India's benchmark stock indices traded little changed through midday on Monday due to a lack of fresh triggers, even as gains in Reliance Industries Ltd., Hindalco Industries Ltd., and the State Bank of India supported the indices.

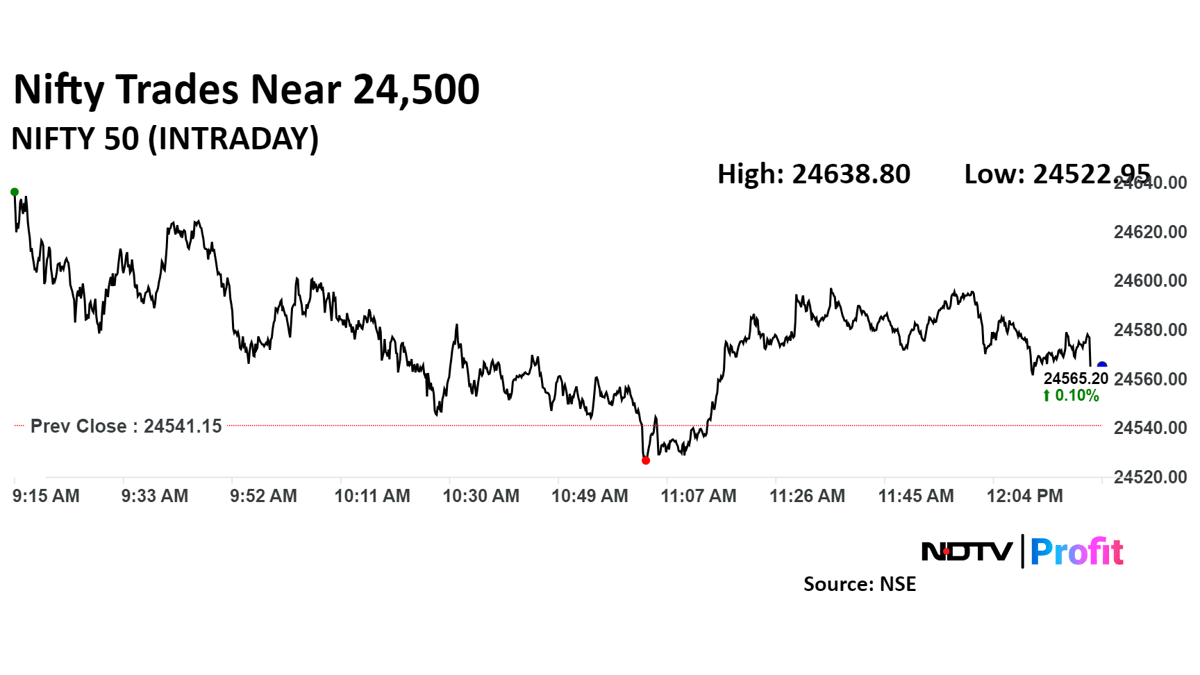

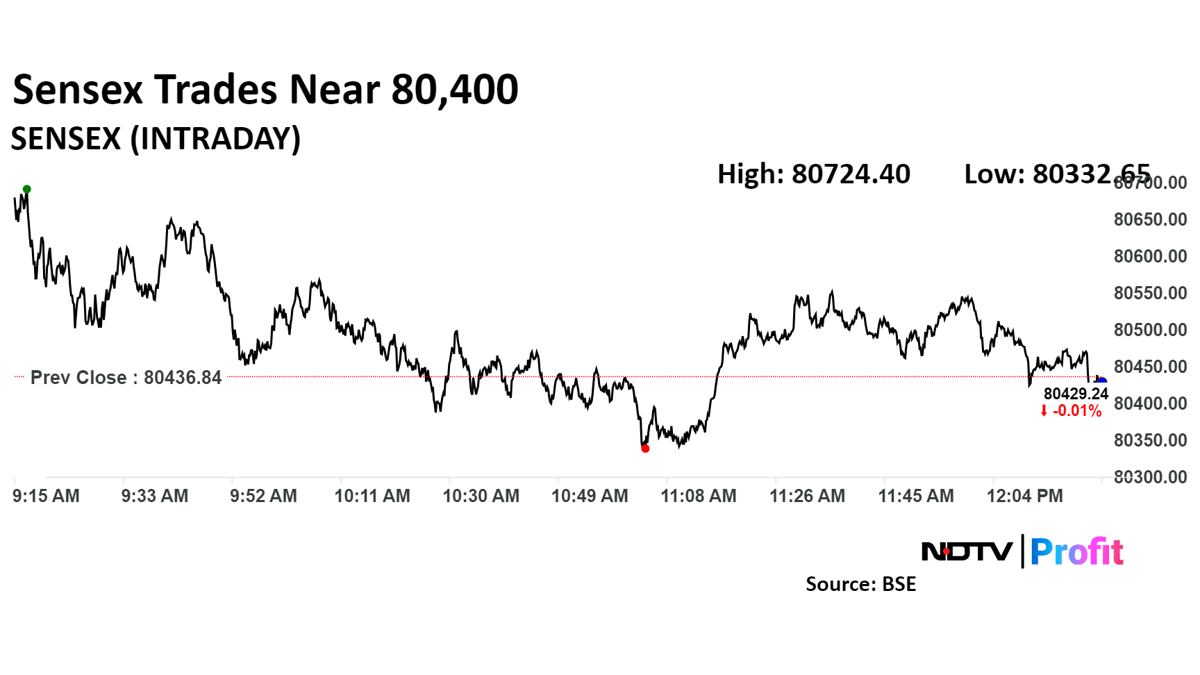

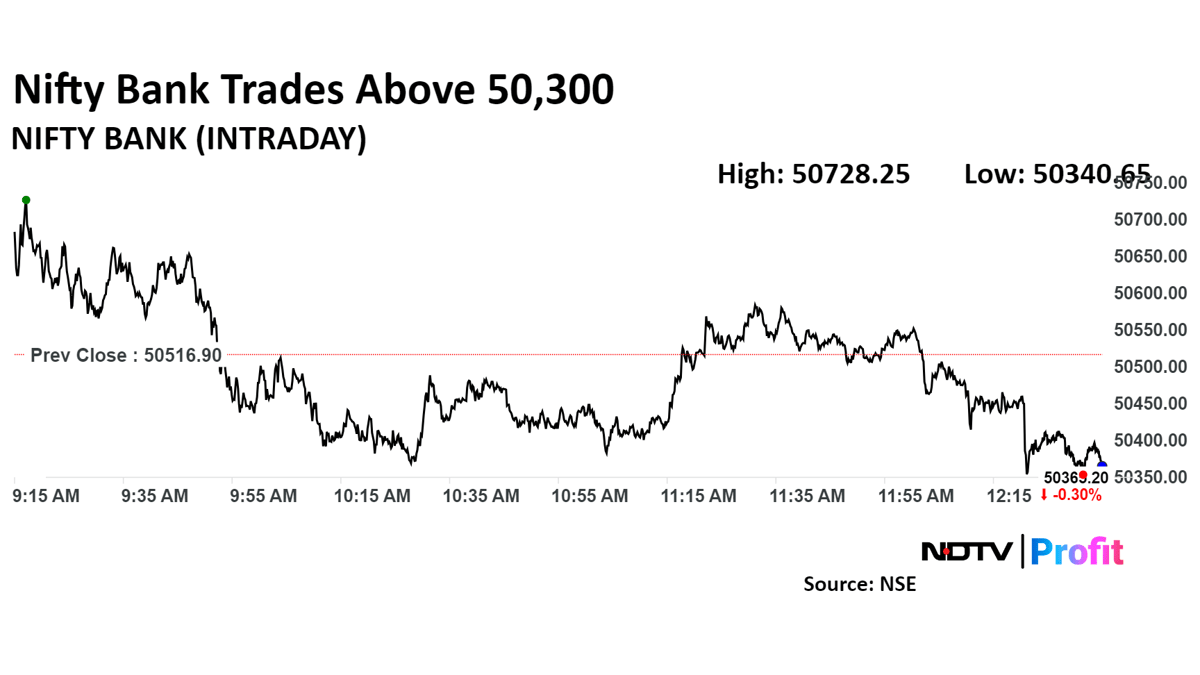

At 12:30 p.m., the NSE Nifty 50 was trading 0.074%, or 18.10 points, higher at 24,559.25, and the BSE Sensex was 26.05 points, or 0.032%, lower at 80,410.80.

"After a short-term correction, the market (Nifty and Sensex) found support near the 50-day Simple Moving Average, or 24,100/79,000, and rebounded sharply," said Shrikant Chouhan, head of equity research at Kotak Securities.

"A promising reversal formation on the daily and weekly charts, as well as a long bullish candle on the daily chart, indicate a further uptrend from current levels," he said.

Zomato Shares Hit Life High After UBS Upgrades Target Price With 20% Upside

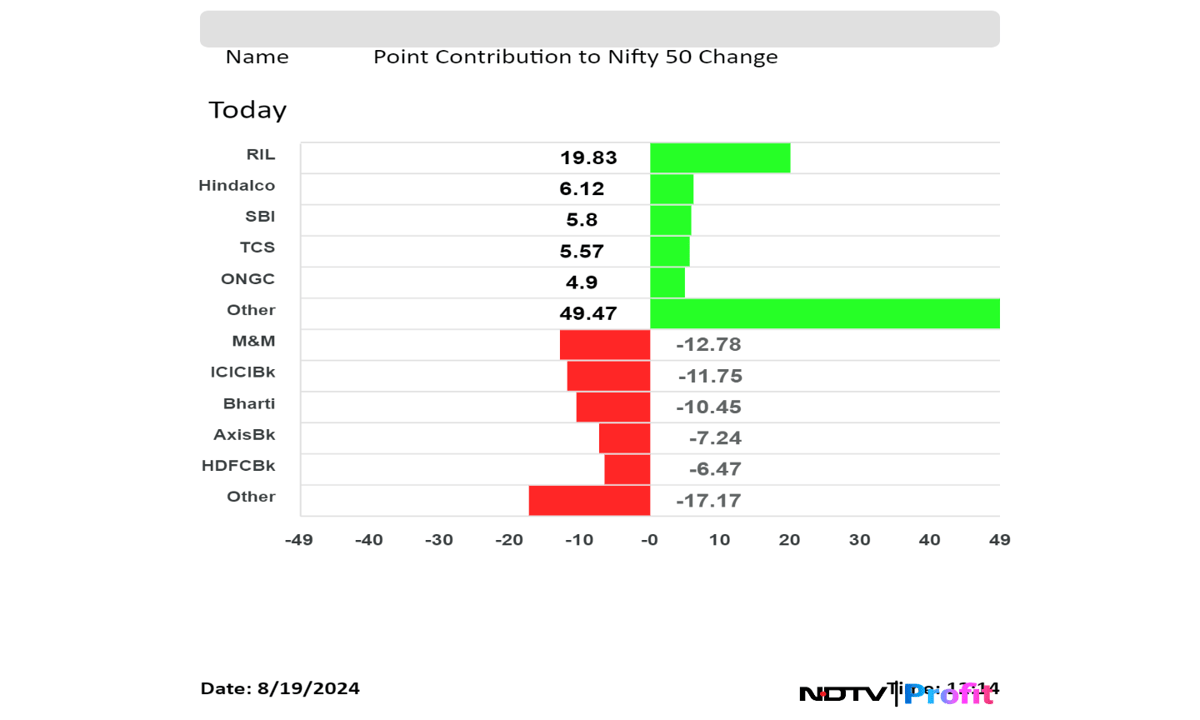

Shares of Reliance Industries Ltd., Hindalco Industries Ltd. and State Bank Of India contributed the most to the gains in the Nifty 50.

While those of Mahindra & Mahindra Ltd. and ICICI Bank Ltd. weighed on the index.

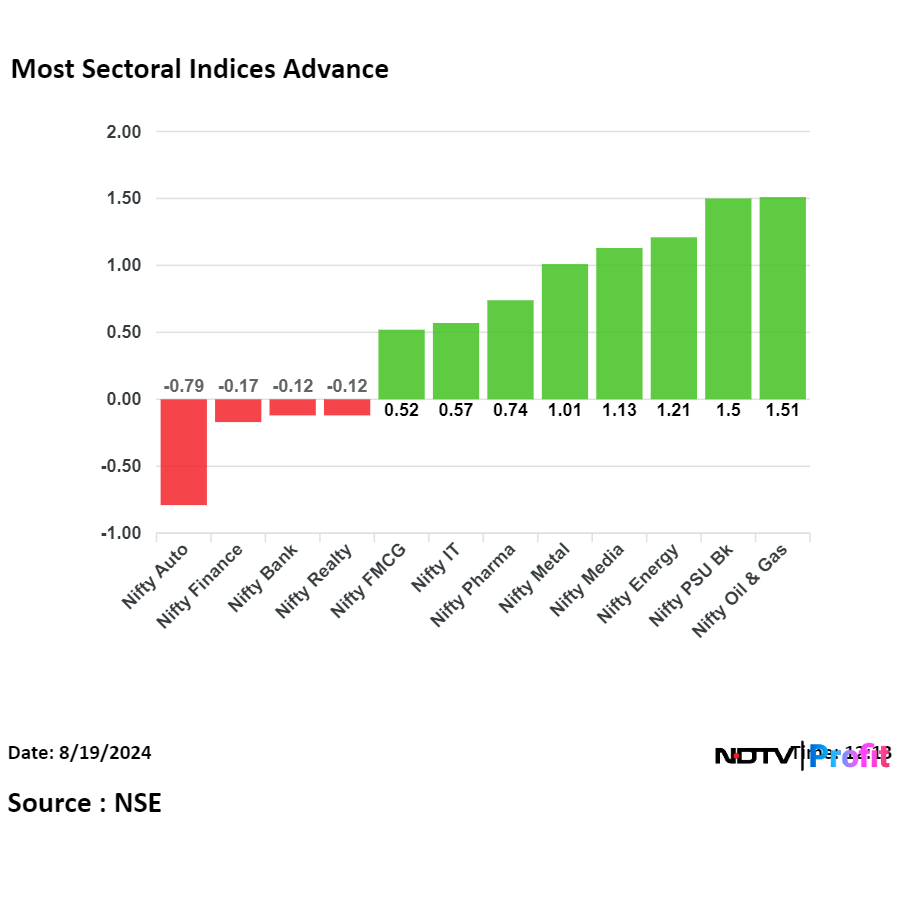

On NSE, eight sectors advanced and four declined. The NSE Nifty Oil & Gas and NSE PSU Banks rose the most, while the NSE Nifty Auto fell the most.

Ola Electric Hits Upper Circuit Again, Crosses Rs 60,000 Crore In Market Cap

The broader indices were trading in the green, with the BSE Midcap and Smallcap gaining 0.61% and 1.19%, respectively, through midday on Monday.

On the BSE, 17 sectoral indices were trading in the green, led by BSE Oil & Gas and BSE Energy. Three were trading lower led by BSE Auto.

The market breadth was skewed in the favour of the buyers. Around 2,676 stocks advanced, 1,201declined, and 163 remained unchanged on the BSE.

Stock Market Live: Nifty, Sensex Flat While RIL, TCS Lead; ICICI Bank, M&M Fall. Read more on Markets by NDTV Profit.