Table of Contents

Strides Pharma Gets US FDA Approval For Theophylline

-

Gets US FDA approval for Theophylline Extended-Release Tablets, 300mg and 450mg

-

Theophylline is used to manage respiratory conditions like chronic asthma

Source: Exchange Filing

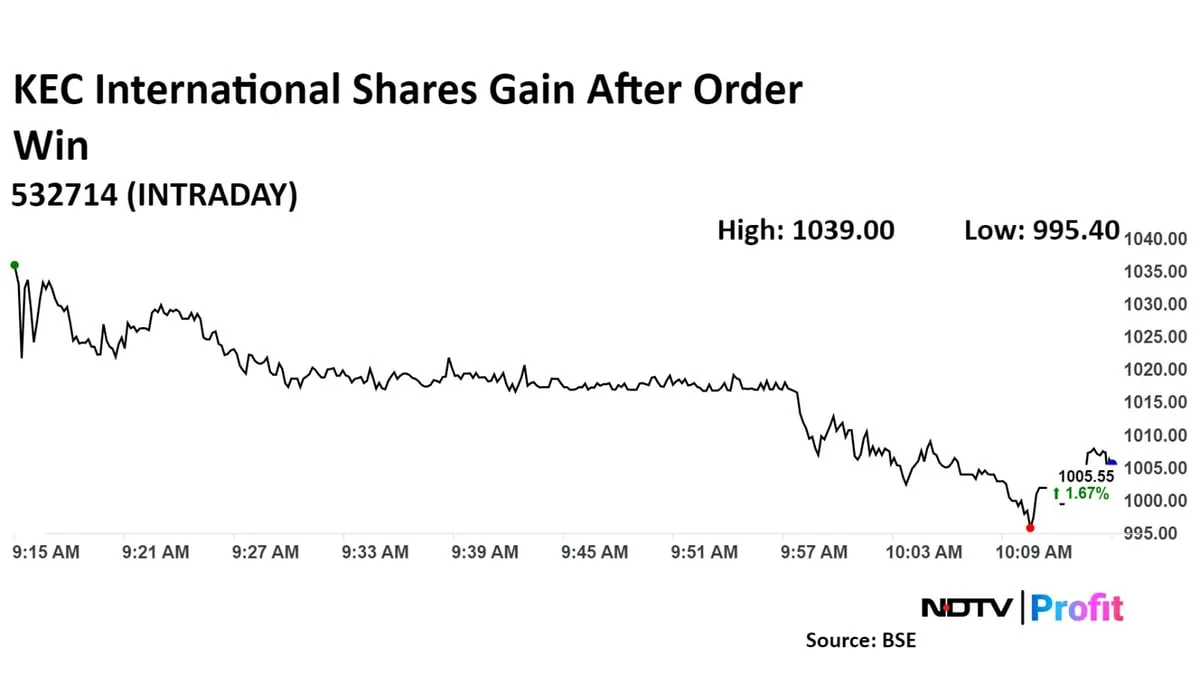

KEC International Jumps On Order Win

KEC International Ltd. stock jumped that it has secured new contracts worth Rs 1,423 crore for the design, supply, and installation of 380 kV transmission lines in Saudi Arabia.

BMW Ventures IPO To Include Fresh Issue

IPO to include fresh issue of 2.34 crore shares

Source: DRHP

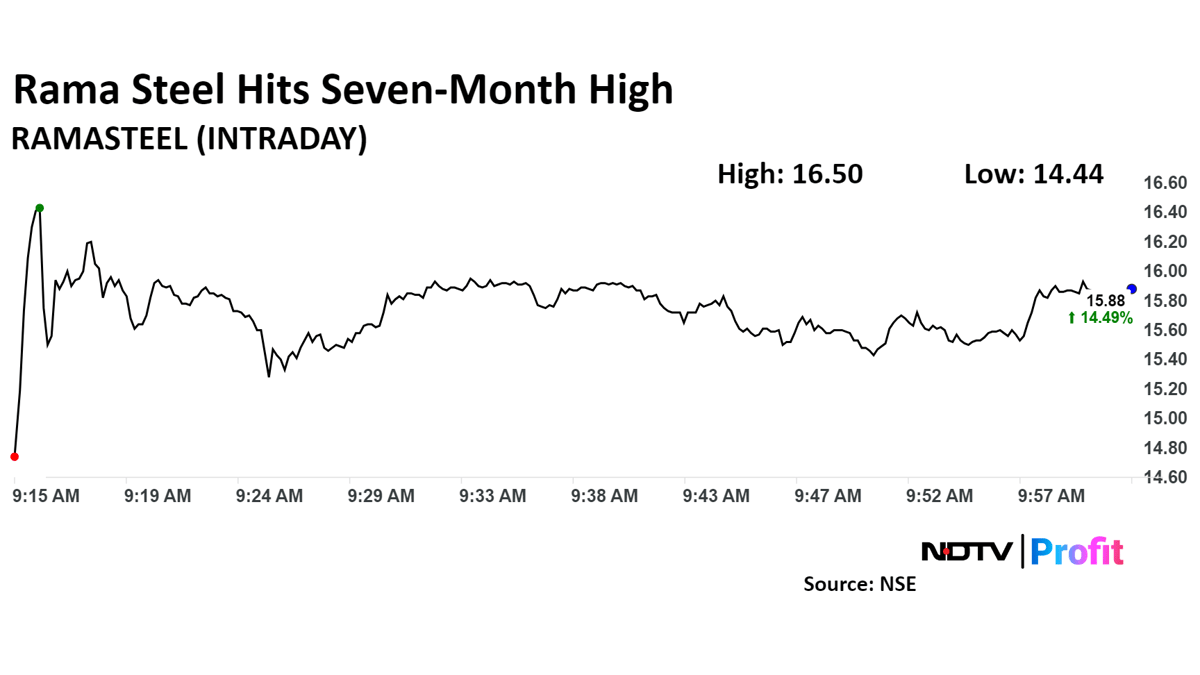

Rama Steel Jumps Over 50% In Five-Session Rally

On September 4, the company announced of a new partnership with Onix Renewable Ltd to supply steel structures for solar projects.

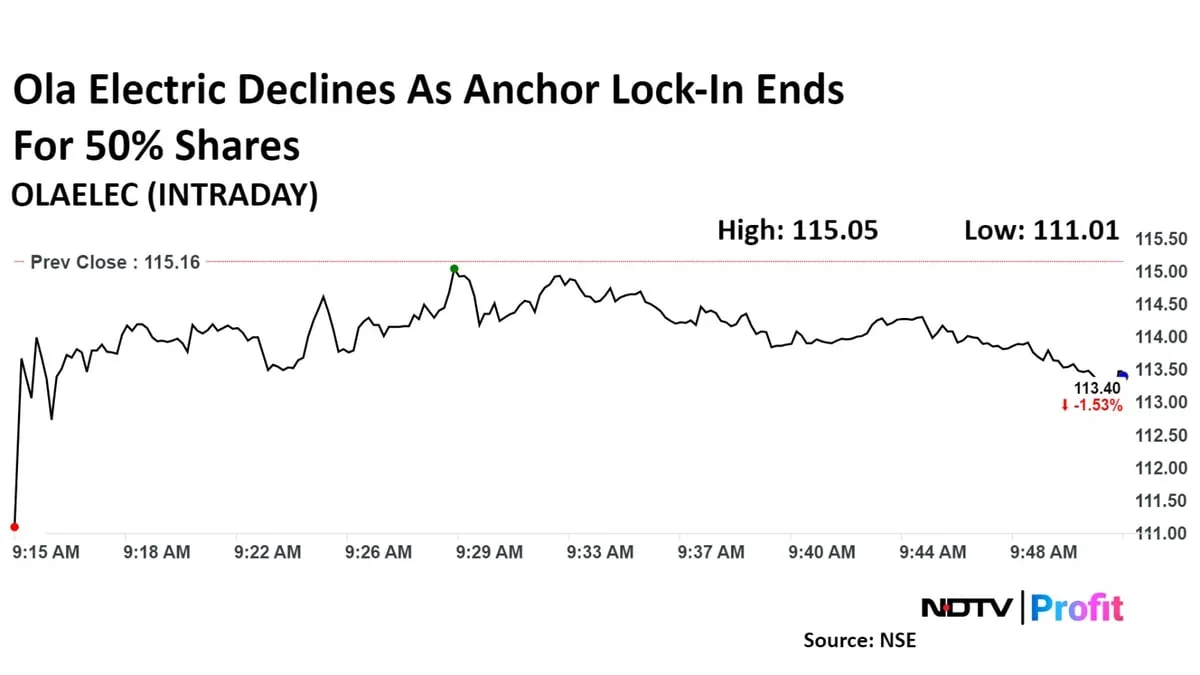

Shares of Ola Electric Mobility Ltd. declined more than 3% in early trade on Friday as the minimum lock-in period of 30 days for anchor book investors ends, freeing up around 18.17 crore shares for sale. This represents 4.1% equity.

Baazar Style Retail Lists At Rs 389

-

Lists at Rs 389 on BSE vs issue price of Rs 389

-

Lists at Rs 389 on NSE issue price of Rs 389

Source: Exchange Filing

Bajaj Finance Rises As Jefferies Ups Target

Bajaj Finance Ltd. got a target price hike on its stock from Jefferies after the investment bank said an improvement in bounce rates i.e. miss on EMI installments should help bring down credit costs from the third quarter, after meeting with the company's management.

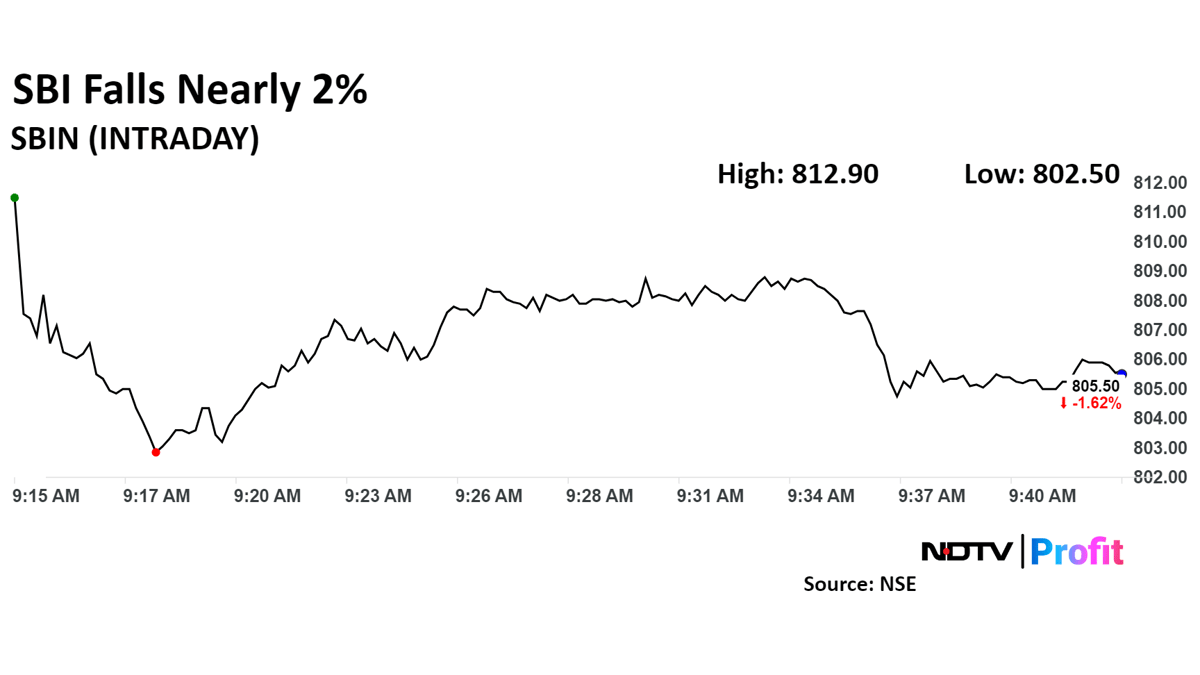

SBI Falls As Goldman Sachs Downgrades Rating To 'Sell'

Headwinds to State Bank Of India's peak return on assets ratio, increasing credit costs, and expectations of a lower loan growth has led Goldman Sachs downgrade the stock's rating to 'sell' from 'neutral' earlier.

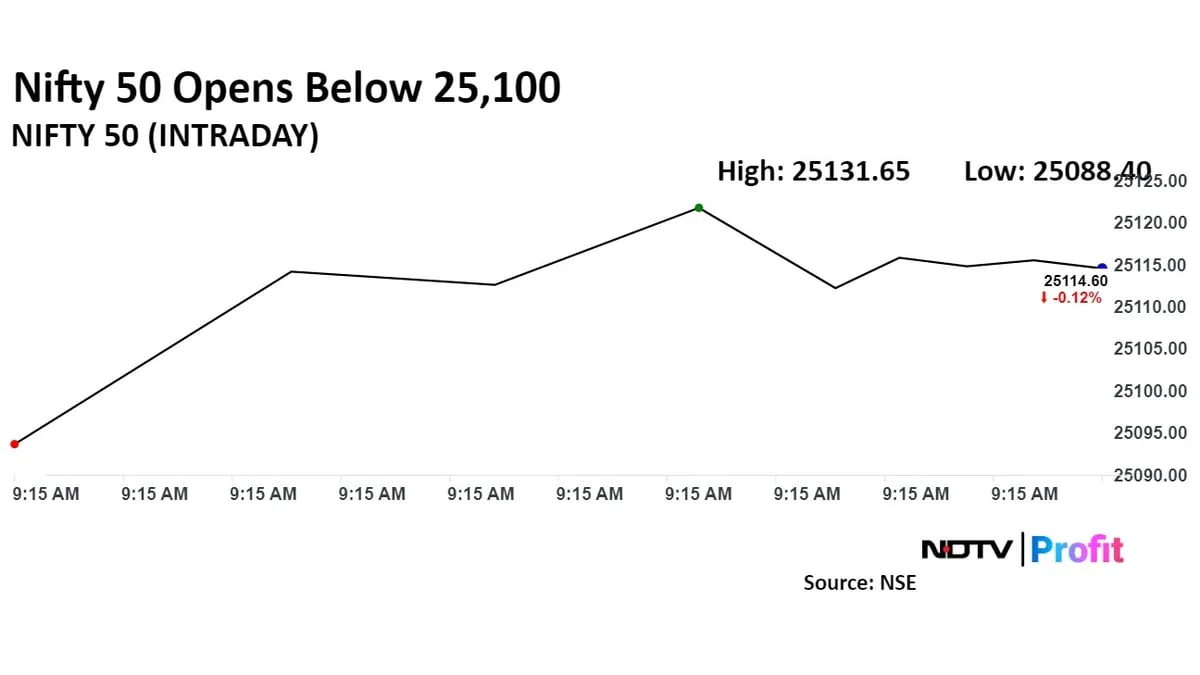

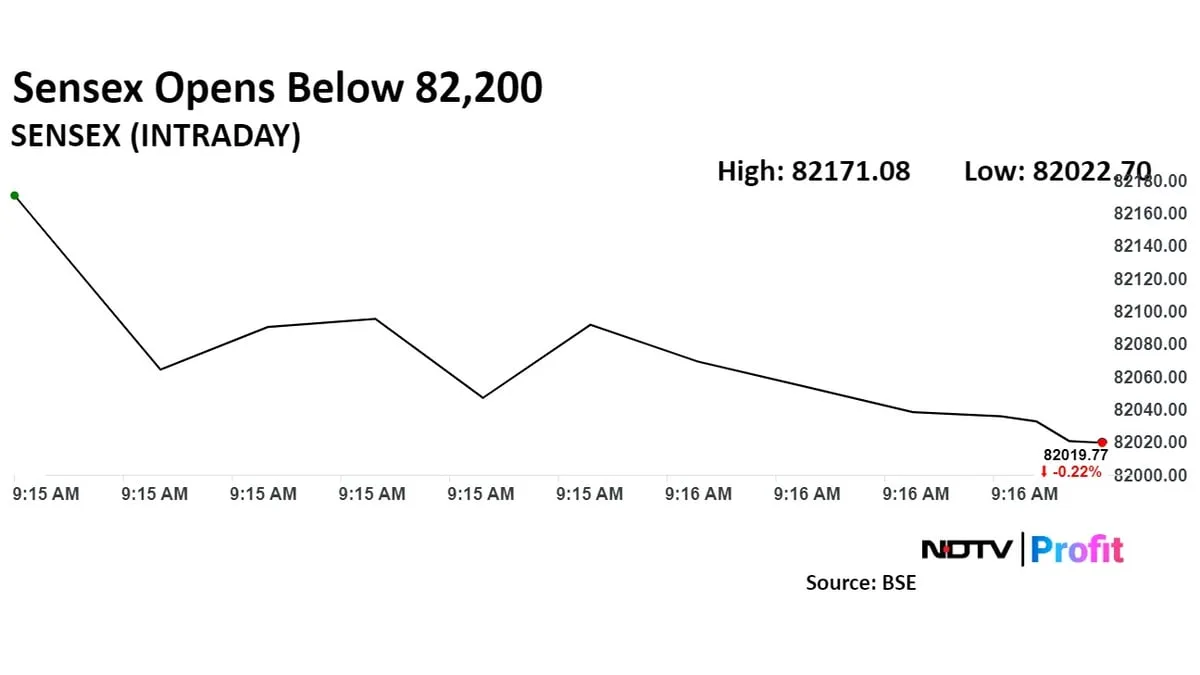

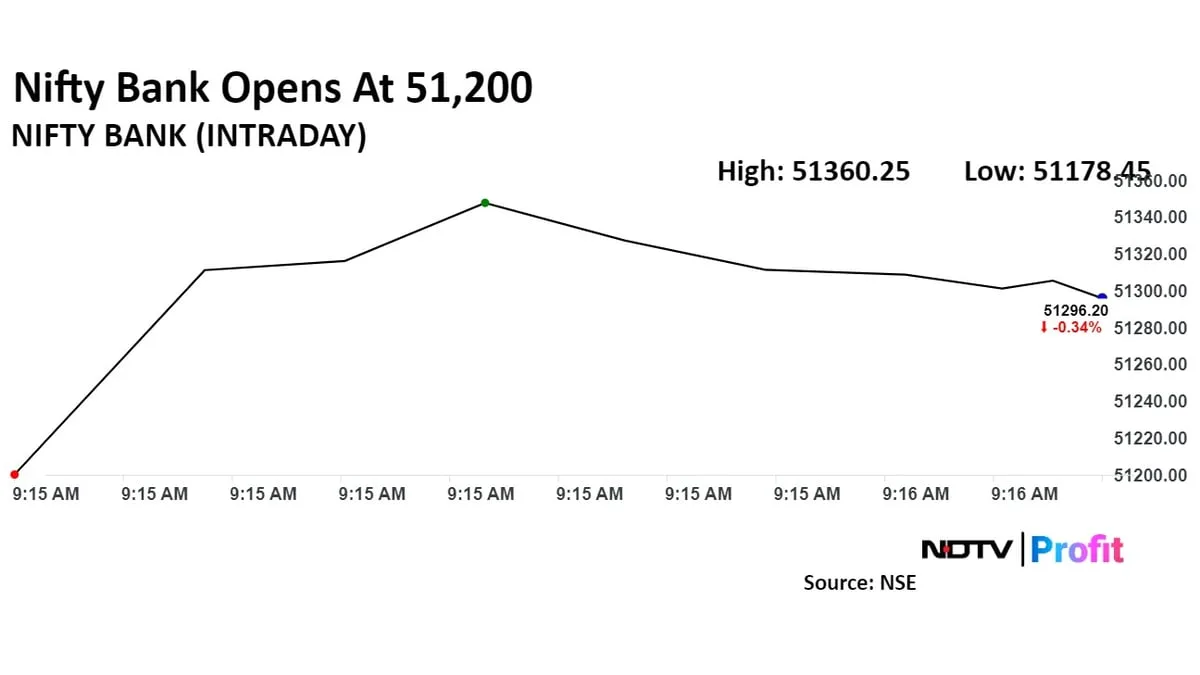

Nifty, Sensex Open Lower As ICICI Bank, SBI Drag: Opening Bell

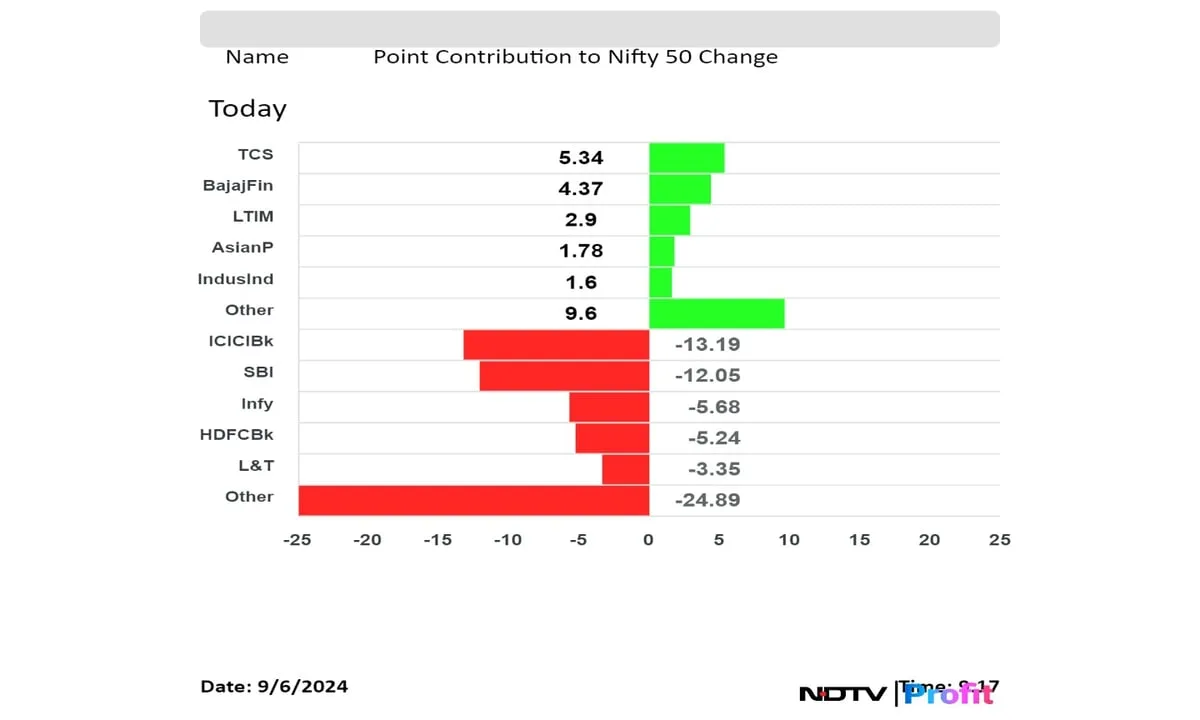

Benchmark equity indices extended their fall to another session as shares of ICICI Bank and State Bank of India dragged them.

At pre-open, Nifty was 25085.15, down 0.24% or 59.95 points and Sensex was at 82148.64, down 0.06% or 52.52 points.

"On the higher side positive up move will be only above 25,300 levels which is the five-day high and break below 25,000 can trigger some sharp profit booking," said Vikas Jain, head of research at Reliance Securities.

"RSI is witnessing reversal on daily charts from the average line and other key technical indicators are also moderating from current levels," he added.

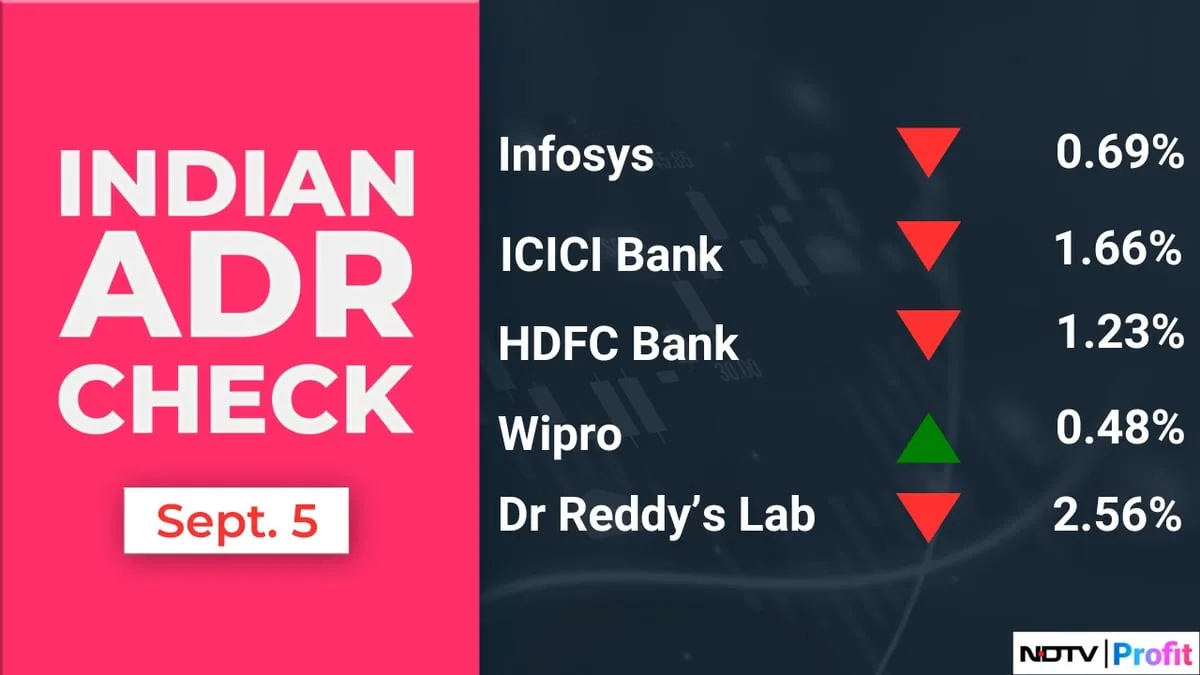

Shares of ICICI Bank Ltd., State Bank Of India, Infosys Ltd., HDFC Bank Ltd., and Larsen & Toubro Ltd. dragged the Nifty. While those of TCS, Bajaj Finance, LTIMindtree, Asian Paints, and IndusInd Bank limited the fall.

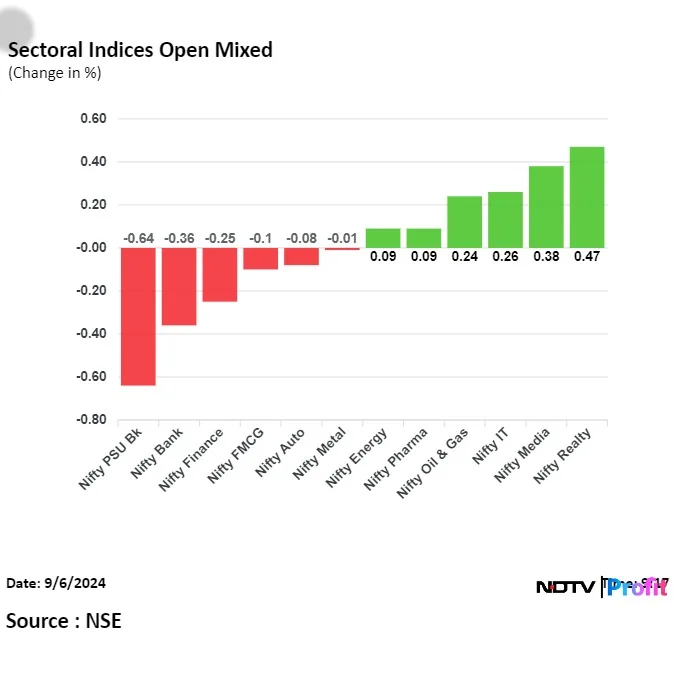

Sectoral indices were mixed at open with Nifty Realty rising the most and Nifty PSU Bank being the top loser.

Nifty, Sensex Lower At Pre-Open

At pre-open, Nifty was 25085.15, down 0.24% or 59.95 points and Sensex was at 82148.64, down 0.06% or 52.52 points.

Yield On The 10-Year Bond Opens Flat

-The yield on the 10-year bond opened flat at 6.85%.

-It closed at 6.85% on Thursday.

Source: Bloomberg

Rupee Strengthens Against US Dollar

-

Rupee strengthened by 2 paise to open 83.96 against the US dollar.

-

It closed at 83.98 on Thursday.

Source: Bloomberg

Dr Reddy's Andhra Unit Gets 'Voluntary Action Indicated'

Gets Establishment Inspection Report from US FDA after inspection at Andhra Pradesh facility

US FDA classifies Andhra Pradesh facility as 'Voluntary Action Indicated'

Source: Exchange Filing

Goldman Sachs on Indus Towers

-

Downgrades to 'sell', target price Rs 350 as against Rs 434 earlier, downside of 19.4%

-

Fundamentals have significantly improved, however re rating is overdone

-

Limited visibility on medium/long term growth outlook

-

Current share price implies 8-10% Ebitda growth till FY30, which is unlikely

-

Multiples are at significant premium to Bharti’s or Jio’s

-

Vodafone’s continued share erosion, reduction Bharti’s tendency roll outs are negative catalysts

Goldman Sachs On SBI

-

Downgrades to 'sell' from 'neutral' with target of Rs 742 and 9% downside

-

Risk reward profile turning unfavourable

-

Headwinds to ROA sustainability, expect sub-1% ROA by FY26

-

Lower loan growth given widening gap between deposits & loans

-

Increase in credit costs from MSME / Agri / unsecured

-

Cut EPS by 3-9% and target multiple to 1 time from 1.2 times earlier

Angel One Business Update (YoY)

-

August client base up 62.9% at 2.67 crore

-

August average client funding book up 169.6% at Rs 3,852 crore

-

August gross client acquisition up 22.9% at 9 lakh

Source: Exchange Filing

Nomura on Tata Motors

-

Maintains 'hold' with target of Rs 1,100, implying upside of 1.8%

-

Key argument for further upside is potential shift up in JLR’s valuation versus Porsche

-

JLRs underperformance between 2017-22 got its valuation to 1.5-2 times EV/EBITDA

-

Currently trading at 3-4 times EV/EBITDA but still 50% lower than Porsche

-

Every 1 time expansion in JLRs EV/EBITDA multiple is 10-15% accretive to TaMo stock price

-

Resale value trends, a proxy for brand-perception remain inferior vs Porsche

-

JLR catching up on financial metrics to Porsche

-

Porsche has lead on EVs but JLR scheduled to launch soon

Nomura's Monthly Economic View on India

-

Lowers FY25 GDP growth forecast to 6.7% YoY from 6.9%

-

Lowers FY25 CPI inflation forecast to 4.1% from 4.4%

-

Lowers FY25 current account deficit forecast to 1% of GDP from 1.1%

-

Increases cumulative RBI rate cut expectations from 75bps to 100bp

-

India’s strong medium-term growth drivers to ensure GDP growth of 7%

-

Sees rising downside risks for FY26 as well

-

Downside growth risks: political instability, stalled reforms, sluggish capex, excess monsoons

-

Upside risks: Resilient consumer demand, pvt capex revival

-

Oil prices pose two-sided risks for India

Emkay on Ashok Leyland

-

Maintains 'buy' with target of Rs 300, upside 25%

-

Margin expansion to mid-teens on track

-

Truck volumes could potentially improve from second half

-

Mid-to-long term outlook driven by economic growth and

-

Triggering of replacement-led demand as fleet-age remains at record levels

-

Co gaining share in buses/LCVs

-

Spares, Defense, and Power Solutions business also faring quite well

-

Improving mix & cost controls gives confidence on mid-teen margin guidance

-

One of the least expensive OEMs, with 13% EPS CAGR, net-cash b/s, >25% RoCE

Jefferies on Bajaj Finance

-

Maintains buy with a target of Rs 8,410

-

Jefferies met with management of Bajaj Finance

-

Indicated that bounce rates are falling, Expect credit costs to fall Q3

-

Tightening credit screens, growth to moderate to 25-26%

-

Earnings growth should pickup from H2FY25

Morgan Stanley On India Oil & Gas

-

ONGC remains top pick, followed by HPCL, GAIL (India)

-

Prefer HPCL and BPCL over IOCL

-

ONGC: Dividend growth, recovering cash flows, better production outlook to drive re-rating

-

GAIL India: Higher transmission volumes & tarrifs, new pipelines to drive return on capital employe

-

Gujarat Gas: Simpler group structure to offer more than 70% upside

-

RIL: Expect 11% EPS CAGR over F23-F26 with multiple triggers

-

Expects next leg of re-rating for Deepak Nitrite

-

Well-supplied markets, strong domestic demand, project monetisation to benefit India's energy value chain

Approves allocation of 1.3 cr shares to QIBs at Issue price of Rs 1,150/share

Source: Exchange Filing

Mangalam Cement In Agreement For Solar Power

-

Enters into purchase power agreement for Solar Power via special purpose vehicle Suryadeep RJ1 Projects

-

Suryadeep RJ1 Projects is setting up solar power plant at Barmer, Rajasthan

Source: Exchange Filing

Citi On India Equity Strategy

-

FII inflows effect on commencement of US rate cut cycle

-

Net negative in 3/4 instances in immediate 1months/3months

-

Global risk-off scenarios key driver of short-term outflows

-

Remains positive over 12 months in most cases

-

Healthcare and Staples do well over 12 months following rate cute cycle

-

Global peers believe India remains relatively better placed vs overall EMs

Changes to Preferred Picks:

-

Remove Industrials & Utilities from sector preferences

-

Add HUL to preferred list seeing improvement on rural side

-

Add Bharti Hexacom to mid-cap list post initiation

-

Key Overweight Sectors: Banks/Insurance, Telecom, Healthcare

-

Key Underweight Sectors: Consumer Discretionary, IT Services, Metals

Poonawalla Fincorp Approves NCD Allotment

Board approves allotment of NCD aggregating to Rs 425 crore, through private placement

Source: Exchange Filing

Emami Acquires First Tranche Of Helios

-

Acquires first tranche of 1.2 lk shares of Helios on September 5

-

Company's stake in Helios increases to 94.24% from 50.40%

-

Company on August 30 announced approval for acquisition of remaining 49.6% stake in Helios Lifestyles

-

Helios Lifestyles is a subsidiary of the company

Source: Exchange Filing

Global Cues

-

U.S. Dollar Index at 101.04

-

U.S. 10-year bond yield at 3.73%

-

Brent crude 0.17% higher at $72.81 per barrel

-

Nymex crude 0.19% higher at $69.28 per barrel

-

GIFT Nifty was down 29.5 points or 0.1% at 25,170.00 as of 07:55 a.m.

-

Bitcoin was up 1.09% at $56,684.87

F&O Cues

-

Nifty September futures fell by 0.05% to 25,236.75 at a premium of 91.65 points.

-

Nifty September futures open interest fell by 2.33%.

-

Nifty Bank September futures rose by 0.2% to 51,727.6 at a premium of 254.55 points.

-

Nifty Bank September futures open interest fell by 1.6%.

-

Nifty Options Sept. 12 Expiry: Maximum call open interest at 26,400 and maximum put open interest at 23,900.

-

Bank Nifty Options Sept. 11 Expiry: Maximum call open interest at 59,000 and maximum put open interest at 51,500.

-

Securities in ban period: Aditya Birla Fashion And Retail, Balrampur Chini Mills, Bandhan Bank, Biocon, Chambel Fertilizers, Hindustan Copper, RBL Bank.

Bulk Deals

-

Rama Steel Tubes: Hrti Private Limited bought 87.2 lakh shares (1.72%) at Rs 13.07 apiece.

-

Oswal GreenTech: Oswal Agro Mills Ltd. bought 124.61 lakh shares (4.85%) at Rs 51 apiece. Bhavani Techno Projects Limited sold 48.54 lakh shares (1.89%), Appu Impex Ltd. sold 36.86 lakh shares (1.43%), Alliance Techno Projects Limited sold 26 lakh shares (1.01%) and Luckystar Entertainments Limited sold 13.2 lakh shares (0.51%) at Rs 51 apiece.

-

Max Financial Services: Max Ventures Investment Holdings Private Limited sold 110 lakh shares (3.18%) at Rs 1107.37 apiece.

-

RattanIndia Enterprises: Lgof Global Opportunities Ltd sold 117.92 lakh shares (0.85%) at Rs 81.94 apiece and Connecor Investment Enterprise Ltd sold 82.61 lakh shares (0.59%) at Rs 83.45 apiece.

-

Thangamayil Jewellery: Chandramogan R G bought 3.53 lakh shares (1.28%) at Rs 2140 apiece.

Trading Tweaks

-

Price Band change from 20% to 10%: IIFL Securities, SEPC.

-

Ex dividend: Eclerx Services, Shipping Corporation of India, Shipping Corporation of India Land and Assets, Senco Gold, Sterling Tools, Tatva Chintan Pharma Chem, Triveni Turbine, Vardhman Textiles.

-

Ex/record dividend: Gujarat Narmada Valley Fertilizers and Chemicals, Gujarat State Petronet, KRBL, Medi Assist Healthcare Services, Metro Brands, NBCC, The New India Assurance Company, Protean eGov Technologies, Quess Corp, Responsive Industries, Triveni Engineering and Industries, Zen Technologies.

-

Ex/ record Bonus: VST Industries.

-

Moved in short term ASM Framework: Geojit Financials Services

Ashoka Buildcon’s Arm Viva Highways Monetises Pune Land

Block Deals

Shanti Educational Initiatives: New Leaina Investments Limited sold 18 lakh shares (1.11%) at Rs 119.32 apiece and LGOF Global Opportunities Ltd. sold 22.77 lakh shares (1.41%) at Rs 119 per share. On the other hand, Legends Global Opportunities (Singapore) Pte. Ltd. bought 22.77 lakh shares (1.41%) at Rs 118.85 apiece.

IPO Offering

Shree Tirupati Balajee Agro: The IPO has been subscribed 6.36 times on the first day. The bids were led by retail investors (7.93 times), non-institutional investors (5.25 times), and institutional investors (4.46 times).

Listing

Baazar Style Retail: Shares of Rekha Jhunjhunwala-backed firm to list on stock exchange today. The IPO was subscribed 40.66 times on its third day, led by institutional investors. The IPO was subscribed 4.64 times on the second day and 0.72 times or 72%, on the first day. The issue price for the firm has been set at Rs 389 according to date on the NSE.

Aditya Birla Fashion To Raise Rs 500 Crore Via NCDs

Stocks to Watch

-

KEC International: The company received new orders worth Rs 1,423 crore for the supply and installation of 380 kV transmission lines in Saudi Arabia.

-

Rashtriya Chemicals & Fertilizers: The company approved the issue of secured/unsecured, non-convertible debentures aggregating up to Rs 1,400 crore in the period of the next twelve months through a private placement basis.

-

Aditya Birla Fashion And Retail: The company will raise funds up to Rs 500 crore through non-convertible debentures. The company also approved the allotment of 5.57 crore shares to shareholders of TCNS Holdings. The company will allot 11 ABFRL shares for every six held in TCNS Holding.

-

Ashoka Buildcon: The company announced that its wholly-owned subsidiary, Viva Highways Ltd, has successfully monetised its land in Hinjewadi, Pune, for a total value of Rs 453 crore.

-

L&T Finance: The company has issued 17,500 listed, secured, rated, redeemable non-convertible debentures worth Rs 175 crore to selected investors through a private placement on Sept 5, 2024.

-

Wipro: The company has been enlisted by JFK International Air Terminal, the operator of JFK’s Terminal 4, to help meet its net zero targets.

-

JSW Energy: The company has received a Rs 55 lakh tax penalty for the financial year 2019-20.

-

Adani Enterprises: The company approved the early closure of the NCD issue. The issue will now close on Sept. 6 instead of Sept. 17.

-

Finolex Cables: Nikhil Naik stepped down as Chairman of the Board, and the board appointed Ratnakar Barve as Chairman in his place.

-

Jindal Stainless: The company has supplied high-strength tempered 301LN grade austenitic stainless steel for this prestigious government project. The coaches are manufactured by Integral Coach Factory and Bharat Earth Movers Ltd.

-

Sky Gold: The company approved the issuance of 4.17 lakh fully paid equity shares worth Rs 50 crore. These shares were issued as part of a share swap deal in exchange for acquiring 100% ownership of Sparkling Chains Private Ltd. and Starmangalsutra Private Ltd. rather than for cash.

-

Pidilite Industries: CollTech Group, a company specialising in high-performance adhesives and thermal solutions, has signed an exclusive distribution agreement with Pidilite Industries. Under this partnership, Pidilite will be the sole distributor of CollTech’s products in India, helping both companies strengthen their market presence, especially in the electronics industry.

-

MedPlus Health Services: Optival Health Solutions Private Ltd., the subsidiary company, has received two suspension orders for drug licenses for stores situated in Bangalore, Karnataka.

-

Akzo Nobel India: The company has commenced the commercial production of the powder coating products from its plant at Gwalior with an installed production capacity of 5166 T per annum.

-

Allcargo Logistics: Ecu Worldwide Korea Co. Ltd., a joint venture company of Allcargo Logistics Ltd, has incorporated a company in the name of Allcargo ULS Terminals Co. Ltd., “Allcargo ULS Terminals.”

-

Nucleus Software Exports: The company’s buyback worth Rs 72 crore is to open on Sept. 9 and close on Sept. 13.

-

Venus Pipes: The Revenue Intelligence Directorate conducted a search at the company’s corporate office over alleged evasion of customs duty on goods imported. The company has deposited Rs 5 crore as duty.

-

Matrimony.com: The board approved Rs 72 crore buyback at Rs 1,025 per share.

-

Dreamfolks: Introduces its latest service, catering to travellers on highways across India.

-

Camlin Fine Sciences: Board to consider fund raise by rights issue of equity shares on Sept. 10

Fresh Saudi Projects Bump Up KEC International’s Order Book By Rs 1,423 Crore

GIFT Nifty Trades Near 25,100

GIFT Nifty was at 25,136.50, down by 63 points, or 0.25% as of 06:38 a.m.

Asian indices were mixed in the early trade with South Korea's Kospi, trading more than 1.3% lower at 6:37 a.m., while Japan's Nikkei and Australia's ASX 200 were flat.

Trading in Hong Kong will be shut on Friday as the country is battered by Super Typhoon Yagi.

US stocks faltered as Wall Street's anxiety intensified just hours before the eagerly awaited US jobs report. S&P 500 ended 0.30% lower at 5,503.41, extending its decline into a third consecutive day, despite some gains among major tech stocks. The Dow Jones ended 0.54% lower at 40,755.75. However, Nasdaq Composite ended 0.25% higher at 17,127.66.

Meanwhile, Treasury yields remained relatively stable, with traders anticipating more than 100 basis points in Federal Reserve rate cuts for 2024, suggesting a substantial reduction may be on the horizon before the year ends.

Brent crude was trading 0.12% higher at $72.78 a barrel as of 6:30 a.m. and gold was flat at $2,516.03 an ounce.

India's benchmark indices ended lower on Thursday, dragged down by heavyweights Reliance Industries Ltd. and Bharti Airtel Ltd. The NSE Nifty 50 extended decline for the second day to end 53.60 points, or 0.21% lower at 25,145.10, while the S&P BSE Sensex fell for the third straight session to settle 151.48 points, or 0.18% down at 82,201.16.

Overseas investors remained net buyers of Indian equities for the fifth consecutive session on Wednesday. Foreign portfolio investors mopped up stocks worth Rs 975.5 crore, while domestic institutional investors stayed net buyers for the third consecutive day and purchased equities worth Rs 97.4 crore, according to provisional data from the National Stock Exchange.

The Indian currency closed at a record closing low of 83.98 against the US dollar.

Trade Setup For Sept. 6: Nifty Set For Range-Bound Trade Ahead Of US Jobs Data. Read more on Markets by NDTV Profit.