Shares of Jubilant FoodWorks Ltd. hit a one-year high on Monday after its profit doubled in the first quarter of fiscal 2025. The company's net profit stood at Rs 58 crore in the quarter ended June 2024, as against Rs 29 crore in the year-ago period.

The company that operates fast-food chains Domino's Pizza and Dunkin' Donuts is focused on the network expansion of 52 net stores in India, taking the count to 2,148 stores, according to analysts.

Jefferies upgraded the stock to 'buy', citing positive delivery growth as a reason, while remaining cautious of the dine-in segment. However, "volatility may persist," they warned.

Motilal Oswal reiterated 'neutral', while Citi reiterated 'buy', citing growth in operational performance led by multiple initiatives such as delivery fee waivers, a reduction in the threshold for free orders to Rs 150 versus Rs 350 in the pre-Covid era, new product launches, and more.

Earnings before interest, taxes, depreciation, and amortisation rose 39% year-on-year to Rs 383 crore. The operating margin was 19.8%.

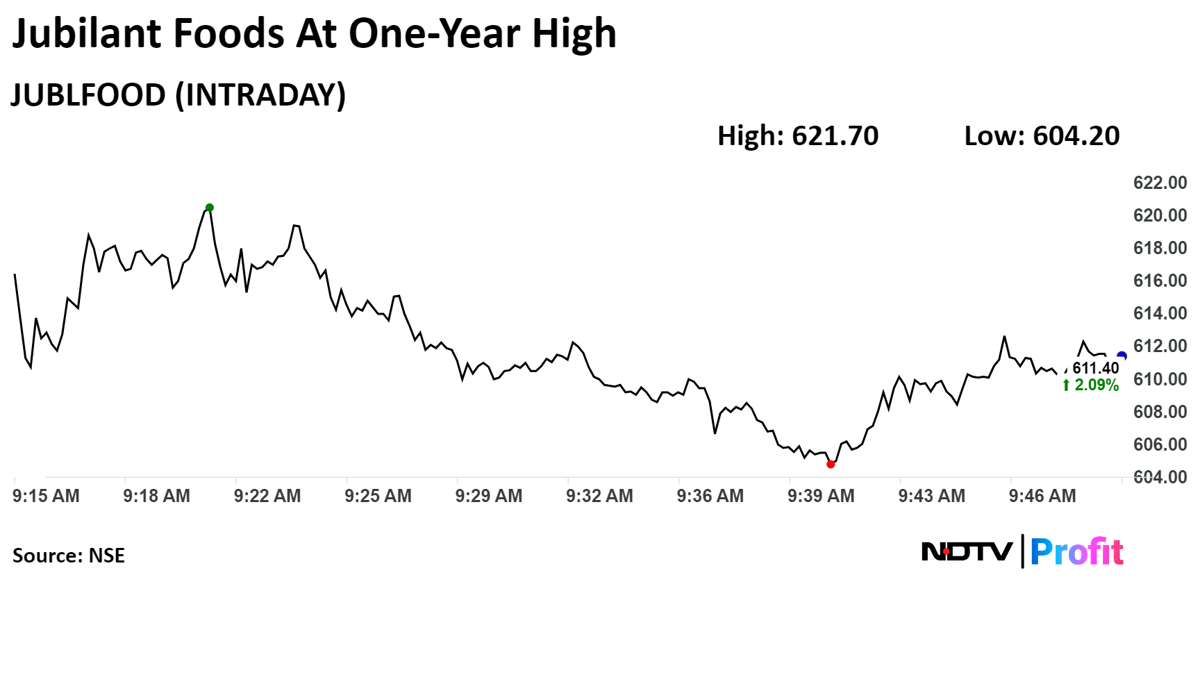

Shares of the company rose as much as 3.81% to Rs 621.70 apiece, the highest level in a year. It pared gains to trade 1.92% higher at Rs 611.70 apiece as of 10:00 a.m. This compares to a 0.63 decline in the NSE Nifty 50 Index.

The stock has risen 8.26% on a year-to-date basis. Total traded volume so far in the day stood at 1.17 times its 30-day average. The relative strength index was at 62.21.

Out of 32 analysts tracking the company, 16 maintain a 'buy' rating, eight recommend a 'hold,' and eight suggest a 'sell,' according to Bloomberg data. The average 12-month consensus price target implies an downside of 4.8%.

Stock Market Live: Nifty, Sensex Rise As HDFC Bank, Infosys Lead. Read more on Markets by NDTV Profit.