Earnings revisions for Nifty companies may remain flattish going forward, analysts said after assessing their June quarter performance. While Citi said it sees limited upside for the Nifty 50, Nuvama has recommended caution amid slowing earnings, weaker demand and 'record-high valuations'.

Citi Research has pegged its target for Nifty during September at 25,000 as against its target of 24,400 for June.

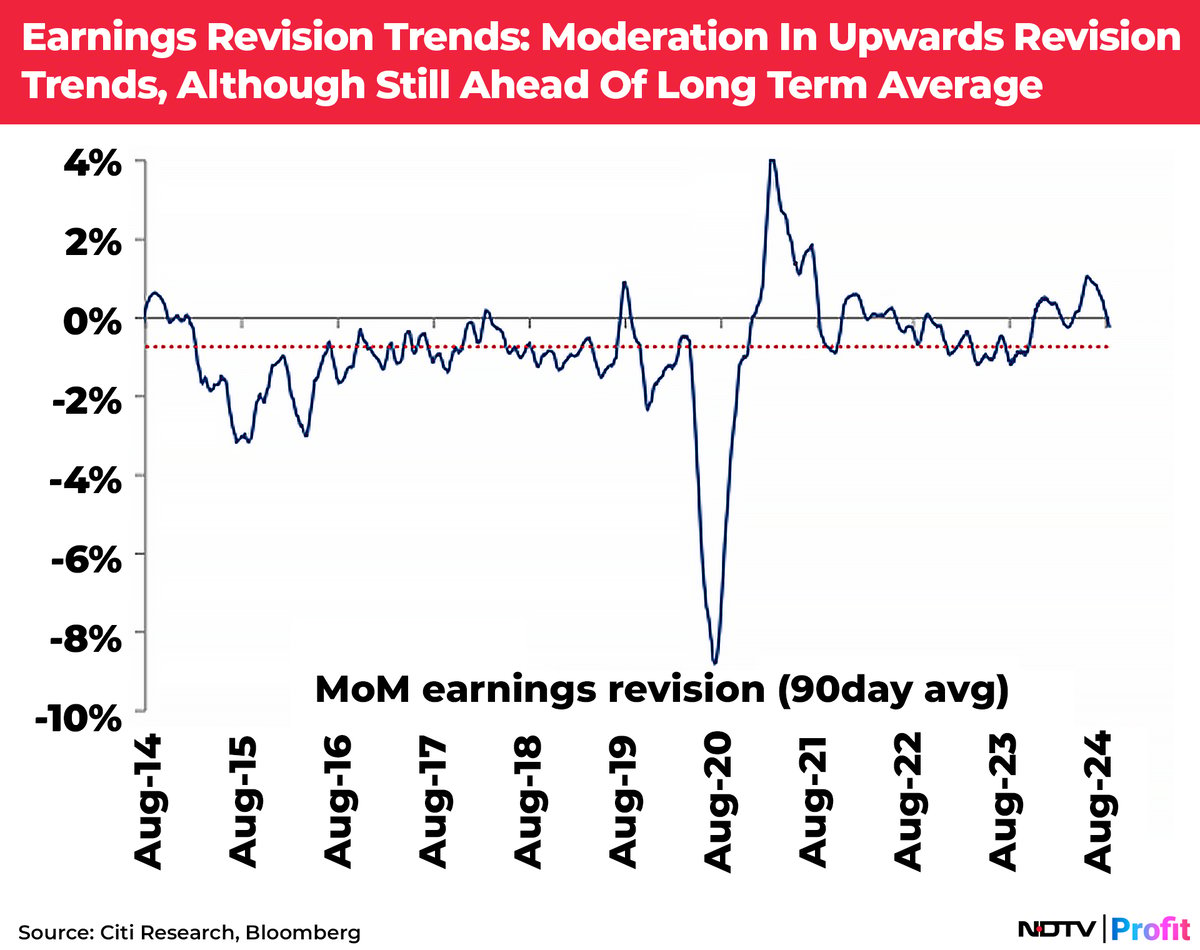

On Friday, the Nifty 50 closed at 24,541.15. The brokerage recommended 'buy on dips' and added that Nifty earnings revision is now flattish compared to upwards revision earlier, although still tracking ahead of the long-term trend.

JPMorgan said in a report that Indian stocks may remain range-bound in the near-term due to “rising domestic headwinds and global market volatility”.

Nifty Q1 Scorecard: Muted Profit Growth As ‘Misses’ Overtake ‘Beats’

“For majority of the sectors, the focus is now shifting towards business prospects, top line guidance, balance sheet strength and other operational efficiencies,” it said.

The brokerage recommends a 'barbell strategy' playing defensive sectors including consumer staples and healthcare on one side and continuing long-term capex including industrial, real estate, and financials on the other hand.

According to Investopedia, the barbell strategy advocates pairing two distinctly different types of assets. One basket holds only extremely safe investments, while the other holds only highly-leveraged and speculative investments.

According to Nuvama Research, the Nifty is forecast to deliver 13–14% earnings growth in fiscal ending March 2026 — largely similar to the fiscal 2024 growth. "However, given the weak start to FY25 (sub-5% growth), we think these numbers are quite optimistic and prone to downgrades," it said. "This, along with persisting headwinds, pose a risk to the outlook."

The brokerage noted that the last fiscal experienced strong profit growth of over 20% despite weak demand, owing to low credit costs and favorable input prices. However, it said this divergence now appears to be reconciling, with profit growth slowing sharply to 10% in the June quarter while demand was stuck at 8% on annual basis despite a low base.

Nuvama believes that margins for Indian companies would bump into more headwinds than tailwinds going ahead. It explained that this is because BFSI credit costs are now normalising as are input prices.

"Furthermore, corporates are already performing at high operating efficiency, leaving little room for margin expansion," it said. "Hence, a top line revival is extremely critical for both margins as well as profits to improve."

Nifty In Technical Charts: Can The Bulls Do It Again?

Nuvama Research said, "We anticipate a sectoral churn, with FY24 laggards consumer, private banks, insurance, and IT likely to lead while cyclical outperformers autos, metals, PSUs and industrials likely to lag."

Citi Research has also downgraded the auto sector to 'neutral' from 'overweight'. The brokerage cited outperformance of over 100% versus Nifty over past 3 years as the reason behind the revision. It also expects growth in two-wheelers, passenger vehicles and tractors to moderate to 7%, 3% and 7%, respectively, while commercial vehicles to degrow at 5% in the current fiscal, as well as the margins for most auto companies close to pre-Covid highs.

Citi's key overweight sectors include PSUs in utilities and defence sector, industrials, and banks and insurance, while it is underweight on consumer discretionary, IT services and metals.

JPMorgan has also downgraded auto to 'neutral' while upgrading consumer staples to 'overweight'.

Citi also noted that while FII flows have been positive quarter to date in the September quarter at over $1.6 billion, FIIs have sold over $3 billion since the last week of July.

Meanwhile, domestic institutional investors flows in the current year to date have very strong at $32 billion, according to the brokerage while FII flows at $2 billion.

Stock Market Live: Nifty, Sensex Flat While RIL, TCS Lead; ICICI Bank, M&M Fall. Read more on Markets by NDTV Profit.