside, it can’t make up for the pullback among nearly 500 million city dwellers.

Fault lines in the India consumption story bode ill for the global giants that have been relying on India’s 1.4 billion strong consumer base to fuel growth amid an economic slowdown in China.

“The cause of concern is that growth is taking place only in certain segments,” R. C. Bhargava, chairman of Maruti Suzuki India Ltd., told reporters on Tuesday after India’s largest carmaker posted underwhelming profit. “What used to be 80% of the market is not growing,” he said, referring to the entry-level small cars whose sales is seen as a gauge of urban consumer demand.

Small cars made up as much as 80% of Maruti’s sales as recently as 2019, according to Bhargava.

Revenue from operations for Reliance’s retail unit, India’s largest retailer and part of billionaire Mukesh Ambani’s conglomerate, slipped 3.5% for the quarter ended Sept. 30 — a fall it attributed partly to weak demand for fashion and lifestyle products.

Revival of rural demand, welcome as it is, cannot offset the shortfall in urban mass spending. For Unilever’s India unit, smaller towns and villages make up only a third of its sales, Chief Financial Officer Ritesh Tiwari told reporters last week. Any recovery in demand growth was a few quarters away, he said.

“The pattern is quite clear that urban growth has trended down in recent quarters,” Rohit Jawa, Hindustan Unilever’s chief executive officer, said after the maker of Dove soaps and Magnum ice-creams posted sluggish earnings.

Urban Middle Class Tightens Its Belt, Consumer Firms Feel The Squeeze

Cutting Projections

The slack is now feeding into India’s growth forecasts although the country’s central bank has shown no signs of relenting on calls for rate cuts.

Investment banks like Goldman Sachs Corp. have already downgraded India’s growth projections to 6.5%. The Narendra Modi-led government also now “conservatively” estimates a real growth of 6.5%–7% for the country in the year ending March 2025.

“Underlying demand conditions bear watching,” India’s finance ministry said in a report on Monday. Softening consumer sentiment was pointing to moderation in urban consumption, according to the report.

The deceleration is showing up across sectors: Passenger vehicle sales fell for two months straight in September, while air travel has declined three out of the four months since June. India’s factory activity has been softening since July, although it registered an uptick this month.

“Companies are scaling down their salary outlays,” Sonal Varma and Aurodeep Nandi, economists at Nomura Holdings Inc. wrote in an Oct. 28 report.

Firms are lowering their cost of wages reflecting a mix of weaker nominal salary growth and a leaner workforce, they wrote.

“We believe this weakness in urban demand is likely to continue,” Varma and Nandi wrote, explaining that the post-pandemic surge in pent-up demand has faded, monetary policy is tight and the central bank’s crackdown on unsecured credit is hurting activity.

Passenger vehicle sales will likely dip 2% in October from last year while two-wheeler sales may rise a mere 7%, Nomura said in an Oct. 29 note. The brokerage said it was “concerned about demand and does not see a revival as of now.”

Brewing Now: Your Cup Of Tea Gets Dearer By 5–10% As HUL, Tata Hike Prices

Credit Card Delinquencies

Kotak Mahindra Bank Ltd. reported an increase in gross non-performing assets and slippages in the September quarter. Axis Bank Ltd. also witnessed “some worsening of asset quality,” Chief Executive Officer Amitabh Chaudhry said in a post-earnings call this month.

The latest data from credit information firm TransUnion CIBIL shows credit card delinquencies increased by 17% as of June from a year ago.

Rising credit card defaults and slowing urban demand are linked, Suresh Ganapathy, head of financial services research at Macquarie Capital, told Bloomberg News.

“The feedback (from banks) was that there is a middle class which is indeed getting affected more,” Ganapathy wrote in an email last week. “There is an issue of inflation, over-leveraging – all that has been causing this slowdown in a way.”

Litmus Test

Companies have been waiting for the Indian festival season to boost sales — a three-month long period that culminates with the Hindu festival of Diwali later this week.

Diwali traditionally sees a shopping spree in India similar to the Christmas season in the US and European countries. That’s why the sales during this festival period will be a litmus test for India’s consumption demand.

India’s festival season demand so far is showing a “mixed picture,” Reserve Bank of India Governor Shaktikanta Das said on Monday.

Last year this time, Indians were splurging big and manufacturers were adding more capacity to keep up with strong demand.

While firms like Reliance and Hyundai Motor India Ltd. said they are seeing an improvement in their sales in the beginning of the festival season, others are less sanguine.

“The motorcycle industry is almost flattish with 1% to 2% growth only. We had thought that it would be upwards of 5%-6%,” Rakesh Sharma, executive director at Bajaj Auto Ltd., said in an Oct. 16 post-earnings call.

Sharma said he was waiting to see how the entire festival season pans out but was keeping his expectations grounded. “I don’t think we’ll reach 8%, 9% growth. I would be surprised.”

Megacities Are Posing Unique Test For FMCG Companies, Says Nestle India MD. Read more on Business by NDTV Profit.