IIFL Finance Ltd. will raise up to Rs 2,500 crore via debt instruments, the company announced on Thursday. The board approved public issue of secured, rated, listed, redeemable non-convertible debentures in one or more tranches, subject to regulatory and statutory approvals.

The details of the NCD issue will be provided during the filing of tranches.

NCDs are fixed-income instruments for specific terms and interest rates that are issued to raise funds without giving any option of conversion to equity.

The fundraise plan comes over a month after the Reserve Bank of India lifted the restrictions that barred IIFL Finance from lending against gold. The curbs were placed in March, when the banking regulator had found serious lapses in the company’s operations. In August, IIFL Finance disclosed that it had submitted its compliance report to the regulator after addressing the concerns raised.

The non-bank lender is exploring the diversification of its assets to reduce the company’s overdependence on gold loan business, said AK Purwar, who is the lender’s chairman and independent director.

"We will be looking to substantially diversify our business. We want to add more verticals, maybe auto loans, or something else, or something more innovative. The aim is to ensure we have a couple of important product lines and our overdependence on gold loans portfolio gets reduced," Purwar told NDTV Profit earlier.

Q2 Performance

For the quarter ended September 2024, IIFL Finance reported a net loss after tax of Rs 93 crore (before non-controlling interest). Among core products, home loans grew by 21% year-on-year, and loans against property AUM grew by 18%.

Microfinance was stagnant, while digital loans grew by 53%. Gold loans declined by 54%.

Gross non-performing assets rose to 2.4% from June quarter's 2.2%. Net NPA remained steady at 1.1%.

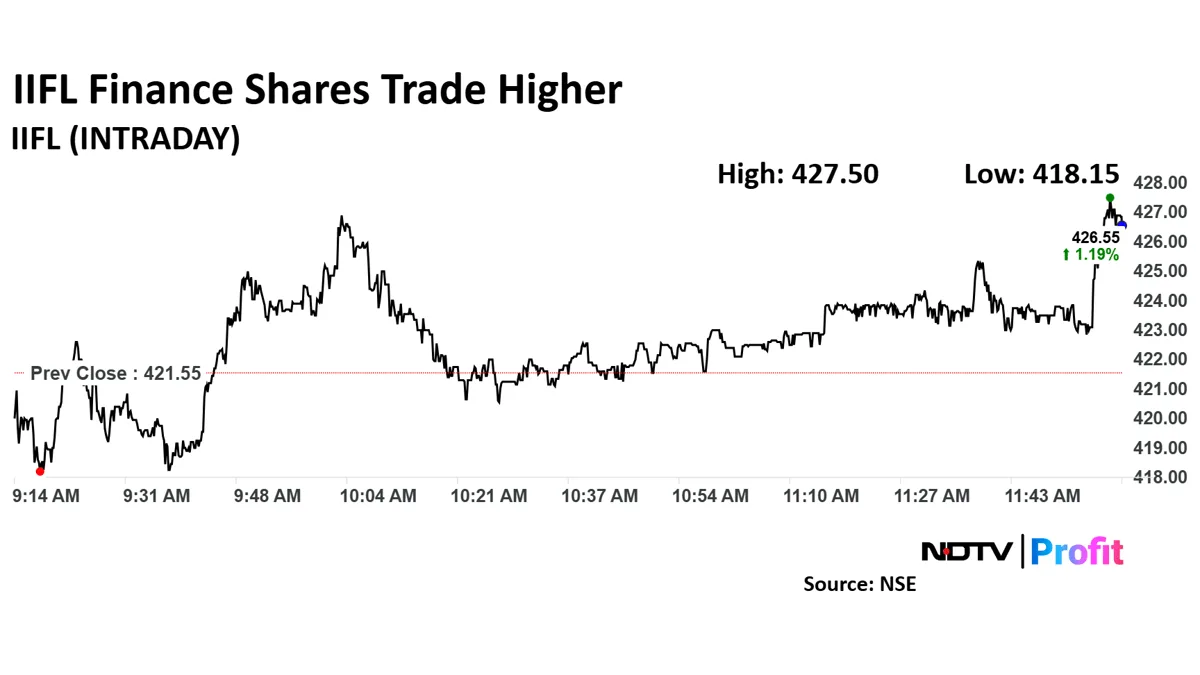

IIFL Finance Share Price Movement

IIFL Finance share price was trading 1.2% higher at Rs 426.5 apiece as of 12:05 p.m.

IIFL Finance share price was trading 1.2% higher at Rs 426.5 apiece as of 12:05 p.m., compared to 0.4% decline in the Nifty 50 index.

The stock has declined 30% in 12 last months and 27% on a year-to-date basis. The relative strength index was at 43.

Out of six analysts tracking IIFL Finance, four maintain a 'buy' rating and two recommend a 'hold', according to Bloomberg data. The average 12-month consensus price target of Rs 508 implies an upside of 20%.

Stock Market Today: Nifty Ends Lower But Snaps Four-Week Fall. Read more on Business by NDTV Profit.