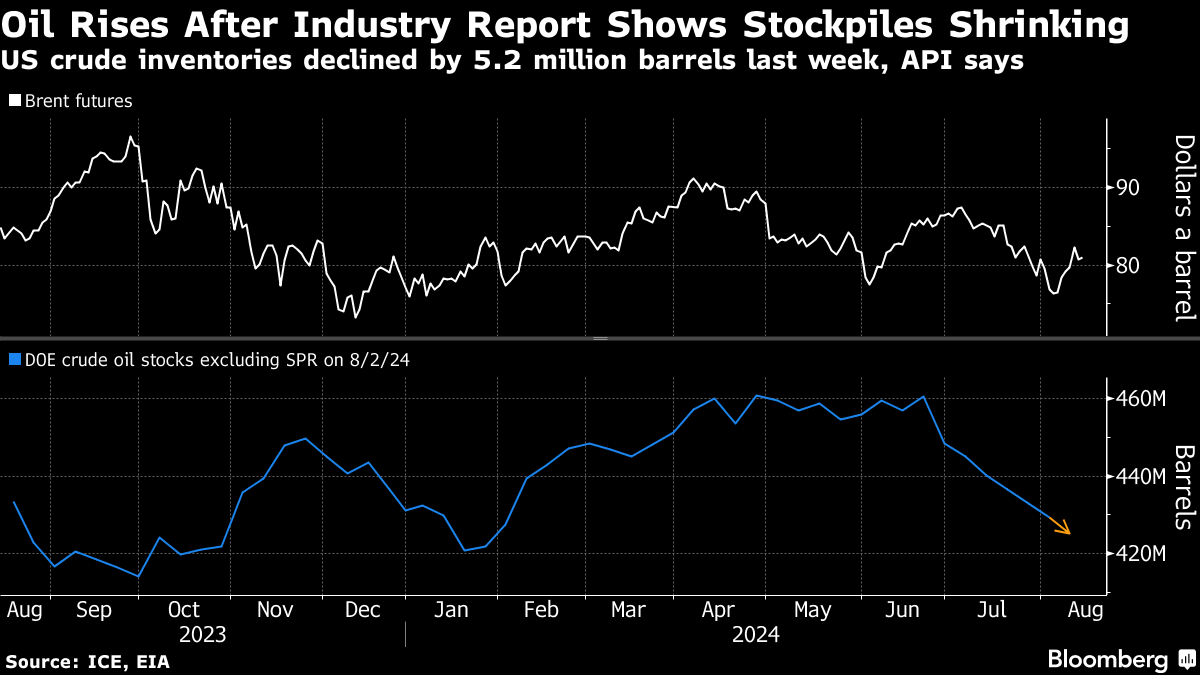

(Bloomberg) — Oil rose, after falling more than 2% on Tuesday, as an industry report pointed to a sizable drop in US crude stockpiles and tensions simmered in the Middle East.

Brent crude climbed to around $81 a barrel, while West Texas Intermediate was below $79. The American Petroleum Institute reported inventories shrank by 5.2 million barrels last week, according to people familiar with the data. That would be the seventh straight weekly drop if confirmed by official figures due Wednesday. Levels remain below seasonal averages.

Tuesday’s selloff pared this year’s gain and came as the International Energy Agency flagged a global surplus in the fourth quarter if OPEC+ proceeded with plans to restore production in October. The Organization of the Petroleum Exporting Countries had also trimmed its forecasts for global demand over this year and next, citing downward revisions for China’s outlook.

Still, there’s a small chorus of voices saying that Brent futures still have room to advance. Citigroup Inc. analysts flagged geopolitical and weather-related risks, while Goldman Sachs Group Inc. said financial demand for crude derivatives should rebound from last week’s record low. Both banks say Brent could climb to the mid-$80s level.

Elsewhere, risks remain that a retaliatory strike by Iran on Israel may lead to a spike in oil prices. The US said an attack has grown more likely and could come as soon as this week.

More stories like this are available on bloomberg.com

©2024 Bloomberg L.P.

. Read more on Markets by NDTV Profit.