Table of Contents

Godavari Biorefineries’ initial public offering opened on Wednesday to raise Rs 554.75 crore. It was subscribed0.09 times, or 9%, as of 12:25 p.m.

The IPO consists of a fresh issue of 92 lakh shares worth Rs 325 crore and an offer for sale of 65 lakh shares worth Rs 229.75 crore. The price band is set at Rs 334 to Rs 352 per share. Retail investors can apply for a minimum lot size of 42 shares, bringing the total investment per application to Rs 14,784.

The subscription period runs from Wednesday to Friday. Ahead of the IPO, the company raised Rs 166.4 crore from anchor investors, allotting 47.3 lakh shares at Rs 352 each to 19 anchor investors. ICICI Prudential ELSS Tax Saver Fund and 360 One Equity Opportunity Fund received the largest allocation of 11.33%.

The company's shares are expected to list on the mainboard exchanges on October 30.

HUL, Godrej Properties, TVS Motor Q2 Results Today — Earnings Estimates

Issue Details

-

Issue opens: Oct 23.

-

Issue closes: Oct 25.

-

Issue price: Rs 334 to Rs 352 per share.

-

Fresh issue: Rs 325 crore.

-

Offer for sale: Rs 230 crore.

-

Total issue size: Rs 554.70 crore.

-

Bid lot: 42 shares.

-

Listing: BSE and NSE.

Business

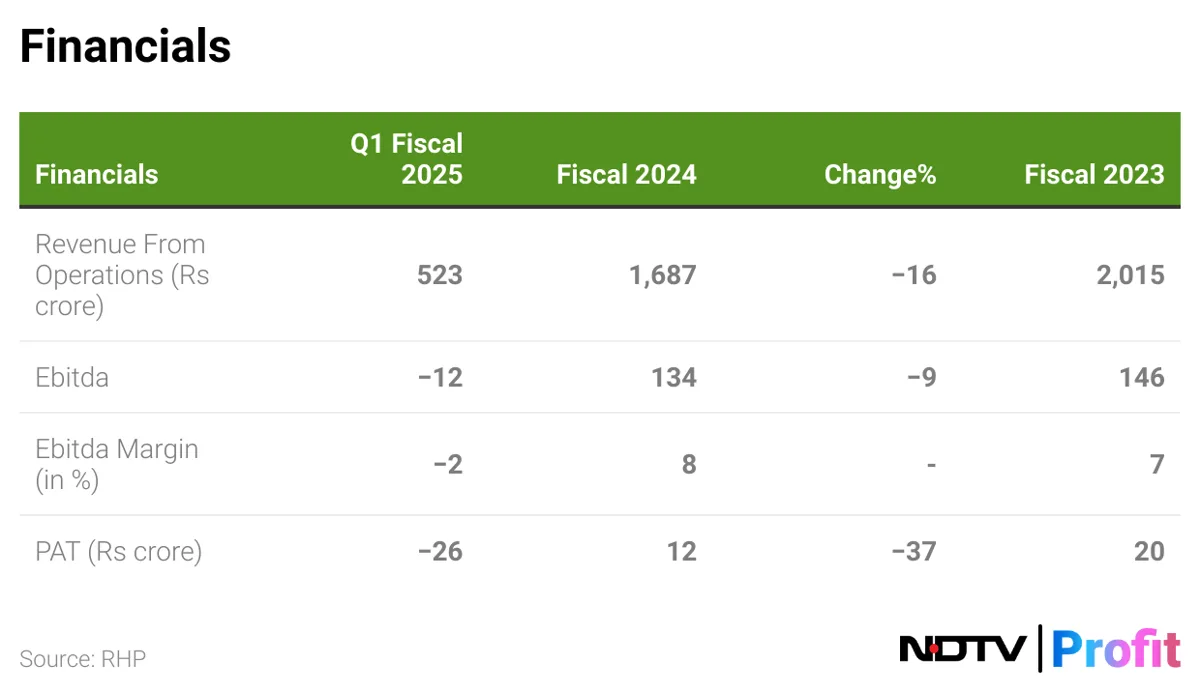

The Mumbai-based company manufactures ethanol based chemicals and is an integrated bio-refinery with an installed capacity of 570 kilo-liter per day for manufacturing ethanol as of June. According to the red herring prospectus, the company is one of India’s largest producers of ethanol in terms of volume as of March.

Their portfolio comprises of bio-based chemicals, sugar, different grades of ethanol and power. These products find application in a range of industries such as food, beverages, pharmaceuticals, flavours & fragrances, power, fuel, personal care and cosmetics.

Bajaj Finance Q2 Results: Profit Rises 13% Led By NII And AUM Growth, Meets Estimates

Use of Proceeds

The company will not be receiving any of the proceeds from the offer for sale component.

Net proceeds from the fresh issue will go into repaying or pre-payment of outstanding borrowings amounting to Rs 240 crore and and general corporate purposes.

Subscription Status: Day 1

The IPO has been subscribed 0.09 times, or 9%, as of 12:25 p.m. on Wednesday.

-

Qualified institutional buyers: Nil.

-

Non-institutional investors: 0.04 times or 4%.

-

Retail investors: 0.17 times or 17%.

Waaree Energies IPO Day 2: Issue Subscribed 8.81 Times, GMP At 91%

Godavari Biorefineries IPO GMP Today

The grey market premium of Godavari Biorefineries was nil as of 12:27 p.m. on Oct. 23, according to Chittorgarh’s unit InvestorGain. The estimated listing price based on the GMP is Rs 352 per share. The GMP indicates a flat listing over the upper end of the price band.

GMP is not an official price quote for the stock and is based on speculation.

Disclaimer: Investments in initial public offerings are subject to market risks. Please consult with financial advisors and read the red herring prospectus thoroughly before placing bids.

Stock Market Today: All You Need To Know Going Into Trade On Oct. 23. Read more on IPOs by NDTV Profit.