India's benchmark stock indices were little changed through midday on Wednesday amid Asian markets trading slightly lower, tracking overnight weakness in US markets.

Banks and financial services stocks, including heavyweights HDFC Bank Ltd., State Bank of India, and ICICI Bank Ltd., outweighed gains in FMCG companies like ITC Ltd. and Titan Co.

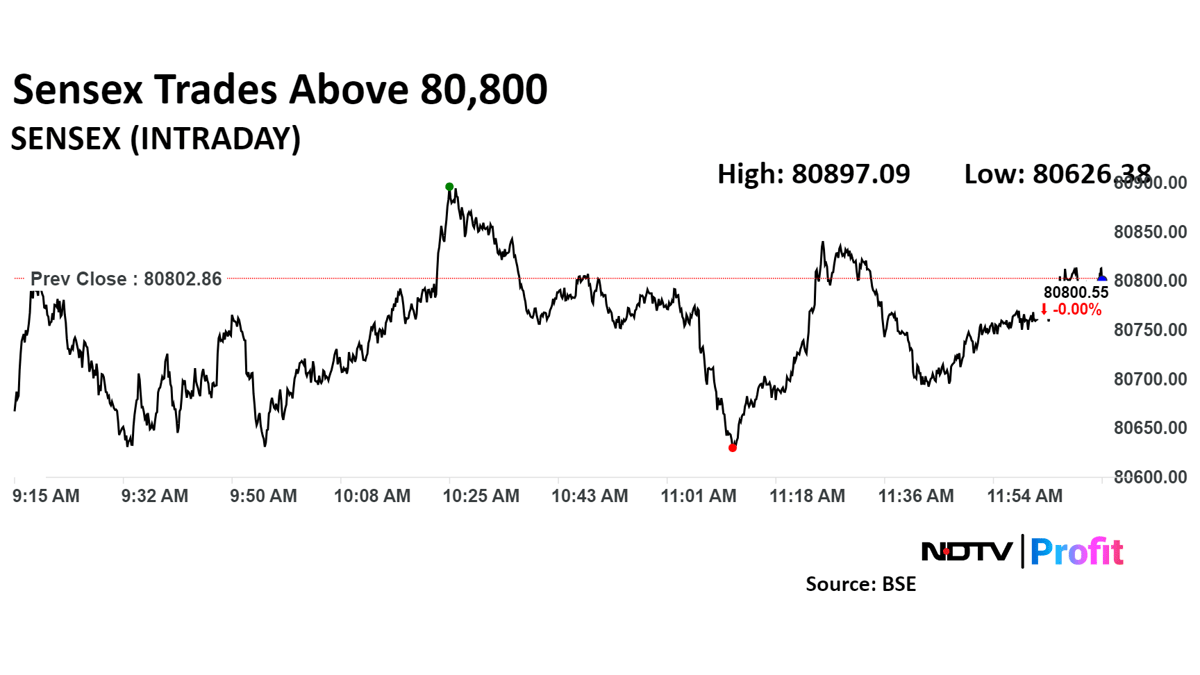

At 12:13 p.m., the NSE Nifty 50 was trading 0.12%, or 25 points, higher at 24,724, while the BSE Sensex was down 19.24 points, or 0.03%, at 80,789.

"The benchmark index started with a decent gap and witnessed a follow-up buying emergence during the initial hours of the trade," said Sameet Chavan, head of research, technical, and derivatives at Angel One Ltd.

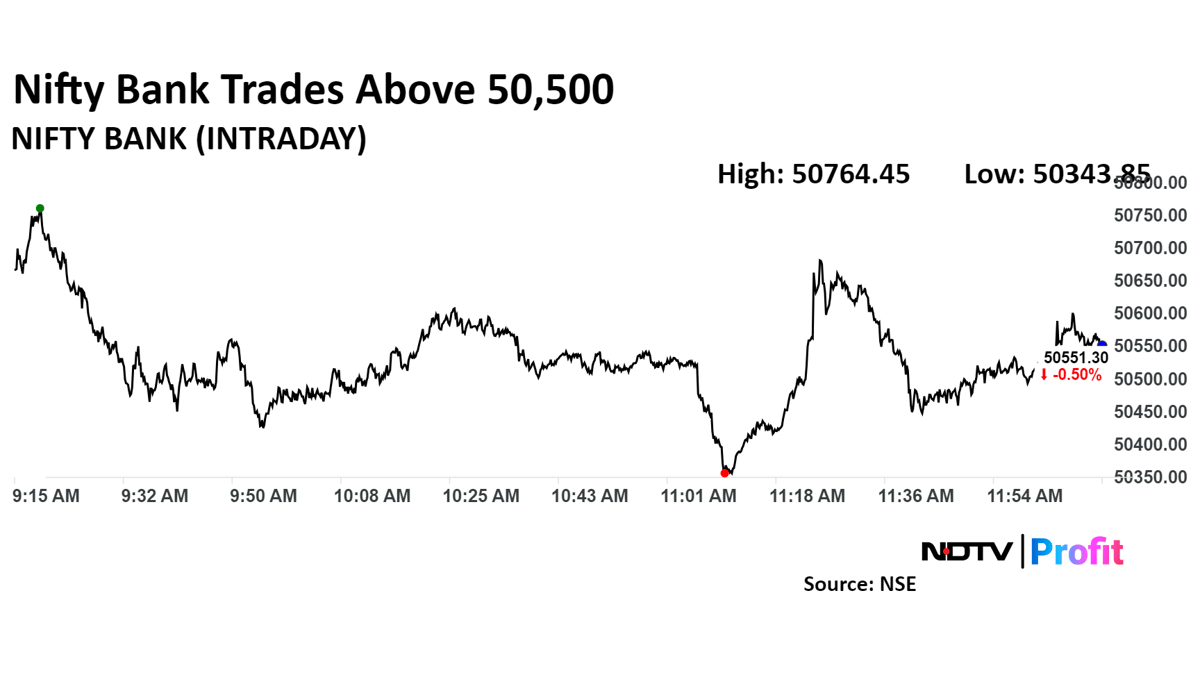

"The contribution from the high beta space Bank Nifty sparked a significant uptick in market activity, with robust buying interest persisting in the broader market for the second consecutive session of the week," he said.

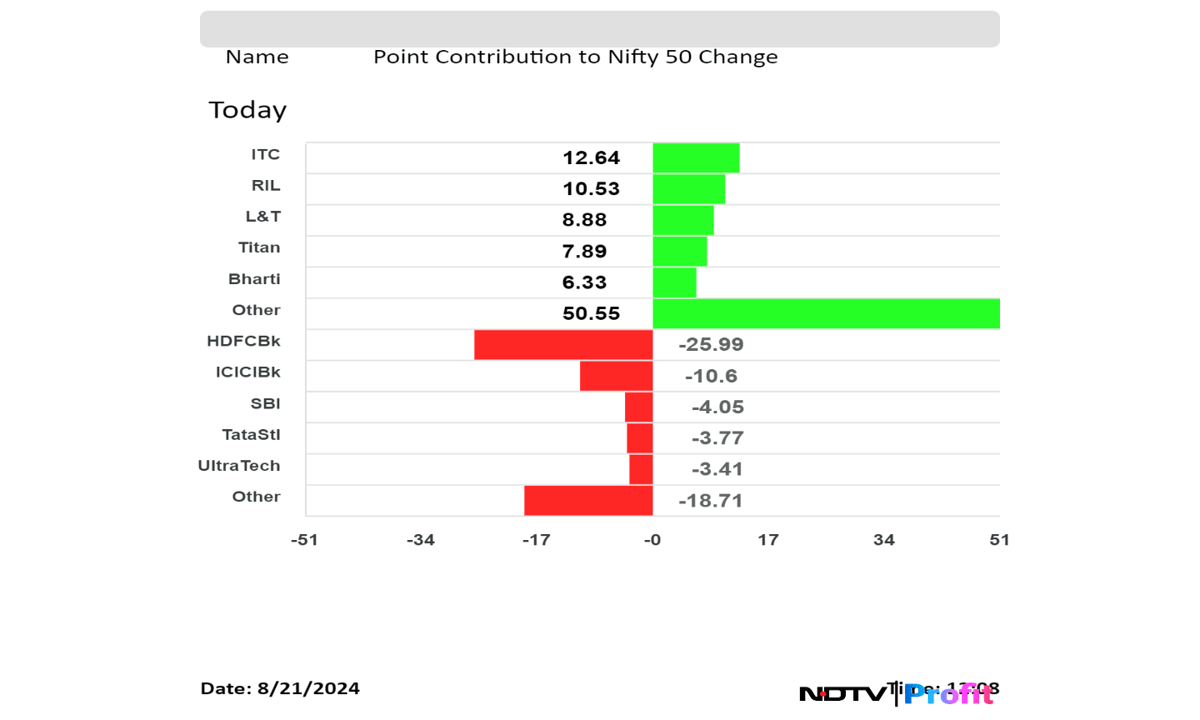

Shares of ITC, Reliance Industries Ltd., and Larsen & Toubro Ltd. contributed the most to the gains in the Nifty 50.

While those of HDFC Bank Ltd. and ICICI Bank Ltd. weighed on the index.

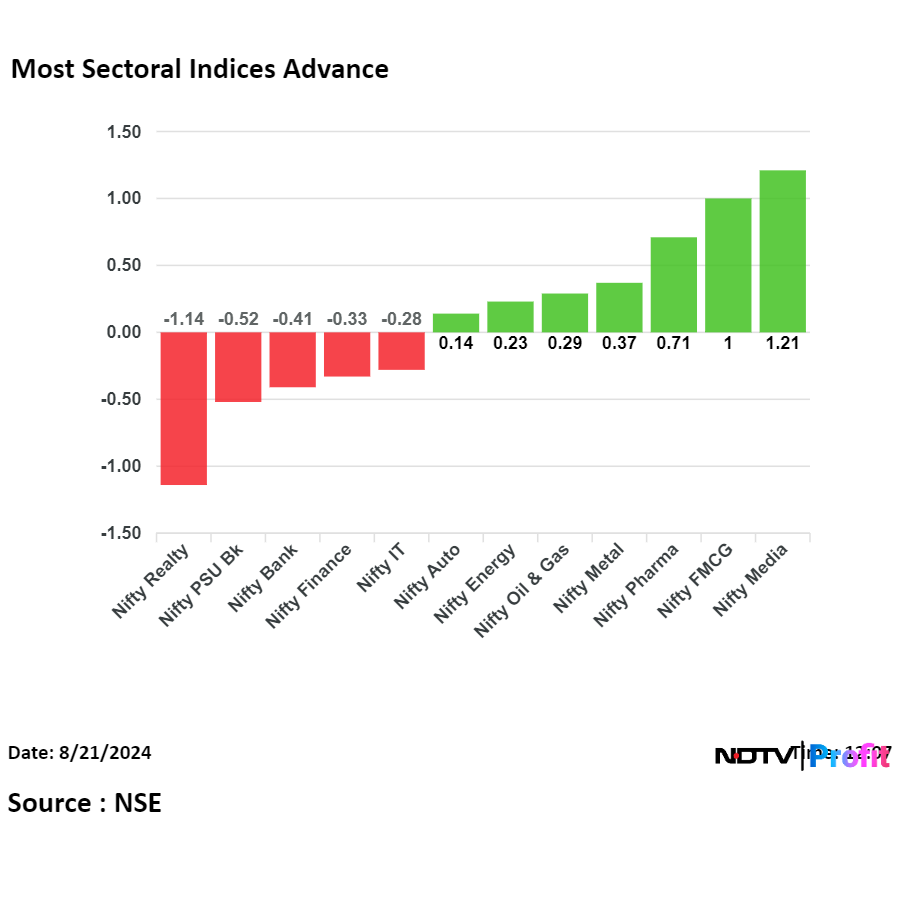

On NSE, seven sectors advanced and five declined. The NSE Nifty Media and NSE FMCG rose the most, while the NSE Nifty Realty fell the most.

The broader indices were trading in the green, with the BSE Midcap and Smallcap gaining 0.33% and 0.76%, respectively, through midday on Wednesday.

On the BSE, 16 sectoral indices were trading in the green, led by BSE Consumer Durables and BSE Fast Moving Consumer Goods. Four were trading lower led by BSE Realty and BSE Bankex.

The market breadth was skewed in the favour of the buyers. Around 2,479 stocks advanced, 1,270 declined, and 146 remained unchanged on the BSE.

Stock Market Live: Nifty, Sensex Move In Narrow Range; Private Bank Stocks Weigh. Read more on Markets by NDTV Profit.