Table of Contents

KEC International Expects 15% Top Line Growth In FY25, MD Says

-

KEC International Ltd. is expecting 15% growth in revenue in financial year 2024-25.

-

The company is expecting Ebitda Margin at 7.5% for the financial year 2024-25.

-

The company has Order Pipeline of 10,000 crore as of today.

-

KEC International should have order book of Rs 25,000 crore by end of the current financial year.

-

Supply chain challenges are slowly easing. The company is seeing more business coming from UAE.

-

The company has around Rs 40,000 crore tenders in international market with 20% success rate.

Source: Vimal Kejriwal, managing director and chief executive officer,KEC International Ltd. to NDTV Profit

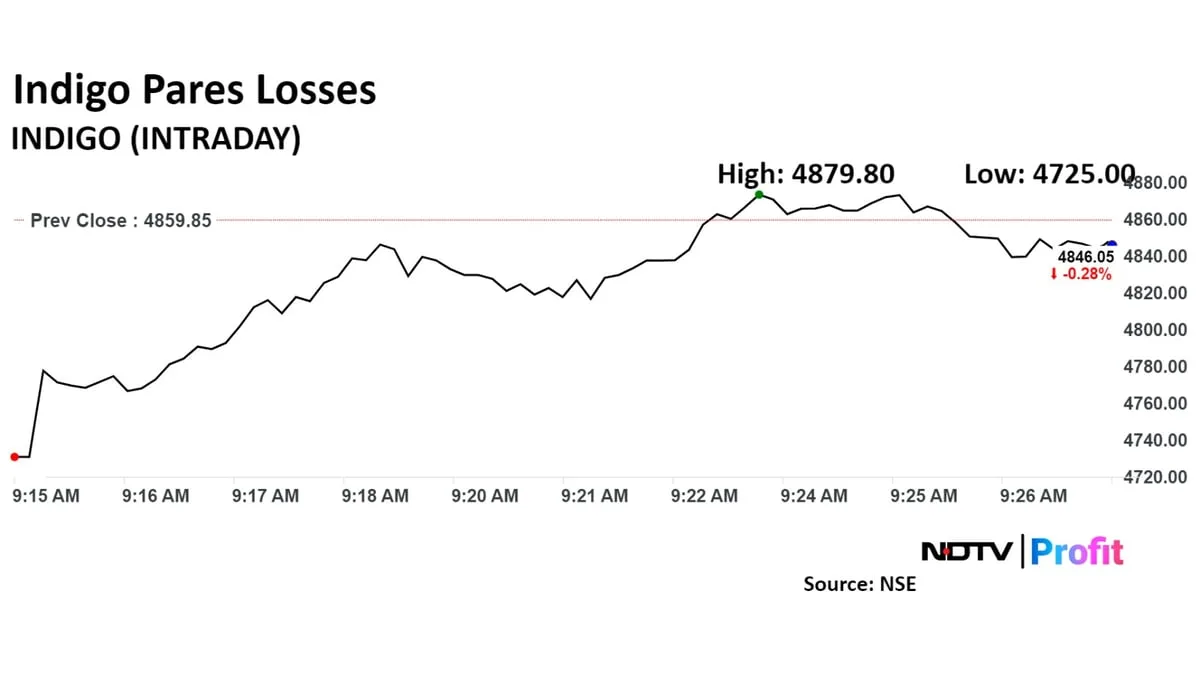

Shares of InterGlobe Aviation Ltd. fell as the company's promoters Rakesh Gangwal and Chinkerpoo Family Trust plan to sell up to 2.25 crore shares in the company in an upsized block trade, Bloomberg reported citing terms of the deal

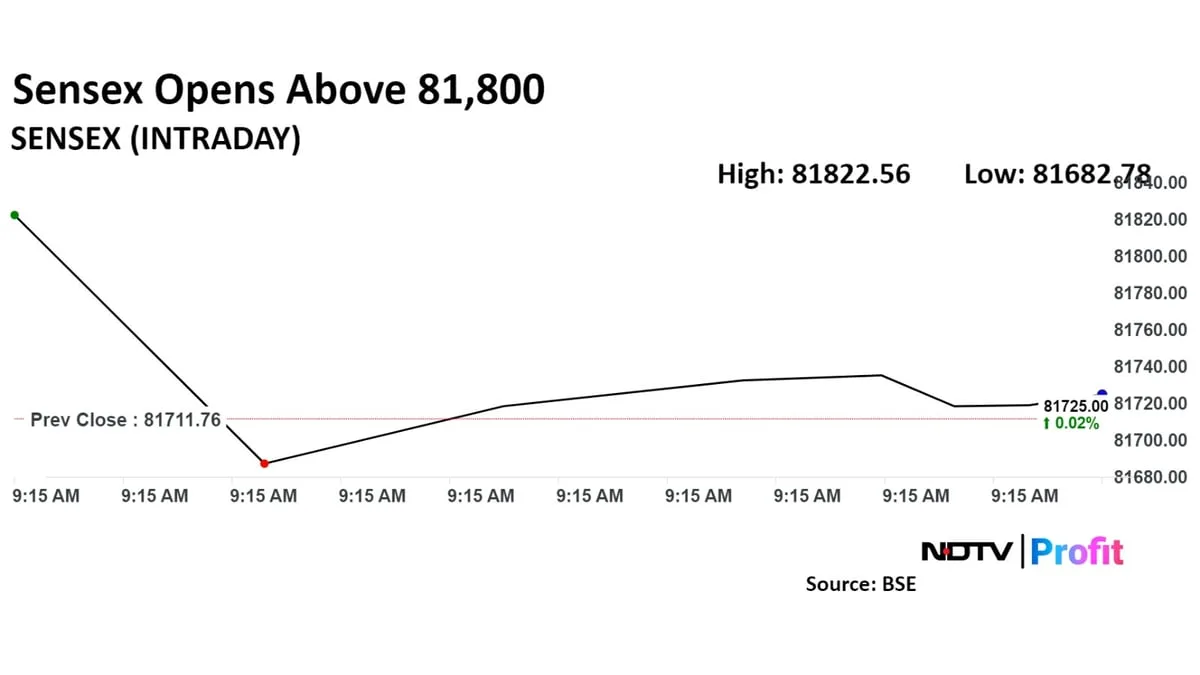

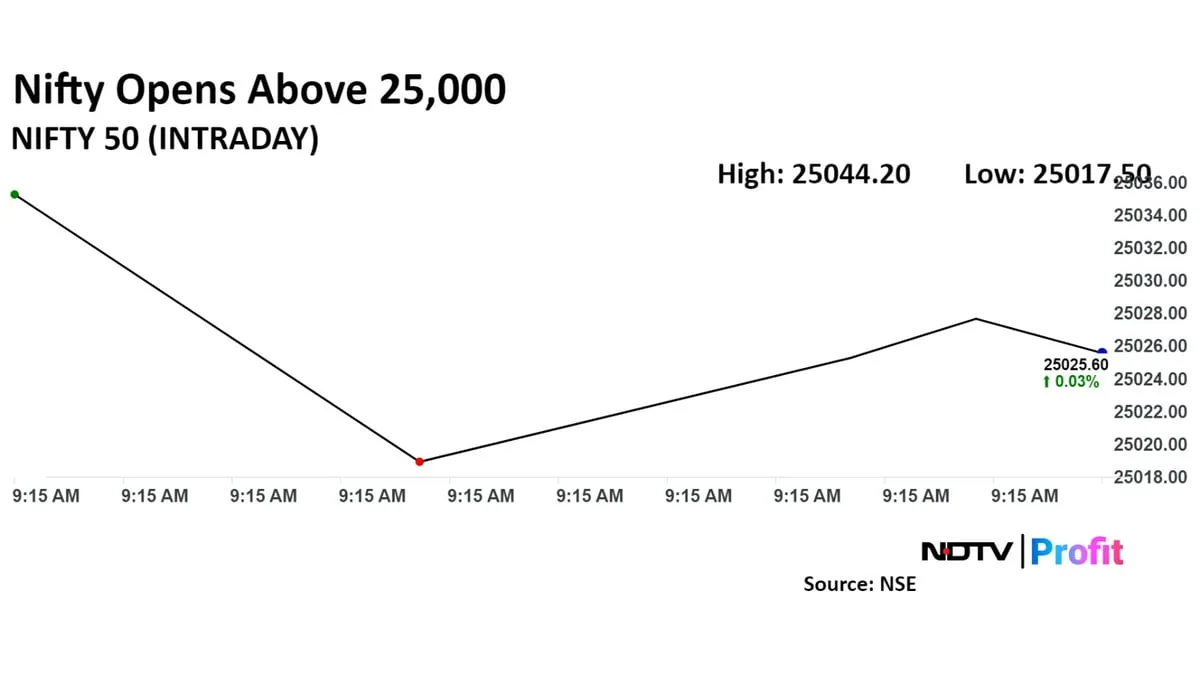

Nifty, Sensex Open Lower As ICICI Bank, TCS Decline: Opening Bell

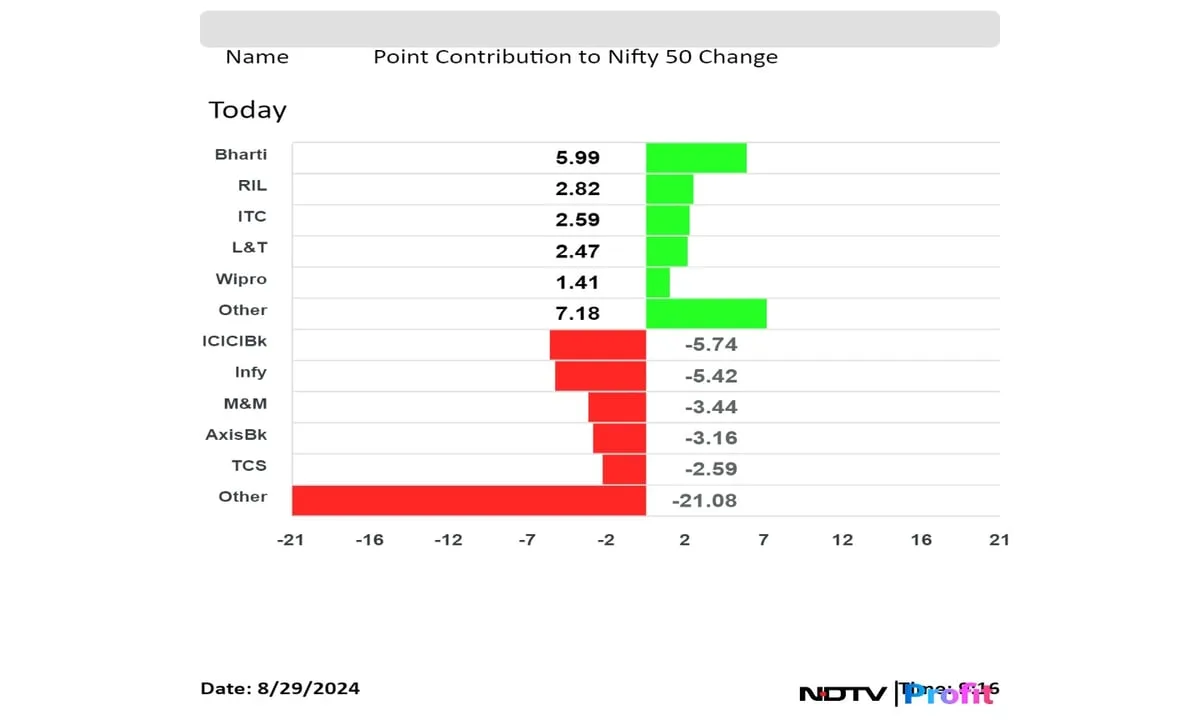

Indian benchmark indices opened lower with the NSE Nifty 50 losing its best winning streak in nearly three years as shares of ICICI Bank Ltd., and Tata Consultancy Services Ltd. fell.

As of 09:17 a.m., the Nifty 50 was trading 24.05 points or 0.1% lower at 25,028.30, and the BSE Sensex was trading 67.95 points or 0.1% lower at 81,717.61.

Thursday, which was likely to be weighed down by global cues. Investors here would also have their attention on the Mukesh Ambani-led Reliance Industries Ltd's annual general meeting, scheduled later today. Investors also await the release of the Federal Reserve's preferred inflation gauge on Friday for signals on US interest-rate reductions, said Avdhut Bagkar technical and derivatives Analyst, StoxBox.

The index needs to sustain over 25,200 to enter the next leg of breakout. When that happens, a move towards 25,700 cannot be ruled out. A breakdown beneath 24,700 could see index retesting the support of 24,000 mark, Bagkar added.

Bharti Airtel Ltd., Reliance Industries Ltd., ITC Ltd., Larsen & Toubro Ltd., and Wipro Ltd. added to the index.

ICICI Bank Ltd., Infosys Ltd., Mahindra & Mahindra Ltd., Axis Bank Ltd., Tata Consultancy Services Ltd. pressured the index.

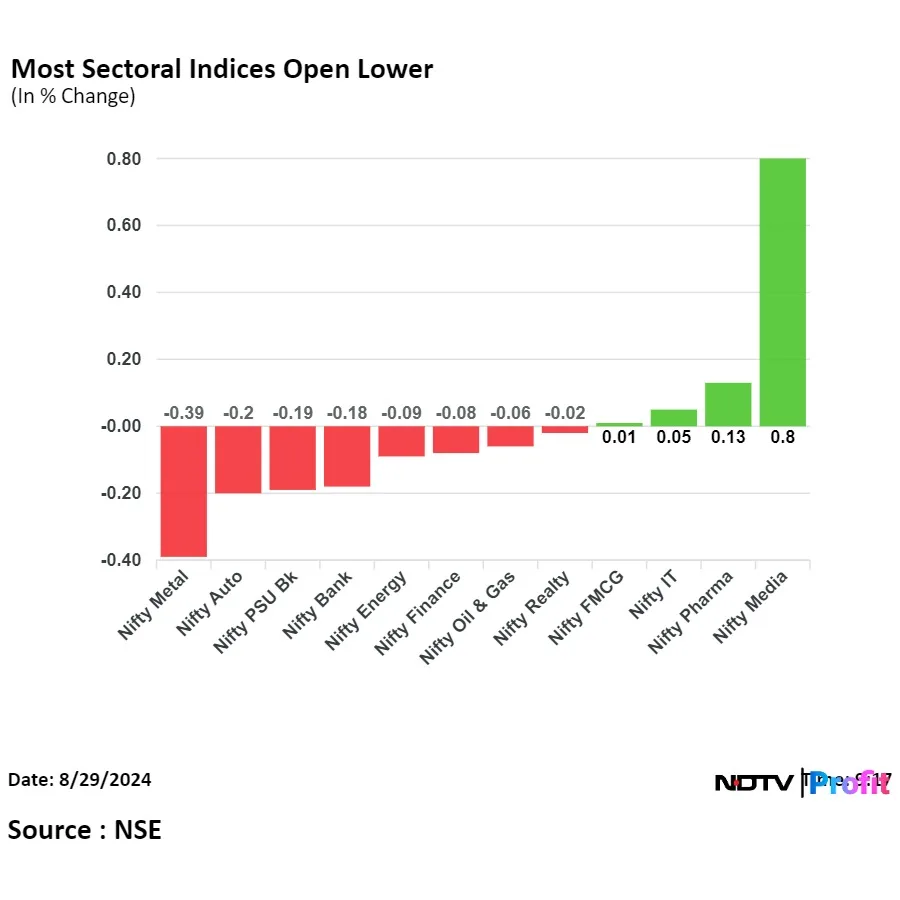

On NSE, seven sectors opened lower, three advanced, two were little changed out of 12. The NSE Nifty Metal declined the most, and the NSE Nifty Media rose the most.

Broader markets outperformed benchmark indices. The BSE Midcap and Smallcap indices were trading 0.28% and 0.20% higher, respectively.

On BSE, 11 sectors advanced, eight declined, and one remained flat out of 20. The BSE Healthcare rose the most, and the BSE Metal declined the most.

Market breadth was skewed in favour of buyers. Around 1,752 stocks advanced, 1,121 stocks declined, and 151 stocks remained unchanged on BSE.

Nifty, Sensex Trade Mixed At Pre-Open

At pre-open, the NSE Nifty 50 was trading 0.07% lower at 25,035.30, and the BSE Sensex was trading 0.05% higher at 81,822.56.

Yield On The 10-Year Bond Opens Flat

-

The yield on the 10-year bond opened flat at 6.86%.

-

It closed at 6.86% on Wednesday.

Source: Bloomberg

JSW Energy Unit Gets Hybrid Power Project From Maharashtra State Electricity Distribution

-

JSW Energy Ltd.'s arm received the letter of award for additional 400 megawatt hybrid power project under MSEDCL–Phase III

-

Cumulative capacity allotted to arm by MSEDCL stands at 600 MW

Alert: MSEDCL stands for Maharashtra State Electricity Distribution Company

Source: Exchange filing

Rupee Strengthens Against US Dollar

-

Rupee strengthened by 4 paise to open 83.92 against the US dollar.

-

It closed at 83.96 on Wednesday.

Source: Bloomberg

Global Cues

-

U.S. Dollar Index at 100.97

-

U.S. 10-year bond yield at 3.84%

-

Brent crude rose 0.15% at $78.77 per barrel

-

Bitcoin was down 0.36% at $59,133.16

IndiGo Promoter Upsizes Block To Rs 10,300 Crore

-

InterGlobe Aviation Ltd.'s promoter Rakesh Gangwal upsized block deal to Rs 10,300 crore from Rs 6,750 crore.

-

IndiGo promoter Gangwal offers 2.25 crore shares of company in block trade.

Source: Bloomberg

Biocon Biologics Gets Market Entry In Europe & UK For Stelara

-

Biocon Biologics gets market entry for generic of Stelara in Europe, UK, Canada and Japan

Source: Exchange filing

Emkay Global On HCL Tech

-

Emkay Global Research retained a 'Buy' with a target price Rs 1,850, which implied 7% upside.

-

Industry is at a major inflection point, with rising adoption of AI

-

Data and AI, SAP cloud services market, cyber security, cloud migration, etc to create opportunities for double-digit growth in medium term

-

Demand setting is a tad more optimistic vs a few months ago, esp. BFSI

-

TMT to continue seeing faster growth than peers

-

Emkay Global Research hiked target multiple to 25 times from 23 times and rolls forward estimates

Money Market

The Indian rupee closed weaker against the US dollar on Wednesday due to month-end dollar demand from importers. However, easing oil prices and continued intervention by the Reserve Bank of India limited the loss.

The local currency depreciated by 4 paise to close at Rs 83.96 and opened at Rs 83.95, according to Bloomberg data. It had closed at Rs 83.92 on Tuesday.

IndiGo Co-Founder Gangwal Plans To Sell Shares Worth Rs 6,750 Crore Via Block Deals, Bloomberg Reports

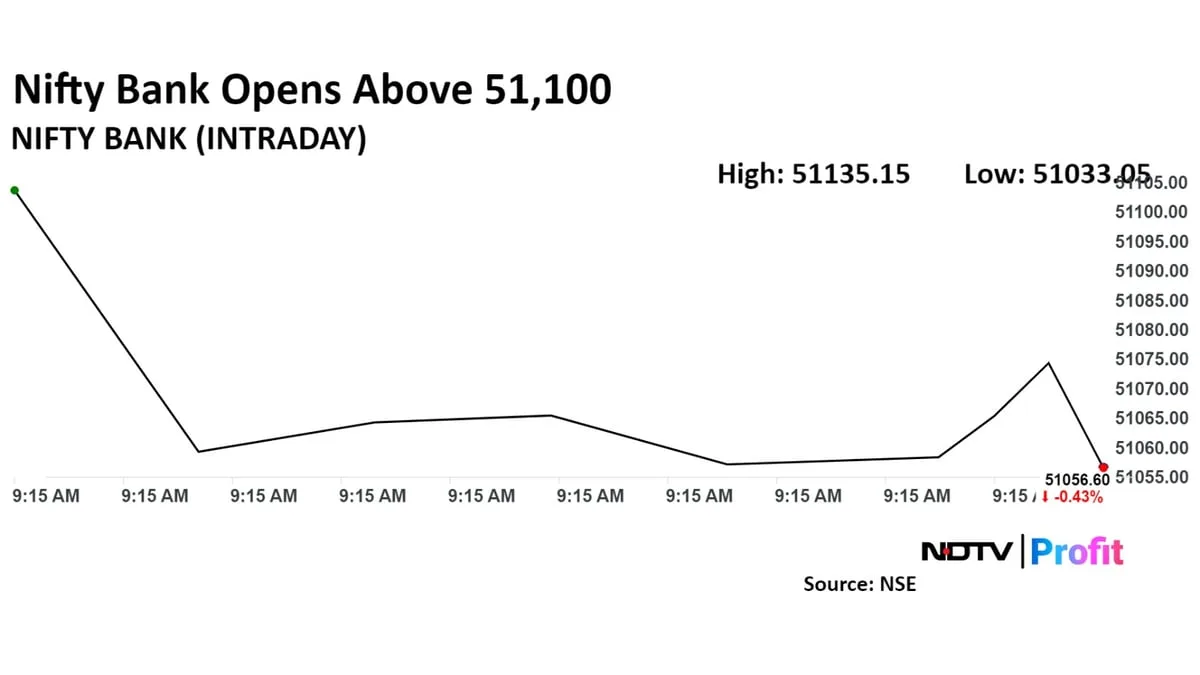

F&O Cues

-

Nifty August futures up by 0.14% to 25,048, at a discount of 4 points.

-

Nifty August futures open interest down by 27.3%.

-

Nifty Bank September futures down by 0.25% to 51,406 at a premium of 262.15 points.

-

Nifty Bank September futures open interest up by 64.8%.

-

Nifty Options Aug. 29 Expiry: Maximum call open interest at 25,500 and maximum put open interest at 24,800.

-

Bank Nifty Options Sept. 4 Expiry: Maximum call open interest at 52,000 and maximum put open interest at 52,000.

-

Securities in ban period: Bandhan Bank, Granules India, Hindustan Copper, India Cements.

Insider Trades

-

ION Exchange (INDIA): Promoter Mahabir Prasad Patni sold 94,000 shares between Aug. 14 and Aug. 23.

-

Paisalo Digital: Promoter Equilibrated Venture Cflow bought 15.58 lakh shares on Aug. 28.

-

Usha Martin: Promoter Peterhouse Investments India sold 6 lakh shares on Aug. 26.

Trading Tweaks

-

Ex/record AGM: Dynamatic Technologies.

-

Moved in short term ASM Framework: GMR Power and Urban Infra,Stove Kraft Ltd., Tata Elxsi.

-

Moved out of short term ASM Framework: GRM Overseas,Jeena Sikho Lifecare,UFLEX Ltd., Uflex.

IPO Offering

-

Premier Energies: The public issue was subscribed to 6.61 times on day 2. The bids were led by non-institutional investors (18.83 times), a portion reserved for employees (6.62 times), retail investors (4.21 times), and qualified institutional investors (1.4 times).

-

ECOS (India) Mobility & Hospitality: The public issue was subscribed to 3.36 times on day 1. The bids were led by non-institutional investors (6.65 times), retail investors (3.85 times), and qualified institutional investors (0.04 times).

Block Deals

-

GMM Pfaudler: Atreides Investments B.V. sold 4.12 lakh shares (0.92%) and Geranium Investments Ltd. sold 37.09 lakh shares (8.25%) at Rs 1,352 apiece. Infinity Partners bought 41.21 lakh shares (9.17%) at Rs 1,352 per share.

-

Krishna Institute of Medical Sciences: Emerald Investments Ltd. sold 15.7 lakh shares (1.96%) at Rs 2,497 apiece. Infinity Partners bought 15.7 lakh shares (1.96%) at Rs 2,497 apiece.

-

Shanti Educational Initiatives: Legends Global Opportunities (Singapore) bought 8.43 lakh shares (0.52%) at Rs 124.9 apiece, while New Leaina Investments sold 8.43 lakh shares (0.52%) at Rs 124.9 apiece.

Bulk Deals

-

Shaily Engineering Plastics: RBA Finance, an investment, sold 5 lakh shares (5.45%) at Rs 940 apiece. Motilal Oswal Mutual Fund bought 5 lakh shares (5.45%) at Rs 940 apiece and 3.11 lakh shares (3.39%) at Rs 923.63 apiece.

-

Kesoram Industries: Sg Sundae Holdings LLC sold 28.56 lakh shares (0.91%) at Rs 207.02 apiece.

Infinity Partners Buys 9.17% Stake In GMM Pfaudler

Stocks To Watch

-

One97 Communication: The company received a nod from the Finance Ministry for downstream investment into Paytm Payment Services. Paytm Payment Services will resubmit the payment aggregator licence and will continue to provide online payment aggregation services to existing partners.

-

InterGlobe Aviation: Founder Rakesh Gangwal and Chinkerpoo Family Trust seek to sell up to 1.47 crore company shares at a floor price of Rs 4,953 per share, which indicates a 5.5% discount on the current market price.

-

PB Fintech: Tencent Cloud looks to sell a 2.1% stake or 97 lakh shares, in the company at Rs 1,660.20 per share, which indicates a 4.5% discount to the current market price.

-

Genus Power Infrastructure: The company’s arm received letters of award for three orders worth Rs 4,469 crore for the appointment of advanced metering infrastructure service providers. The company’s total order book stood at Rs 32,500 crore.

-

KEC International: The company received new orders worth Rs 1,171 crore for its transmission and distribution business in the UAE and Saudi Arabia.

-

Tata Steel: The company acquired 178 crore shares for Rs 2,348 crore in Tata Steel Holdings. Tata Steel Holdings will continue to be an arm of the company post-acquisition.

-

Sonata Software: The company received a multi-year, multi-million-dollar IT outsourcing contract from a US-based healthcare and wellness company.

-

Wipro: The company voluntarily liquidated its China subsidiary.

-

MTNL: Union Bank freezes all company accounts, including collection and current accounts, over non-payment of dues.

-

NLC India: The company signed a power usage agreement for the supply of 200 MW of green power to Telangana for 25 years.

-

VLS Finance: The company’s buyback is to open on Aug. 30 and close on Sept. 5.

-

Nalco: The company signed an MoU between JV KABIL and Oil India for collaboration in projects and exploration.

-

Reliance Industries: CCI approved the Reliance-Disney merger subject to compliance with voluntary modifications.

Paytm Payments Services To Resubmit Application For Payment Aggregator License

GIFT Nifty Trades Near 25,000

Markets in Asia-Pacific dropped in early trade on Thursday, taking cues from overnight losses on Wall Street after Nvidia Corp.'s earnings for second quarter failed to impress investors' expectation. Further, concern about a slow down in China, world's second largest economy, weighed on the Asia-Pacific stocks.

The Nikkei 225 was 102.71 points, or 0.27% lower at 38,269.05, and the S&P ASX 200 was down 43.10 points, or 0.53% at 8,028.30 as of 06:58 a.m.

On Wednesday, the S&P 500 and Nasdaq Composite settled 0.60% and 1.12% lower, respectively. The Dow Jones Industrial Average ended 0.39% down.

Brent crude was trading 0.13% higher at $78.75 a barrel. Gold rose 0.31% to $2,512.35 an ounce.

The GIFT Nifty was trading 23.50 points, or 0.09% higher at 2,512.35 as of 07:01 a.m.

The Indian benchmark equity indices continued their uptrend on Wednesday, with the NSE Nifty 50 recording its best gaining streak since October 2020 to close at its lifetime high and the S&P BSE Sensex extending gains for the seventh consecutive session.

Nifty closed 34.6 points, or 0.14% higher at 25,052.35 and Sensex ended up 73.80 points, or 0.09% at 81,785.56.

Overseas investors turned net sellers of Indian equities on Wednesday after being buyers for four straight sessions. Foreign portfolio investors offloaded stocks worth Rs 1,347.5 crore while domestic investors turned net buyers after selling for a day and bought equities worth Rs 439.4 crore, according to provisional data from the National Stock Exchange.

The Indian currency weakened by 4 paise to close at 83.96 against the US dollar.

Trade Setup For Aug 29: Nifty To Test New Highs While Weak Nvidia Outlook Hits Global Stocks. Read more on Markets by NDTV Profit.