Shares of Balkrishna Industries Ltd. tumbled 10% to their lowest in over a month after its management guided a cautious outlook on cost pressure and muted demand, prompting Citi to cut the stock's target price.

Citi Research lowered the target price to Rs 2,150 apiece from Rs 2,300 apiece and retained a 'sell' rating on the company, citing a weak demand environment and rising cost pressure. The target price implies a 29.1% downside from Friday's closing price.

Balkrishna Industries' management expects a 2-3% rise in raw materials with some of the price rise been transferred to the customers, Citi Research said in a note on Sunday. However, given the weak demand, Balkrishna Industries will not be able to substantially transfer the cost rise to customers, the brokerage said.

Motilal Oswal Financial Service Ltd. estimates that freight costs will increase by 8–9% of revenue in the second quarter of the fiscal year 2025 due to the Red Sea crisis.

Adani Green May Rally 43%, Says Emkay On Initiating ‘Buy’

Further, the Europe Deforestation Regulation, which requires rubber to not be supplied from deforested land and will come into effect in December 2024, will further increase Balkrishna Industries' production costs. "While the company has secured compliant suppliers, costs could increase by $300 per metric tonne over the current base price of $1,800 per metric ton," the brokerage said.

Motilal Oswal kept the stock rating and target price unchanged at 'neutral' and Rs 2,770 apiece.

Citi Research also expects "potential headwinds" to affect margins, hence cutting the net profit estimates by 9.9% for the current fiscal 2025 and 4.9% for fiscal 2026.

An adverse macro-economic situation will impact growth in the global market, especially in North America. Moreover, geopolitical tensions in Europe, Middle East will also weigh on the tyre manufacturer's growth. However, Indian markets are better positioned, according to Citi Research.

Meanwhile, Balkrishna Industries announced a capital expenditure of Rs 1,300 crore for its facility in Bhuj with a production capacity of 350 crore tonne per annum, Citi Research said.

Apollo Tyres Q1 Results Review – Rising Cost Pressure Hurts Margins: Motilal Oswal

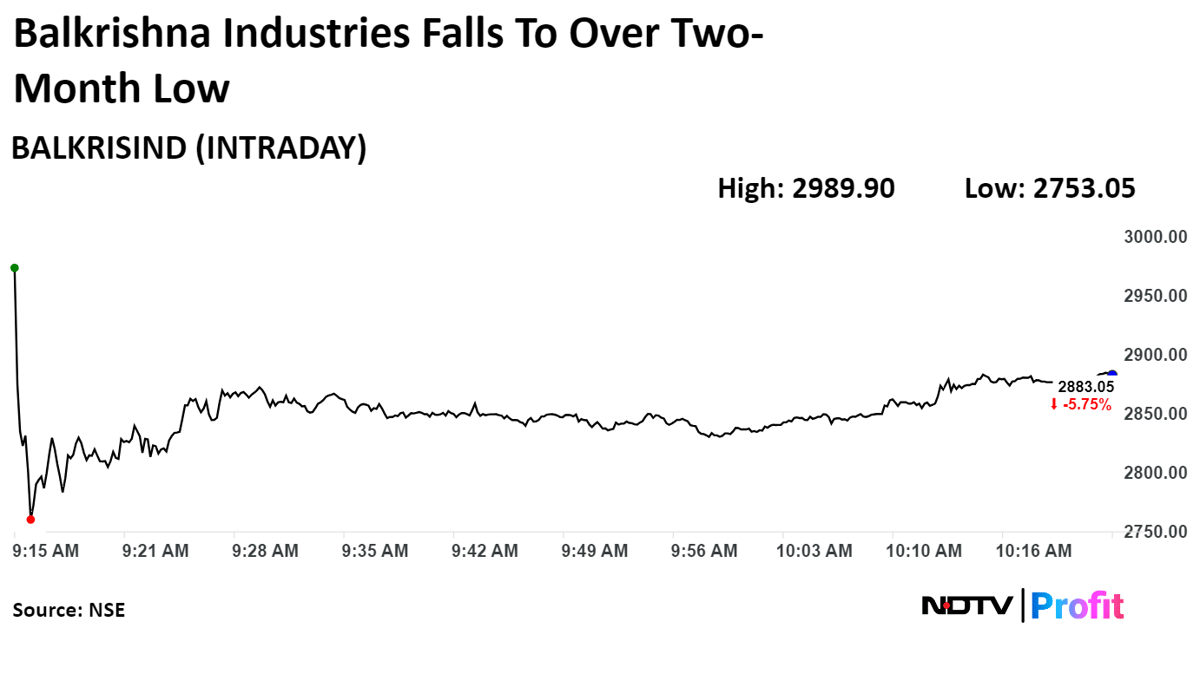

Shares of Balkrishn Industries tumbled 10% to Rs 2,753.05, the lowest level since May 18. It was trading 5.75% lower at Rs 2,883 as of 10:25 a.m., compared to 0.32% decline in the NSE Nifty 50 index.

The stock has gained 21.39% in the last 12 months and 12.03% on year to date basis. Total traded volume so far in the day stood at 11 times its 30-day average. The relative strength index was at 31.72.

Out of 24 analysts tracking the company, seven maintain a 'buy' rating, eight recommend a 'hold,' and nine suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an downside of 0.1%

Stock Market Live: Nifty, Sensex Rise As HDFC Bank, Infosys Lead. Read more on Markets by NDTV Profit.