The Union Government in May 2020 decided to increase state borrowing limits from 3% to 5% of the Gross State Domestic Product, or GSDP, to help the states with the fiscal stresses of the pandemic. However, there were strings attached. States had to join the One Nation, One Ration Card scheme, take steps to increase urban local body revenues, implement certain ease of doing business measures, and carry out power sector reforms. Unfortunately, amidst political differences, the economic rationale behind these conditions took a back seat.

Globally, debt is intrinsically tied to outcomes and obligations. Just as a bank extends a loan to a business in anticipation of growth and interest earnings, governments provide loans to states with the expectation that funds will be used to foster economic development and enhance social welfare. Nevertheless, the Department of Expenditure determines each state’s annual borrowing ceiling using a formula incorporating factors such as GSDP, existing debt levels, fiscal discipline, and other relevant considerations.

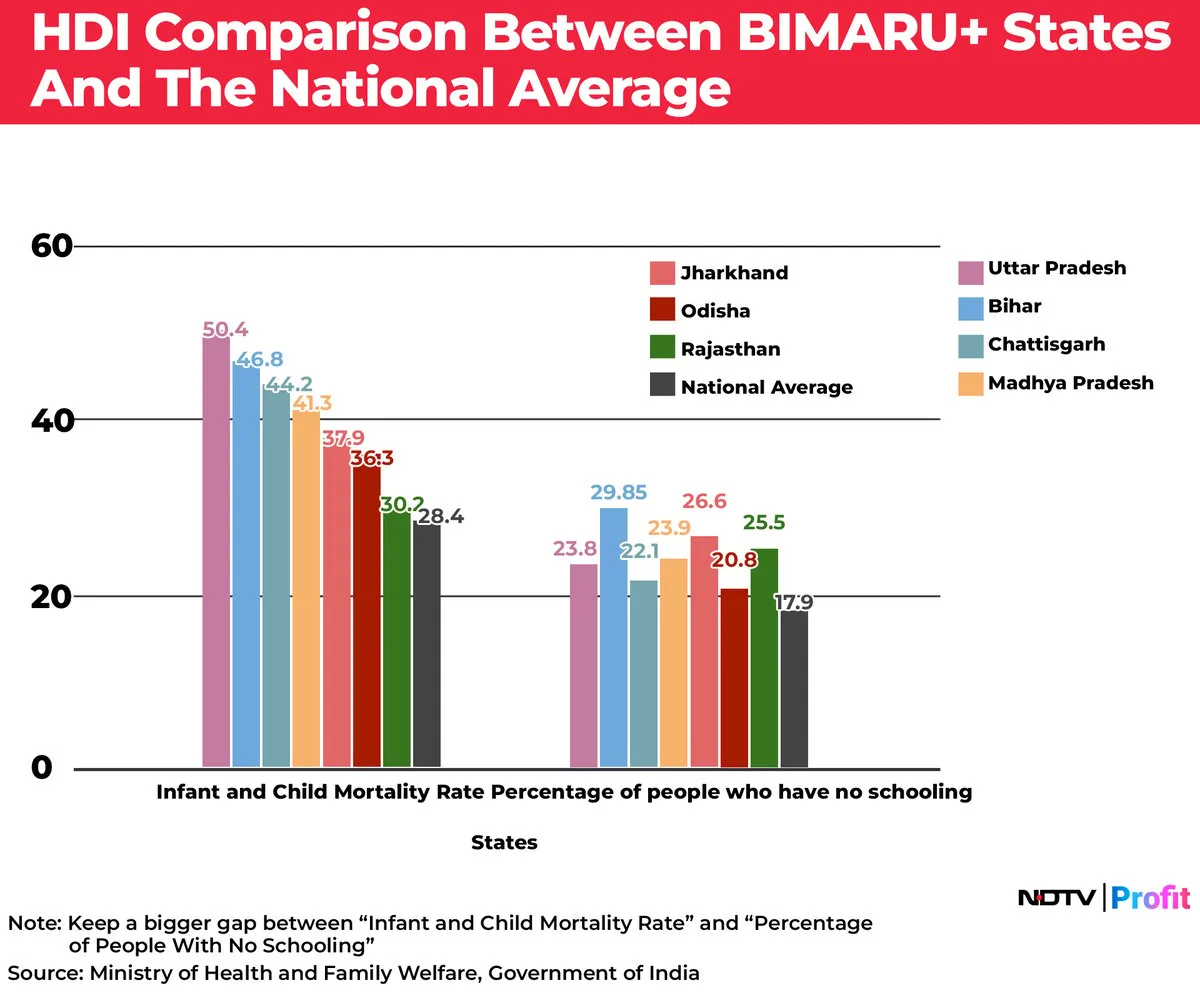

However, a crucial component missing from this equation is the improvement of social indicators within states. This gap is particularly pronounced in the BIMARU+ states—Bihar, Madhya Pradesh, Rajasthan, Uttar Pradesh, Odisha, Chhattisgarh, and Jharkhand. Analysing Human Development Indicators such as Infant and Child Mortality Rates and the Percentage of People with No Schooling from the National Family Health Survey 2019-21 reveals a stark disparity.

For instance, the below-given figure illustrates that the infant and child mortality rate in Uttar Pradesh is 50.4%, significantly higher than the national average of 28.4%. Similarly, the percentage of people with no schooling in Bihar stands at 29.8%, compared to the national average of 17.9%. These statistics underscore the urgent need for targeted social development initiatives in these states to bridge the gap and foster overall growth.

The issue is not related to spending levels; the average social sector spending of BIMARU+ states is actually higher than the national average. In 2021-22, the average social sector spending in these states was 45% higher than the national average. However, the average central government debt taken by BIMARU+ states was also 27% higher than the national average.

Big Question

The question remains: why, despite higher spending and borrowing, are the BIMARU+ states unable to improve their human development indicators?

The core issue is the focus of the spending. The spending primarily focuses on achieving outputs, not on improving outcomes. By incorporating social development indicators into debt eligibility criteria, the welfare of people in these states can be significantly improved. This approach could foster a new era of cooperative federalism, focused on achieving tangible improvements in human development outcomes.

The nature of federalism in India is such that the majority of the spending on sectors that affect people’s daily lives is done by state governments. On health and education, for instance, the total expenditure incurred by the Union Government in 2022-23 was Rs 2,23,000 crore, while the combined expenditure by all state governments was Rs 19,18,200 crore. Moreover, the combined developmental expenditures by all State governments as proportion to the country’s GDP increased from 8.8% in 2004-05 to 12.5% in 2021-22, while this proportion for the Union government has remained more or less stagnant between 5-7% during this time period. Spending by the state government has also been shown to have a greaterimpact with every 1% increase in revenue expenditure by states estimated to result in a 0.6% increase in GDP, compared to just a 0.2% increase if the money is spent by the union government.

However, states face three significant challenges in their spending. Firstly, there is a revenue shortfall; states collect approximately 37.5% of revenues but incur over 60% of total public expenditures, necessitating borrowing to bridge the gap. This gap is even more pronounced for BIMARU+ states. In 2021–22, the average gap between a state’s own revenue and its total revenue expenditure for BIMARU+ states was 15% higher than the national average.

Secondly, there exists considerable horizontal inequity among states, stemming from varying capacities to generate revenue and provide public services at efficient costs. This disparity is exacerbated by a third issue: low state capacity. States with low social indicators usually have higher vacancies, less trained administration, and a higher workload. Some states effectively deliver social programs with minimal costs, while others struggle. The Government of India has attempted to address these issues through centrally sponsored scheme grants, yet the complexity of 28 schemes with multiple criteria disadvantages states with lower capacity and furthers the process of focussing on outputs instead of outcomes. This situation results in a sparse distribution of resources and a limited impact on improving conditions.

On the contrary, loans extended to states have demonstrated significant impact. For instance, interest-free infrastructure loans have alleviated disparities in infrastructure quality among states. The effectiveness of debt stems from the changes it incentivises: higher debt levels impose both political and fiscal commitments on states, prompting them to utilise funds more responsibly.

To enhance the efficacy of this financial tool, the Finance Commission can determine loan amounts and interest rates based on each state's improvements in social indicators, thereby fostering a positive, cascading effect. By linking financial assistance directly to social improvements, the commission would incentivise states to prioritise effective governance and targeted developmental initiatives. This approach not only ensures responsible use of resources but also promotes a sustainable and equitable growth trajectory across regions.

Firstly, the incentive of debt would compel states to address horizontal inequities by enhancing revenue collection capabilities and optimising the efficiency of social service delivery. Failure to do so could lead to states facing high interest rates on loans or foregoing debt altogether, presenting a costly political dilemma for the government.

Secondly, as loans rather than centrally sponsored grants, states would gain autonomy to utilise funds for improving social indicators through locally tailored solutions. This approach offers administrative flexibility, allowing states to design and implement programs without the bureaucratic constraints associated with grant applications.

Thirdly, there would be a substantial reduction in the fiscal burden on the Union Government. Over time, the compounded benefits of improved revenue streams and enhanced social outcomes would diminish states' reliance on large-scale borrowing from the Union Government to meet their financial requirements.

Lastly, effective spending on social indicators will not only build state capacity to deliver services essential for redistribution but also contribute towards accelerating the growth of the economy and making it inclusive for all. Better social indicators will also result in more investments in the home state leading to more jobs and lower migration to already overcrowded Indian cities.

Viksit Bharat can only be realised when every state prospers, ensuring that all citizens enjoy the benefits and positivity of a high quality of life. To truly embrace cooperative federalism, we must tie financial assistance to tangible social outcomes, ensuring that every loan drives meaningful progress in the lives of citizens across all states.

Dr. Srinath Sridharan is a policy researcher and corporate advisor and Harshit Pai is a public policy professional.

The views expressed here are those of the author, and do not necessarily represent the views of NDTV Profit or its editorial team.

. Read more on Opinion by NDTV Profit.