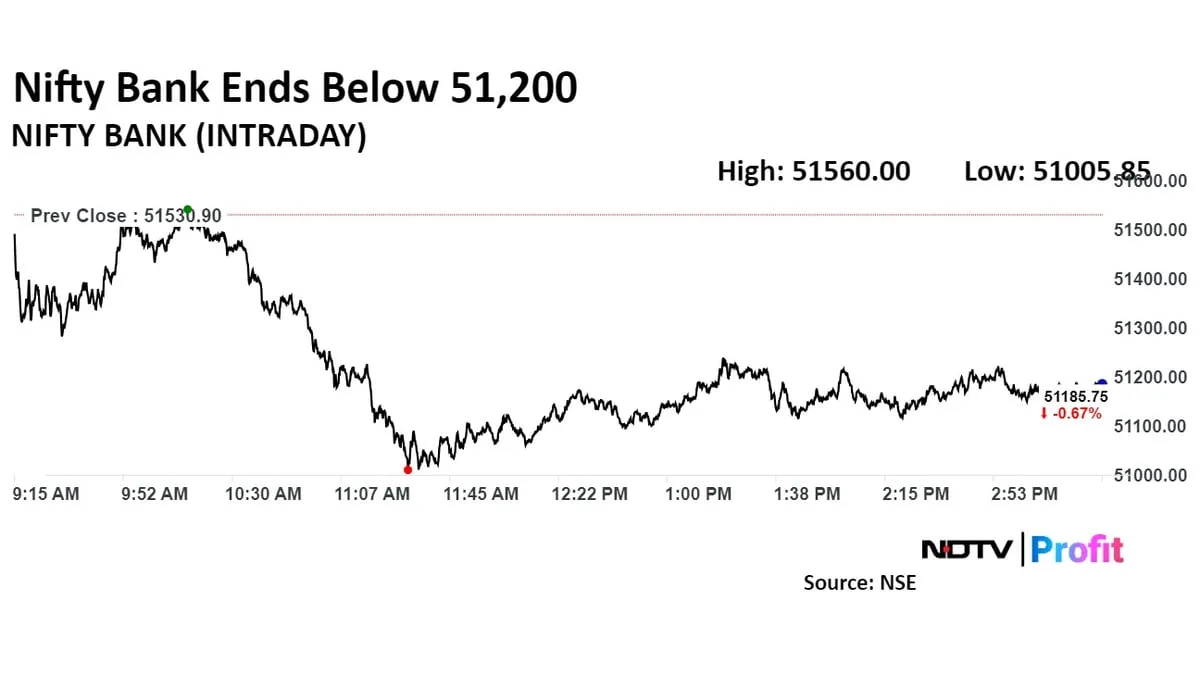

India's benchmark equity indices closed lower for a second consecutive week on Friday, with Titan Co. and Tata Steel Ltd. emerging as the top losers on a weekly basis. On Friday, indices ended lower, weighed by losses in banks and Tata Consultancy Services Ltd.

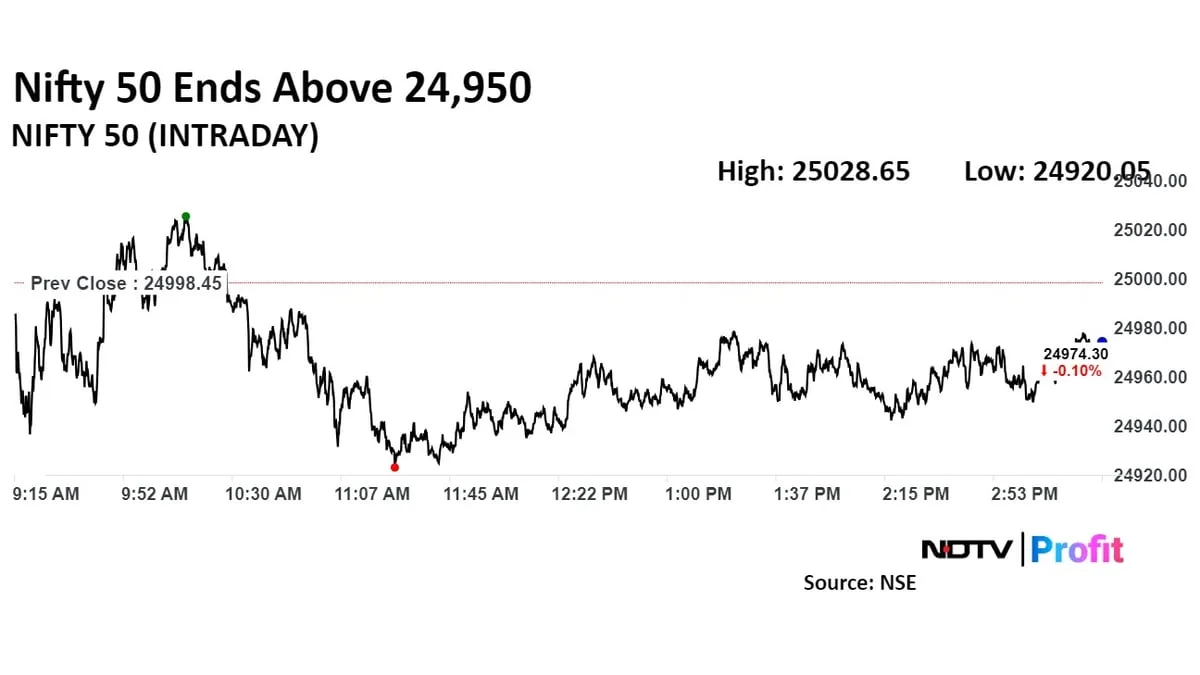

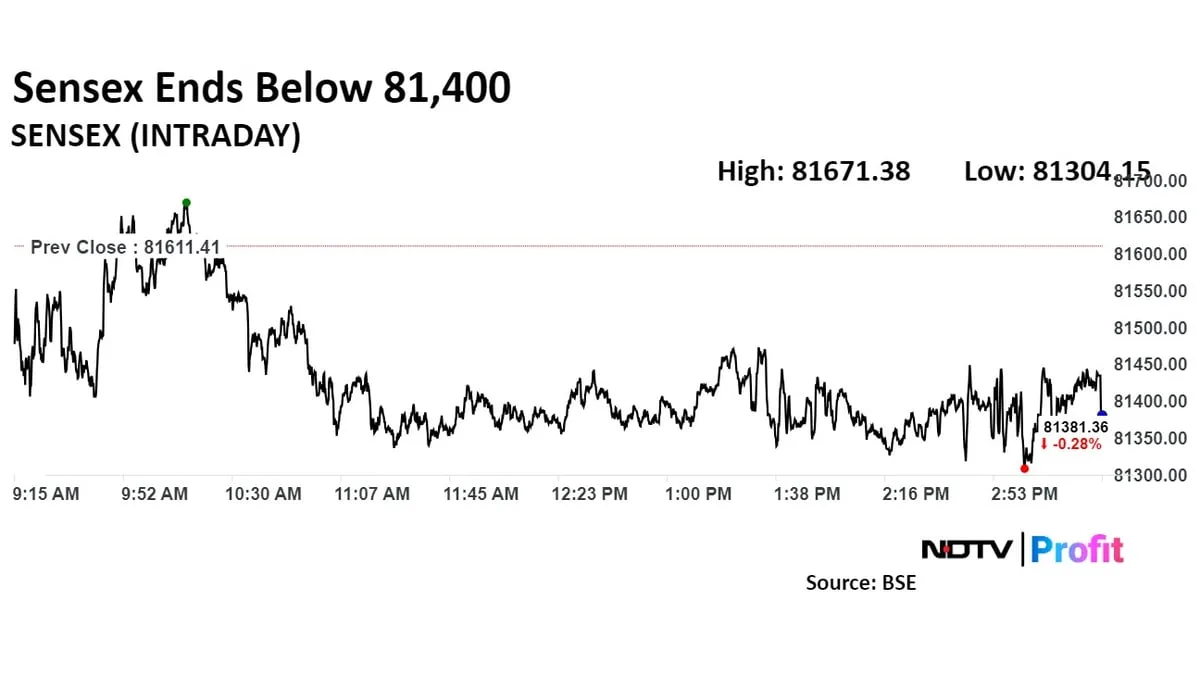

On Friday, Nifty ended 0.10%, or 24.15 points, down at 24974.3, and Sensex closed 0.22%, or 176.01 points, lower at 81435.40.

"Global investors will be keenly looking forward to the press conference to be held by China’s Ministry of Finance on Saturday," said Shrikant Chouhan, head of equity research at Kotak Securities. "With the start of second-quarter earnings, we could see stock-specific action over the next few weeks based on results and management commentary."

He also said risk sentiments are expected to be influenced by volatile commodity prices, geopolitical turmoil, the global monetary easing cycle, and flows to China.

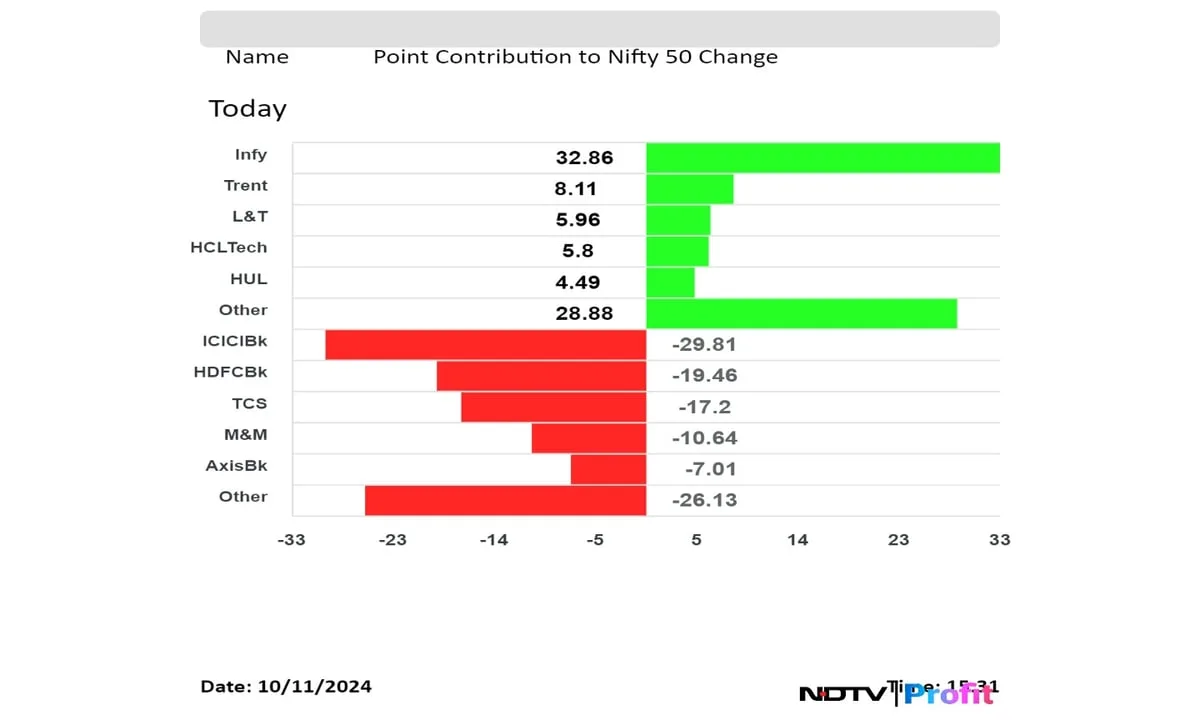

Shares of ICICI Bank Ltd., HDFC Bank Ltd., Tata Consultancy Services Ltd., Mahindra & Mahindra Ltd., and Axis Bank Ltd. pulled the Nifty lower. While those of Infosys Ltd., Trent Ltd., Larsen & Toubro Ltd., HCL Tech Ltd., and Hindustan Unilever Ltd. cushioned the fall.

Broader markets ended on a positive note. The BSE Midcap and BSE Smallcap both ended 0.44% higher on Friday.

On BSE, 14 out of 20 sectors ended higher, while six declined. The BSE Metal index rose the most, while the BSE Realty declined the most.

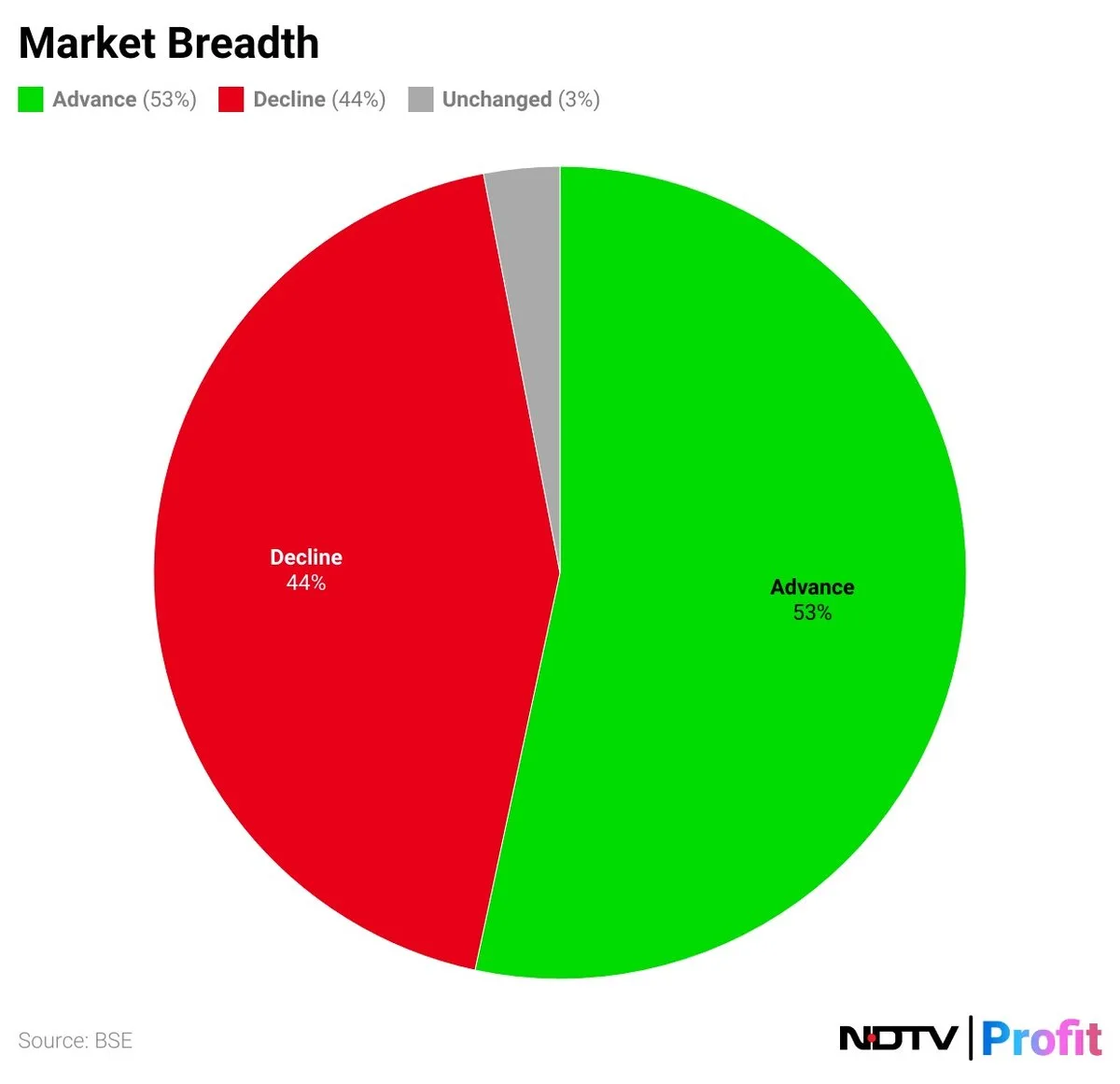

Market breadth was skewed in the favour of buyers. Around 2,140 stocks rose, 1,750 stocks declined, and 121 stocks remained unchanged on BSE.

Weekly Performance

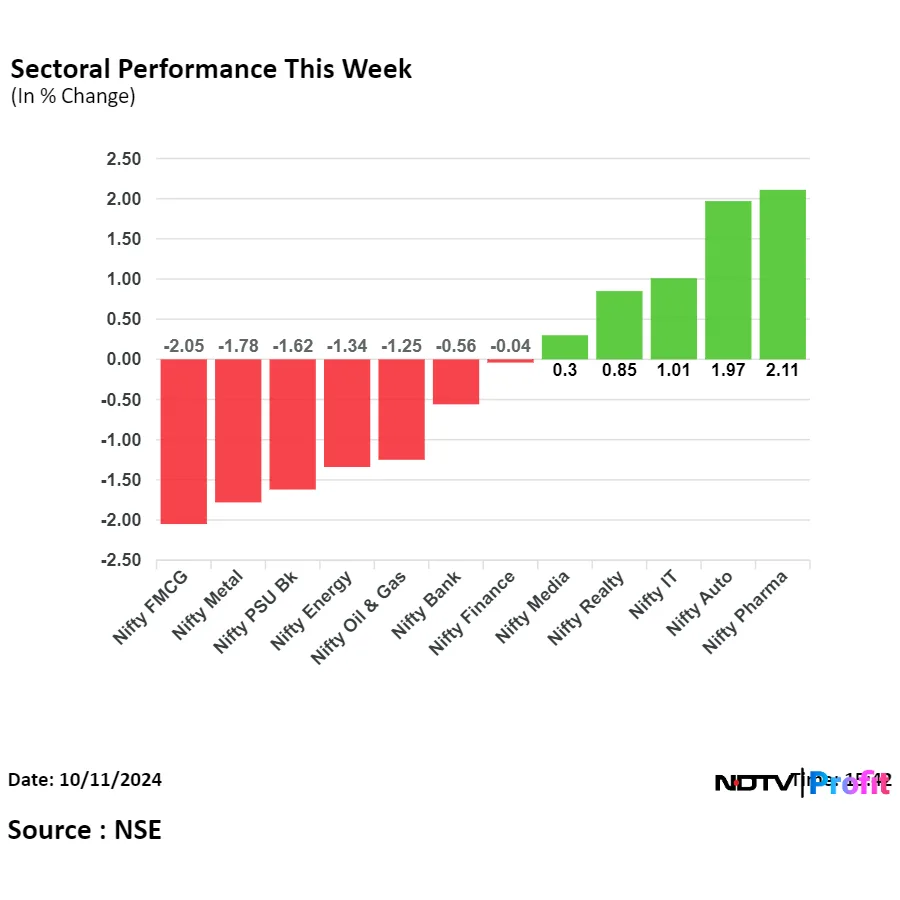

On a weekly basis, Nifty ended 0.2% lower and Sensex closed 0.4% down. Nifty Pharma gained the most this week, and Nifty FMCG was the top loser.

. Read more on Markets by NDTV Profit.