Shares of Brainbees Solutions Ltd., the owner of FirstCry.com, jumped to a one-month high, after Morgan Stanley initiated coverage on the stock with an 'overweight' rating and a target price implying a 28% upside.

"Despite strong share-price performance since listing on Aug. 13, 2024, we believe current valuations indicate further upside," the brokerage said. The brokerage has a target price of Rs 818 per share.

The rationale behind the brokerage's 'overweight' rating is its online store for newborn, baby and kids products. Brainbees is well placed to capitalise on India's growing childcare market through its FirstCry brand, Morgan Stanley said. Multiple levers of growth and profitability improvement are in place, with some option value through GlobalBees brands, it said.

NTPC Green Energy Listing Could See Market Cap At 7.5 Times The IPO Size

At the same time, GlobalBees accounts for only 2% of its base case value, given the early stage of the business, the brokerage pointed out.

It is also positive on India's demographics, which is unlikely to change for several decades. "This, combined with the consumer shift towards online and organised retailing, augers well for demand for childcare products, in our view," it said.

FirstCry is the largest retailer in India's childcare ecosystem, with over three-fourth of revenue coming from online and the rest from its network of over 1,000 stores. "We estimate 16% of revenues in FY27 will come from its international business," it said.

Given the low brand salience in the childcare category, the company derives a large portion of revenue from its home brands, the brokerage also noted.

Morgan Stanley also likes the company's back-end capabilities, some manufacturing, and a large warehousing footprint for same/next-day delivery. "In FY24-27, we expect domestic revenue to rise at an 18% CAGR with the Ebitda margin improving from 9% in FY24 to 13% by FY27," it said.

Childcare revenue is estimated to deliver a 20% CAGR over fiscal 2024-27, with Ebitda margin improving to 9.9% in fiscal 2027 from 5.2% in fiscal 2024, Morgan Stanley said.

On GlobalBees Brands—through which the company makes strategic investments in, and acquisitions of, direct-to-customer brands—the brokerage said that if it can create a handful of success stories from its six dozen brands, this would create large option value for Brainbees. The brokerage estimates Globalbees' revenue will accelerate at a 17% CAGR in fiscal 2024-27.

Downside risks to its call include lower-than-expected growth; senior management exits and/or insider selling after the lock-in period expires; changes in the competitive landscape from horizontal, vertical players as well as apparel retailers; and unfavorable changes in India's demographics.

India’s Demographics Give FirstCry Room To Grow, Says CEO

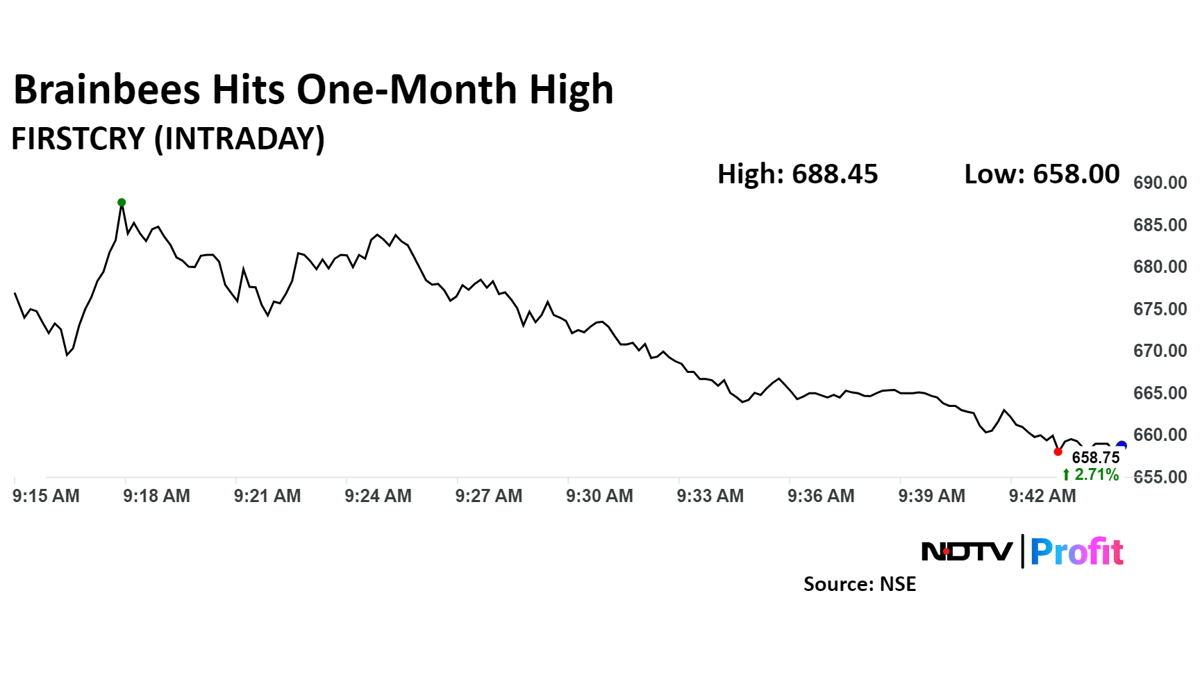

Shares of the company rose as much as 7.34% to the highest level since Aug. 19, before paring gains to trade 2.7% higher at Rs 659 apiece, as of 9:48 a.m. This compares to a 0.9% advance in the NSE Nifty 50.

Total traded volume so far in the day stood at 4.1 times its 30-day average. The relative strength index was at 52.13.

The two analysts tracking the company have a 'buy' rating, according to Bloomberg data. The average 12-month analysts' consensus price target implies an upside of 19.4%.

Stock Market Today: Nifty, Sensex End At Record Highs As Private Bank Stocks Lead. Read more on Markets by NDTV Profit.