Cipla Ltd.'s share price rebounded strongly from a two-day fall on Thursday to post the best single-day gains since July 2023. The strong recovery came as the US Food and Drug Administration concluded inspection at its Goa facility with 'Voluntary Action Indicated', which paved the way for Abraxane generic launch.

Citi Research said in a report that pancreatic cancer treatment drug Abraxane's approval is contingent upon Goa unit clearance.

Obtaining regulator's approval for its compliance had been a challenge for Cipla since 2019. Hence, the VAI status is a positive development for the pharma company, especially at a time when it's facing supply challenge in Lanreotide, and competitive challenge in Albuterol, Nuvama said in a report on Thursday afternoon.

Now, the anticipated launch of Abraxane generic will present estimated revenue opportunity of $120 million for Cipla, Nuvama said. The brokerage retained 'Hold' rating and hiked the target price to Rs 1,601 from Rs 1,593 apiece. The current target price implied 12.88% upside from Wednesday's closing price.

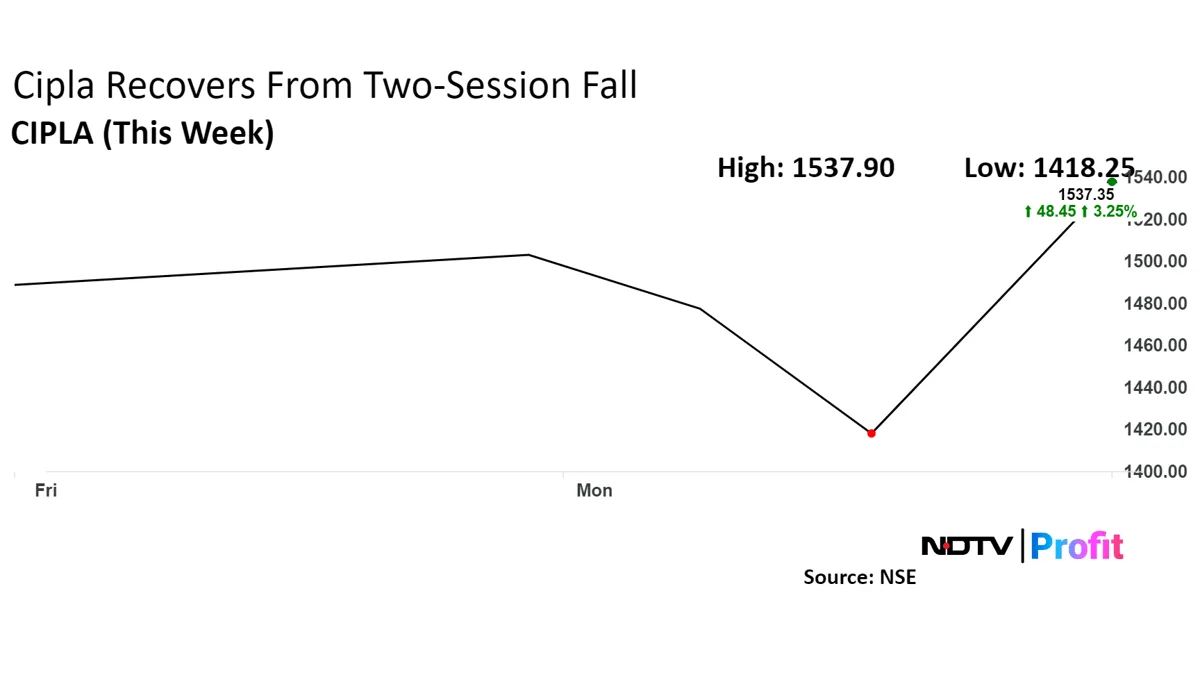

Cipla's share price had declined for the past two days as its earnings for July–September failed to impress investors despite meeting estimates. The stock hit over a five-month low on Wednesday after analysts and brokerages cut its target price on concerns over weaker-than-expected performance of domestic business and challenges in its key products.

In the last two days, Cipla lost over 4% of its share value. Recovering the loss, it jumped 10% on Thursday so far.

Cipla was trading 7.54% higher at Rs 1,525.25 apiece.

Cipla share price jumped 10% to Rs 1,560.05 apiece, the highest level since Oct. 21. The intraday gain is highest since July 27, 2023, when Cipla jumped 14.1%.

The stock pared gains to trade 7.39% higher at Rs 1,523.00 apiece as of 10:08 a.m., compared to a 0.26% decline in the NSE Nifty 50 index.

The stock gained 26.92% in 12 months and 22.14% on a year-to-date basis. Total traded volume so far in the day stood at 18 times its 30-day average. The relative strength index was at 45.63.

Out of 38 analysts tracking the company, 22 maintain a 'buy' rating, seven recommend a 'hold,' and nine suggest a 'sell', according to Bloomberg data. The average 12-month consensus price target implies an upside of 4.3%.

Stock Market Today: Nifty Ends Lower But Snaps Four-Week Fall. Read more on Markets by NDTV Profit.