Table of Contents

US Futures Decline On Middle East Tension With US Jobless Data In focus

December futures contract of Dow Jones traded 0.4% lower at 42,363.00 as of 3:30 pm when futures contract of S&P 500 was down 0.3% at 5,742.5 and that of Nasdaq 100 was 0.4% lower at 19,928.50.

Economic Data Releases & Events October 3

-

US: Weekly Jobless Claims — 6:00 p.m. IST

-

US: Final Services PMI — 7:15 p.m. IST

-

US: ISM Services PMI — 7:30 p.m. IST

-

US: Factory Orders — 7:30 p.m. IST

-

US: Federal Reserve Bank of Kansas City President Jeffrey Schmid speaks at opening of the Community Banking Research Conference hosted by the Federal Reserve Bank of St. Louis — 7:30 p.m. IST

-

US: Weekly Energy Information Administration Natural Gas Storage — 8:00 p.m. IST

-

US: Federal Reserve Bank of Atlanta President Raphael Bostic speaks at the Institute Research Conference hosted by the Federal Reserve Bank of Minneapolis — 8:10 p.m.

Nifty, Sensex Clock Worst Fall In Nearly Two Months On Weak Global Cues, Middle-East Tensions: Market Wrap

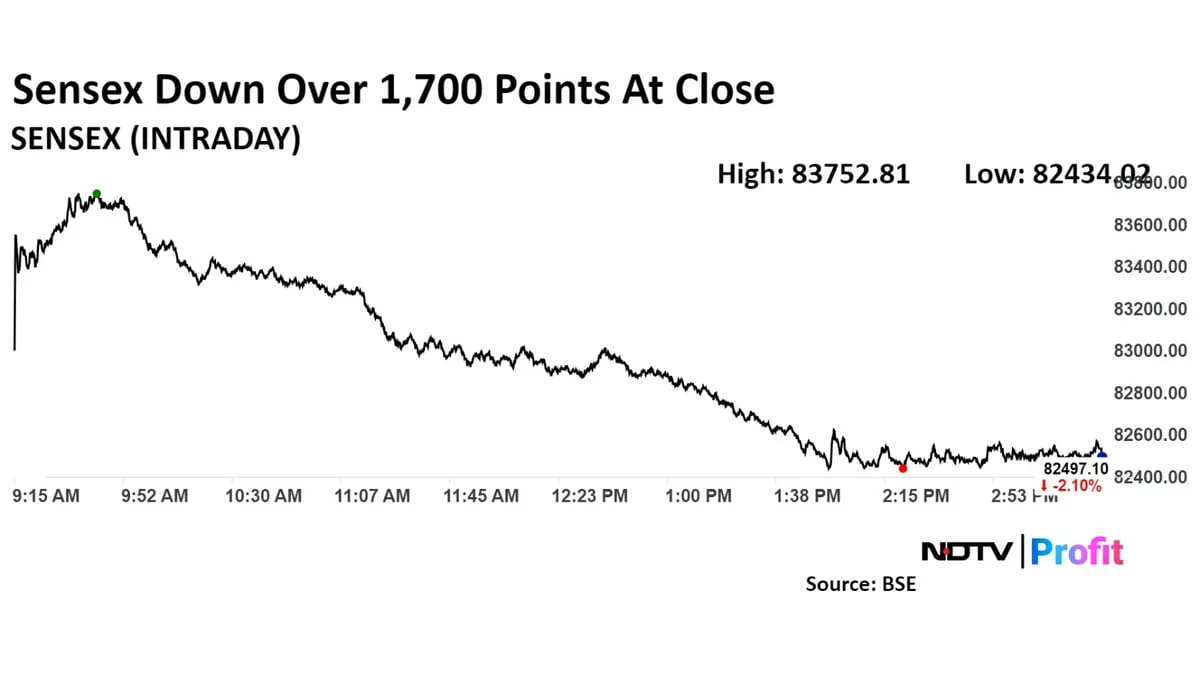

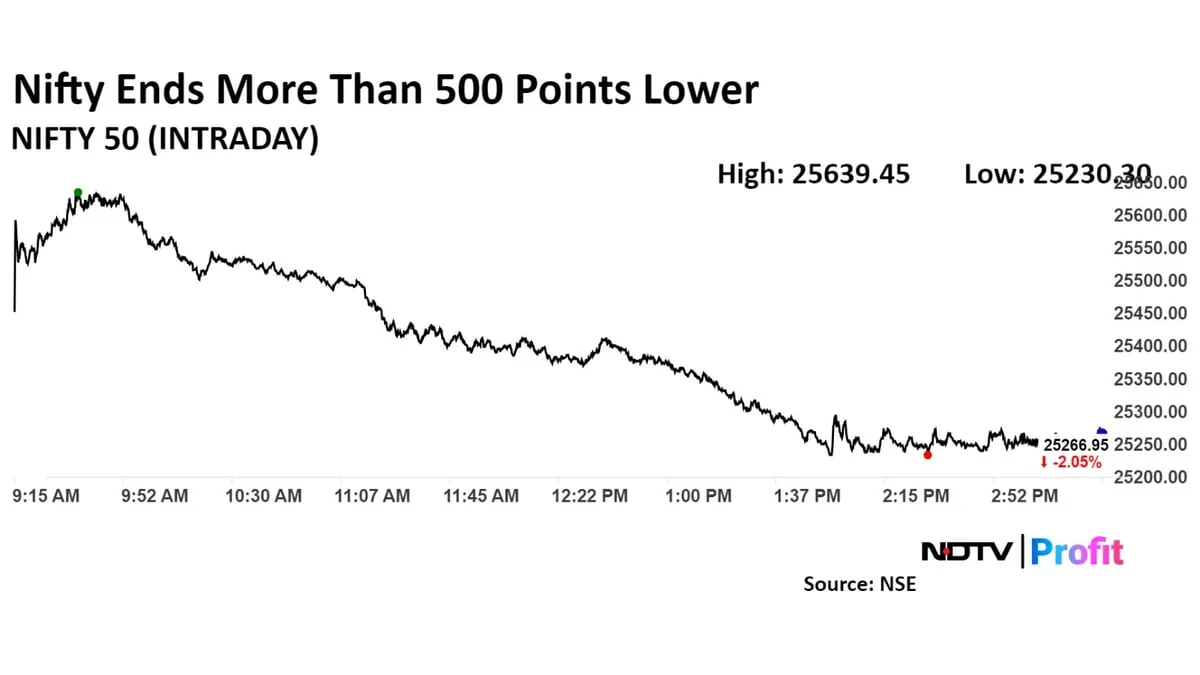

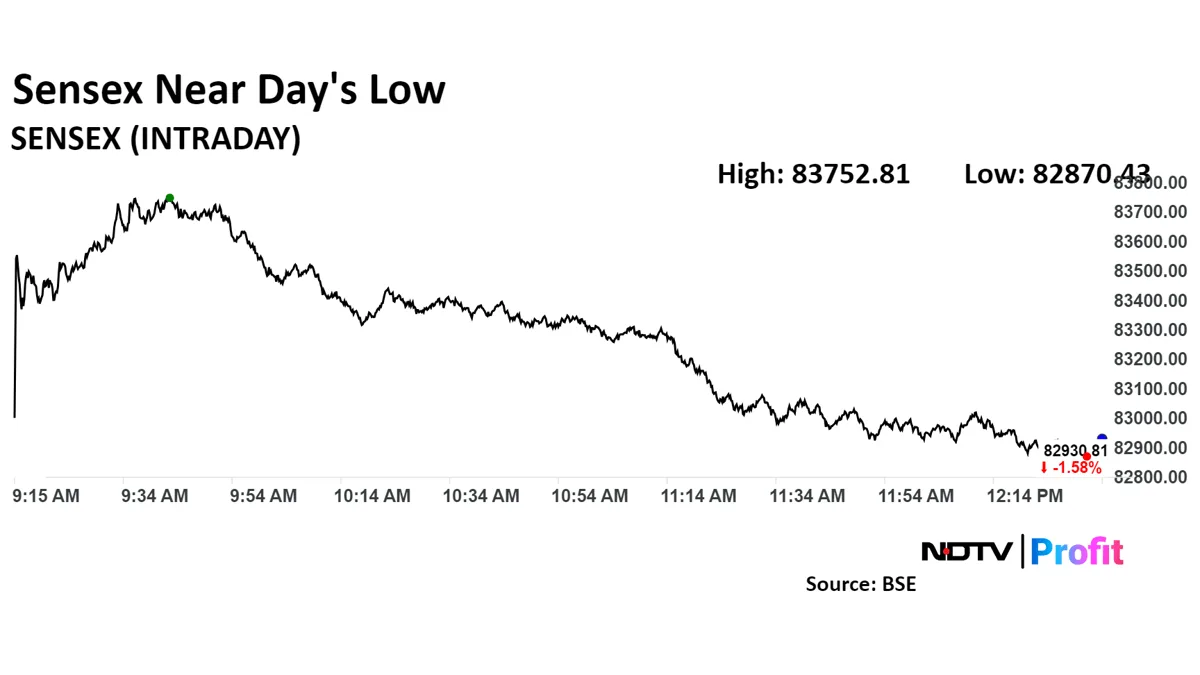

The NSE Nifty 50 and BSE Sensex had their worst session Thursday since Aug 5 as the Securities Exchange Board unveiled curbs on Futures & Options trading, which dented risk appetite of investors. Heavyweights Reliance Industries Ltd., HDFC Bank Ltd. dragged the NSE Nifty 50 index.

Moreover, rise in safe-haven assets like the US treasury yields, and the dollar index in the wake of geopolitical tension in the Middle East pressured risky assets like emerging markets' stocks.

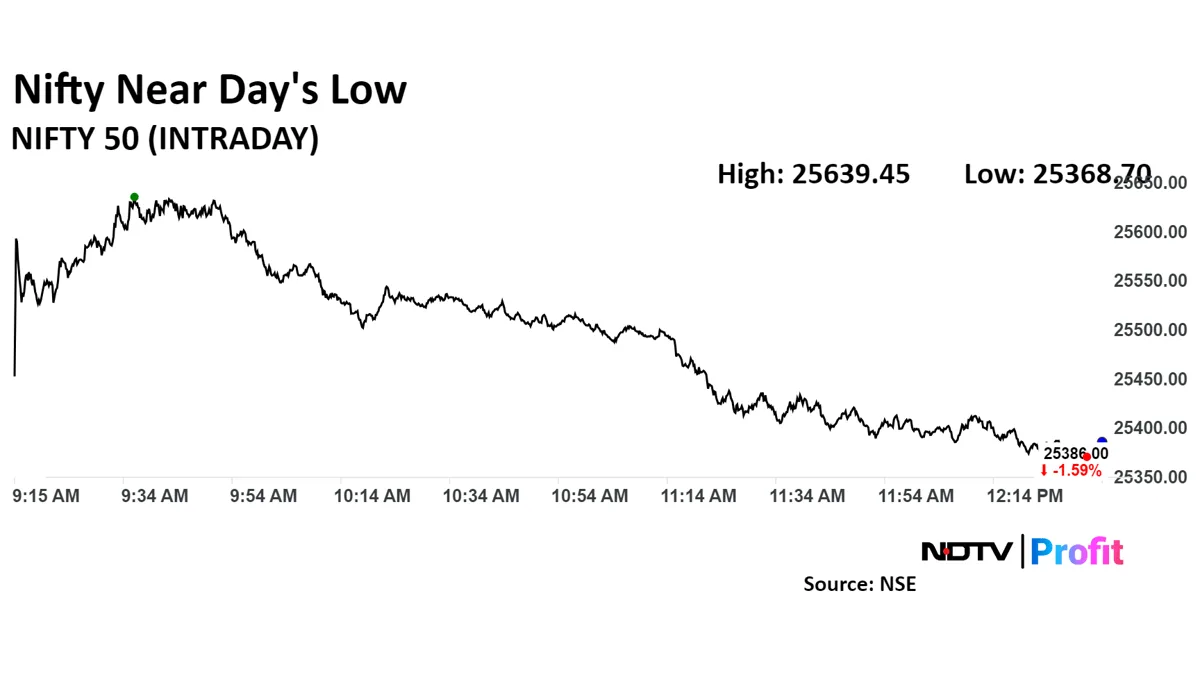

The Nifty 50 ended 546.80 points or 2.12% lower at 25,250.10, and the Sensex ended 1,769.19 points or 2.10% down at 82,497.10.

The Nifty 50 index declined 2.20% to 25,230.30, and the Sensex fell 2.17% to 82,434.02.

One reason behind today's fall is money is shifting from India to China after it announced measures to stimulate the struggling country. This helped Chinese markets rally. Investors are catching up weightage gap between India and China, said Vaibhav Sanghavi, CEO, ASK Hedge Solution.

Secondly, from fundamental perspective, earnings are likely to be weaker than expected for second quarter. Sanghavi said.

" With a strong bearish candle, the Index has given a breakdown from the series of higher top higher bottom formation which indicates trend reversal but on the lower timeframe i.e. hourly chart, overall markets seem extremely oversold and a pullback rally is warranted. Now, the next critical support is placed at the psychological support of 25,000 coupled with 50DMA while on the higher side, 25,550-25,600 will work as a resistance zone," said Aditya Gaggar, director, Progressive Shares.

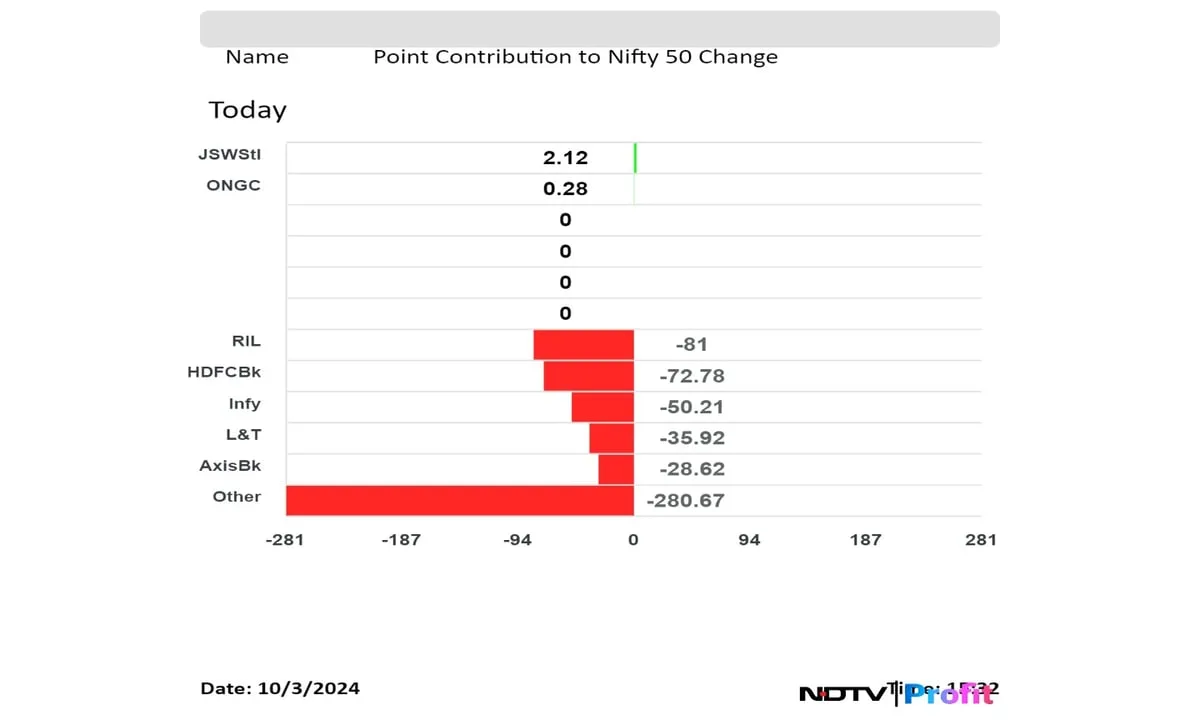

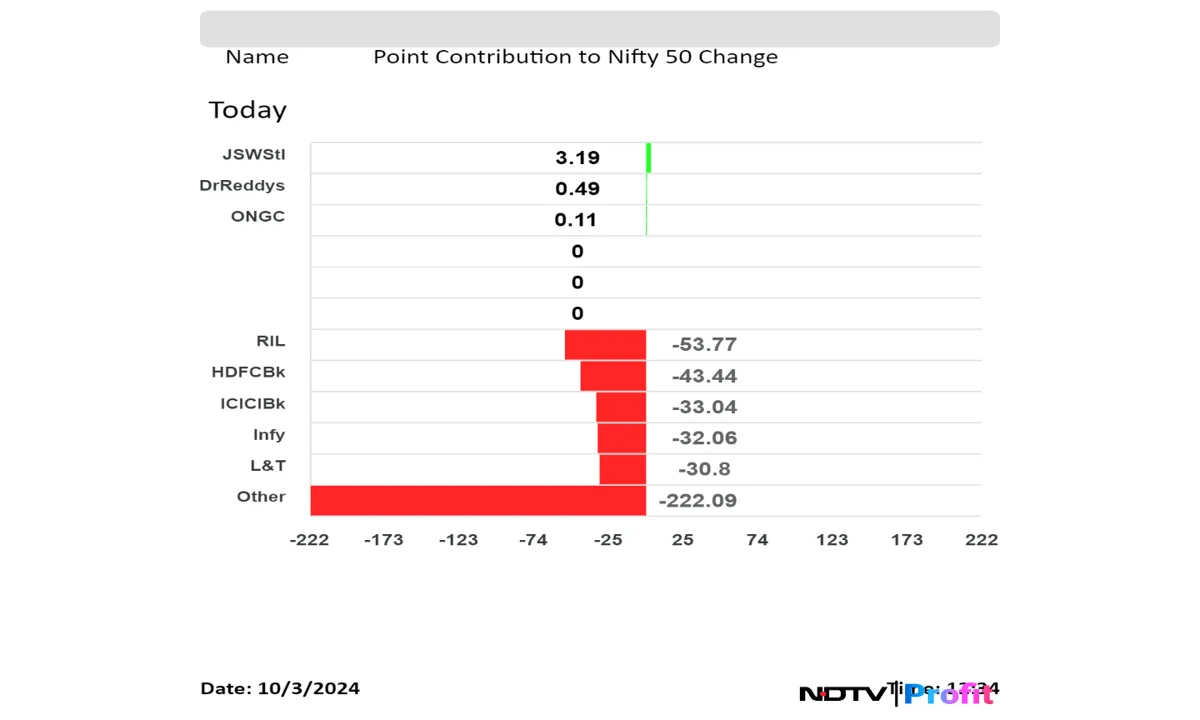

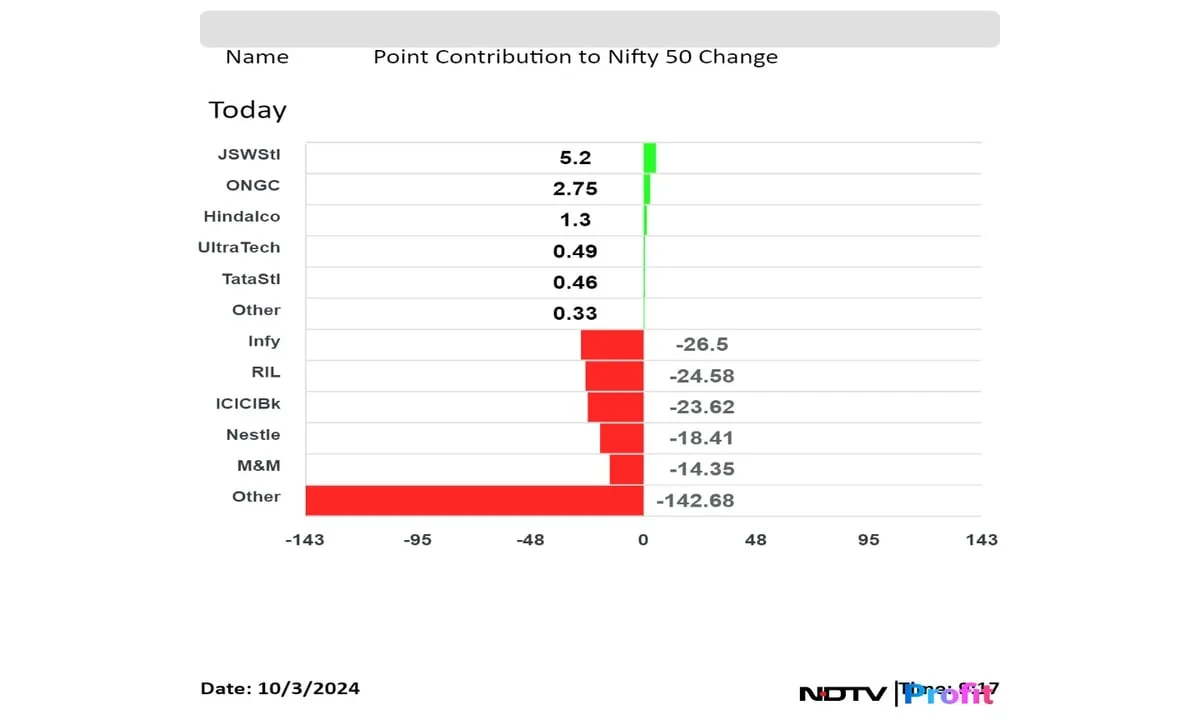

Reliance Industries Ltd., HDFC Bank Ltd., Infosys Ltd., Larsen & Toubro Ltd., and Axis Bank bank Ltd. weighed on the index.

JSW Steel Ltd., Oil and Natural Gas Corp limited losses in the index.

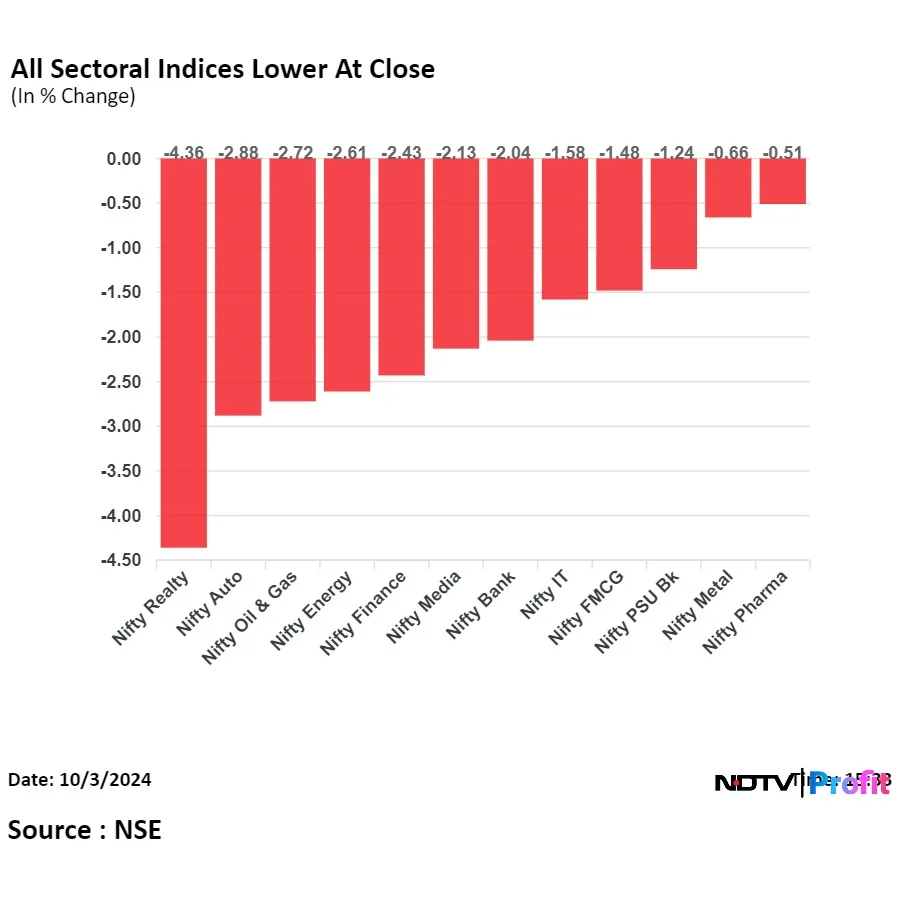

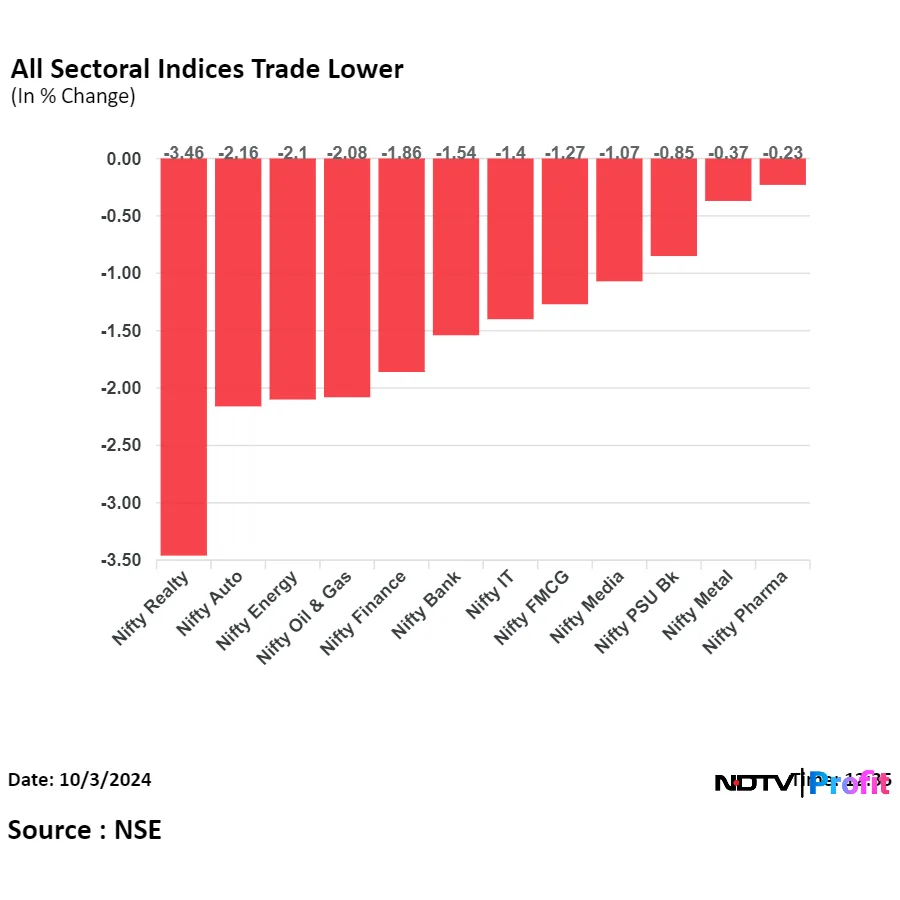

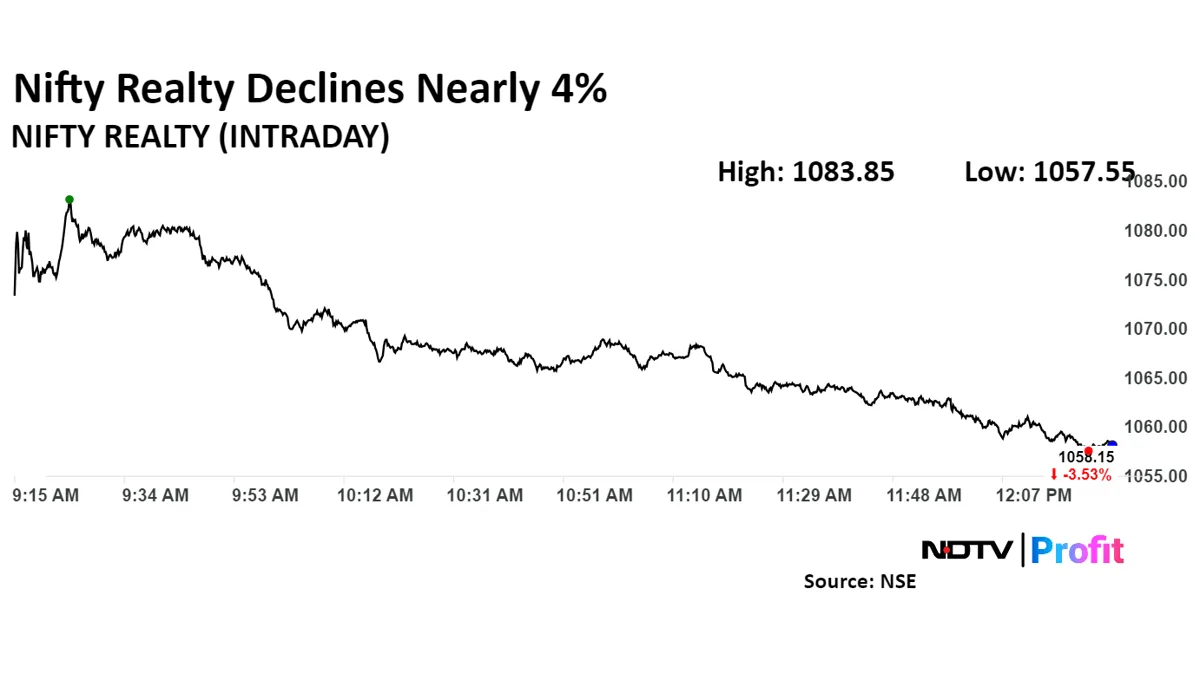

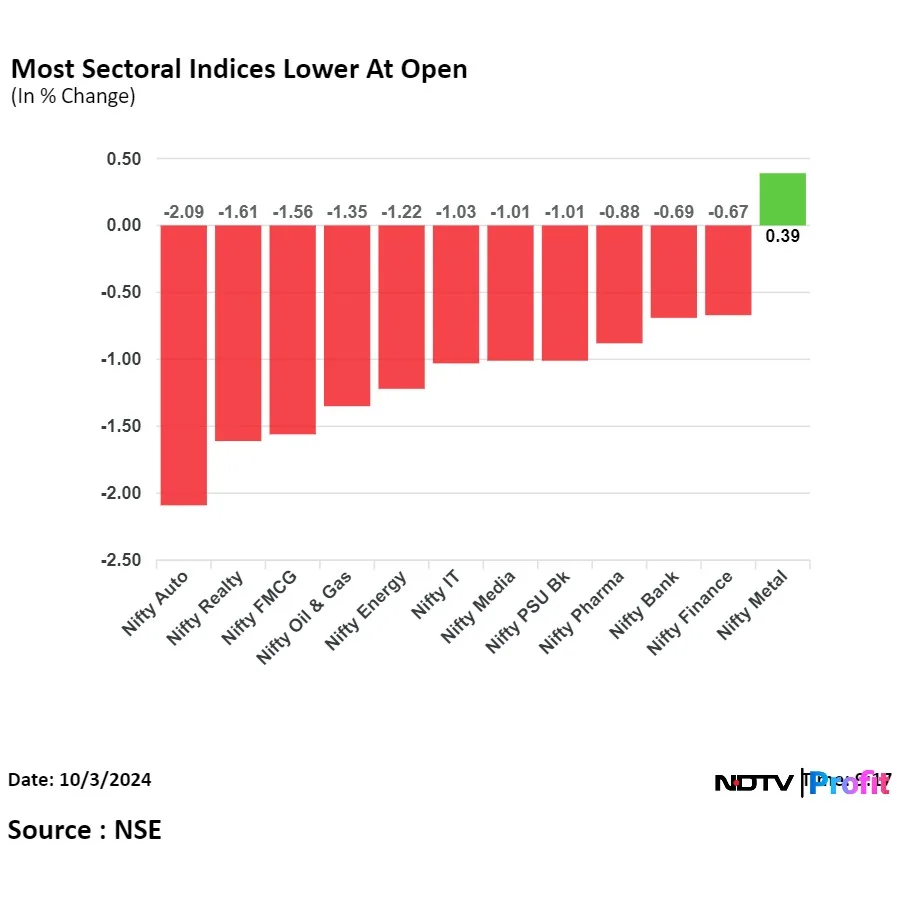

On NSE, all 12 sectors ended lower with the NSE Nifty Realty declining the most. The NSE Nifty Pharma was the top performing sector with least gain.

Broader indices mirrored the benchmarks. BSE Midcap closed 2.27% lower and BSE Smallcap ended 1.84% down.

All sectoral indices closed lower and BSE Realty was the top loser.

Market breadth was skewed in the favour of sellers. As many as 2,864 stocks fell, 1,120 rose, and 92 remained unchanged on the BSE.

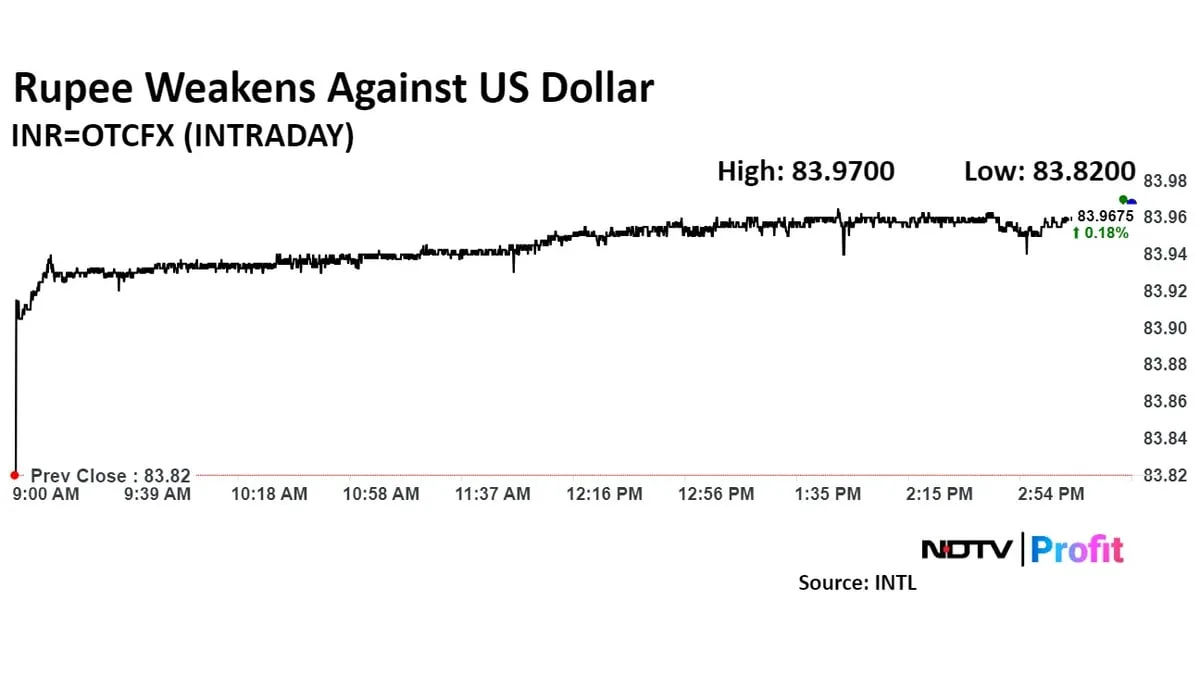

Rupee Weakens Against US Dollar

Rupee weakened by 15 paise to close at 83.97 against the US dollar. It closed at 83.82 on Tuesday, according to data on Bloomberg.

Market At Close

The NSE Nifty 50 and BSE Sensex recorded their worst intraday loss Thursday since Aug 5.

Reliance Industries Ltd. and HDFC Bank Ltd. were top loser in the index.

The NSE Nifty Realty was the top losing sector as DLF Ltd., and Godrej Properties dragged.

The Nifty Pharma was the top performer in today's session with least decline. The index ended 0.51% lower at 23,178.75.

The NSE Nifty Midcap 150 ended 2.12% lower at 21,904.70.

The NSE Nifty Smallcap 250 ended1.90% lower at 18,179.20.

Bank Dhofar To Acquire Bank Of Baroda's Oman Operations

Bank Dhofar accepted offer for acquisition of Bank of Baroda's Oman operations, it said in an exchange filing.

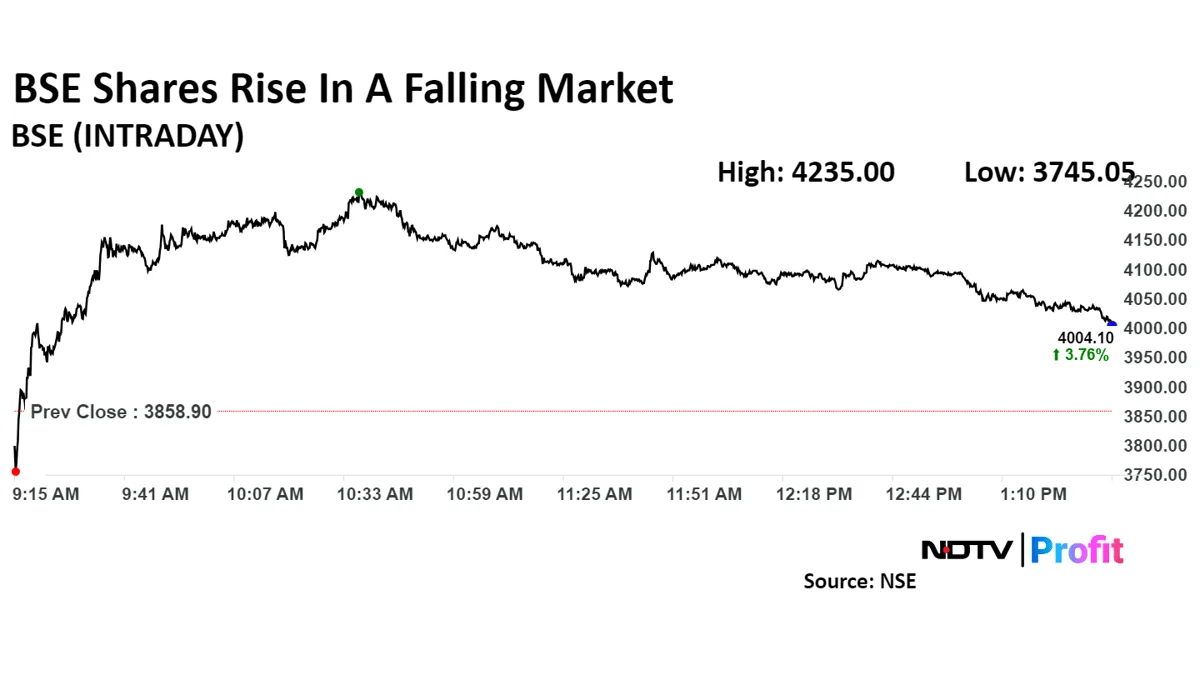

BSE Ltd. share price surged nearly 10% on Thursday after the market regulator announced measures to curb trading in equity derivatives.

BSE Share Price Rises As New SEBI F&O Norms Level Playing Field

Stock Market Live: ICICI Bank Submits SEBI's Exemption Letter To NCLT

ICICI Bank Ltd. submitted SEBI's exemption letter to NCLT in a green sealed cover. The letter is not submitted through an affidavit. The letter was sealed to protect sensitive information and prevent leaks, counsel said.

European FX Update: Pound Sterling Slumps Over 1% After BoE Governor's Comments

The Pound Sterling declined as much as 1.20% against the US dollar on Thursday after the Bank of England Governor Andrew Bailey said that it can go a bit more aggressive on rate cuts.

Bailey said while talking to the The Guardian that the UK central bank may become ‘a bit activist’ on interest rates if the news on inflation continued to be good.

The Euro was trading 0.05% higher against the greenback at 1.1039 as of 2:24 p.m.

The dollar index continued to rise on safe haven demand as tension escalated after Israel attacked central Beirut early Thursday. Market participant await the release of US weekly jobless claims data, due to be published today. The index was trading 0.27% higher at 101.88 as of 2:26 p.m.

European Market Update: Stocks Slid On Risk-Off Sentiment After Tension Rises In Middle East

Most markets in Europe declined in early trade on Thursday as geopolitical tension rose in the Middle East after Israel attacked central Beirut and started ground incursions in Lebanon. This dented risk-appetite of investors.

The Euro Stoxx and FTSE 100 declined 0.96% and 0.01% lower, respectively as of 2:12 p.m. IST.

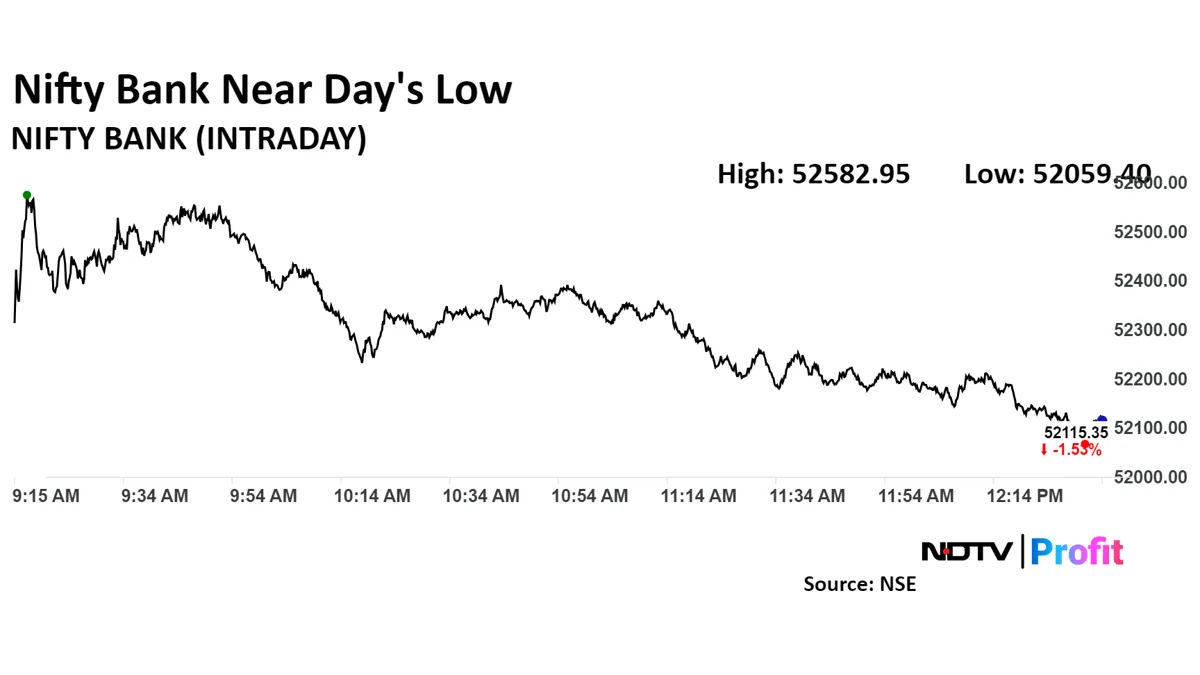

Nifty, Sensex Extend Losses On Israel-Iran Tension, F&O Action; RIL Among Top Losers: Midday Market Update

India's benchmark stock indices extended losses through midday on Thursday after a gap-down opening, with most of the largecaps trading lower, spooked by rising geo-political tensions between Iran and Israel and SEBI's new norms on the futures and options segment.

At 12:37 p.m., the Nifty was at 25,402.55, down 1.53% or 394.35 points, and the Sensex was at 82,978.34, lower by 1.53% or 1,287.95 points. Only 9 of the Nifty 50 stocks traded higher.

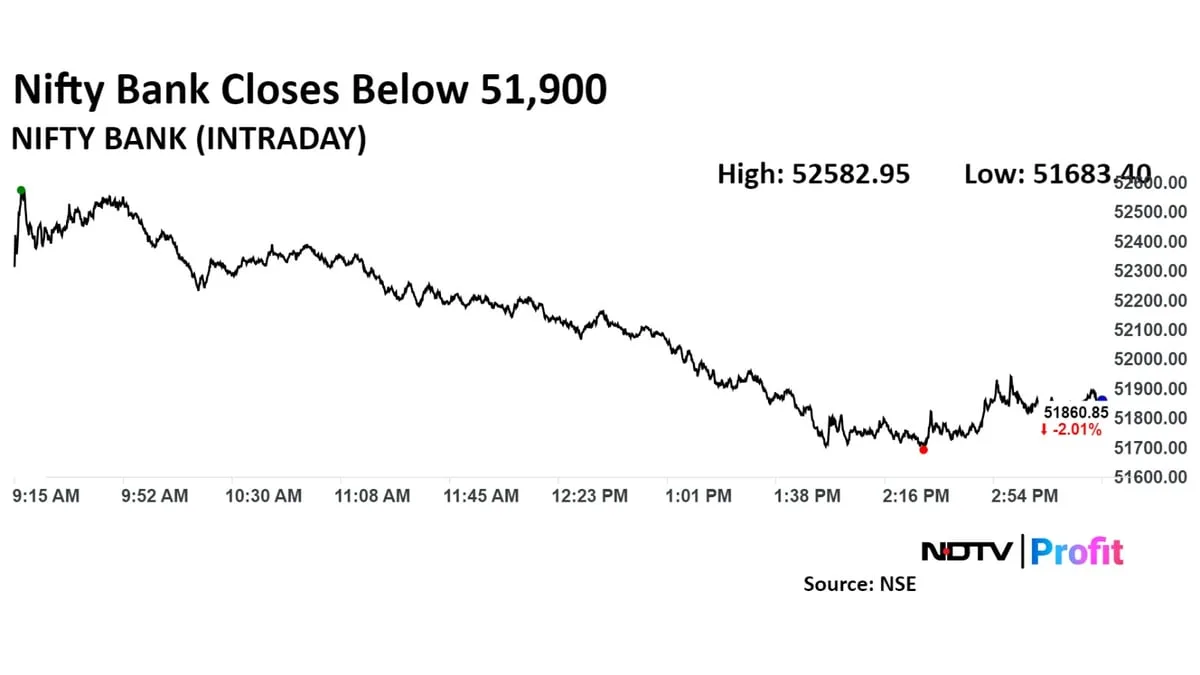

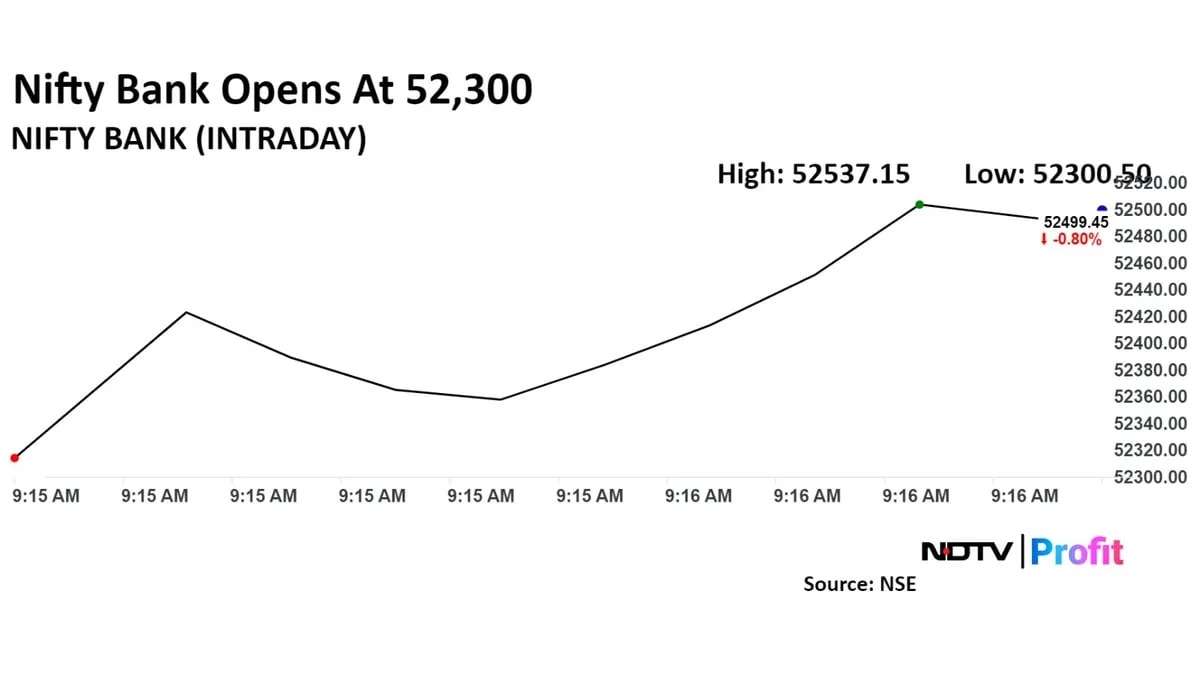

Nifty and Bank Nifty extended their fall, driven by global and domestic factors, with both indices now trading below their 20-day moving average (DMA), indicating near-term pressure, according to Kush Bohra, founder of Kushbohra.com. "Despite the significant decline, hourly charts suggest the indices are approaching oversold territories, making a technical rebound plausible," he said. "However, investors should resist creating positional long positions until the downtrend conclusively reverses."

Bohra expects support for Nifty at 23,300 and resistance at 23,800. He said that for the Bank Nifty, support is at 51,700 and resistance at 53,000, while recommending investors exercise caution and wait for a clear reversal signal before creating new positional longs.

Shares of Reliance Industries Ltd., HDFC Bank Ltd., ICICI Bank Ltd., Infosys Ltd., and Larsen & Toubro Ltd. dragged the Nifty the most. While those of JSW Steel and Dr Reddy's Labs cushioned the fall.

All sectoral indices on the NSE fell with Nifty Realty losing the most.

Broader indices too fell, with the BSE Midcap and Smallcap trading 1.52% 1.25% lower, respectively, during midday on Thursday.

All sectoral indices on the BSE fell with BSE Realty falling the most.

Market breadth was skewed in favour of the sellers. Around 2,773 stocks fell, 1,089 rose, and 112 remained unchanged on the BSE.

Adani Renewable Energy Enters In Agreement For Commercial & Industrial Power Consumption

Adani Green Energy Ltd.'s unit Adani Renewable Energy entered into a power consumption agreement for supply of green power from commercial and industrial customers, it said in an exchange filing.

Green Power shall be supplied from 61.4 megawatt renewable energy plant at Khavda, it said in an exchange filing.

Adani Green Unit Inks Power Consumption Agreement For Supply Of Green Power

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Rites Signs MoU With Delhi Metro

Rites Ltd. signed a memorandum of understanding with the Delhi Metro for exploring metro works, it said in an exchange filing.

Asia Market Update: Japan Markets Close Higher As Yen Weakens On Ishiba's Dovish Remarks

The Nikkei 225 and Topix ended 1.20% and 1.97% higher, respectively on Thursday after leading gains in the region. The indices gained strength as the export-orient country's currency declined after Prime Minister Shigeru Ishiba said the current economic condition of Japan doesn't support another rate hike.

Share indices in Australia concluded Thursday with gains. The index ended 0.09% higher at 8,205.20 as of 1:12 p.m.

The Hang Seng declined after snapping a six-day rally on Thursday as the euphoria from China unveiling stimulus fizzled out, reported South China Morning Post. The index was trading 1.39% down at 25,372.65 as of 1:01 p.m.

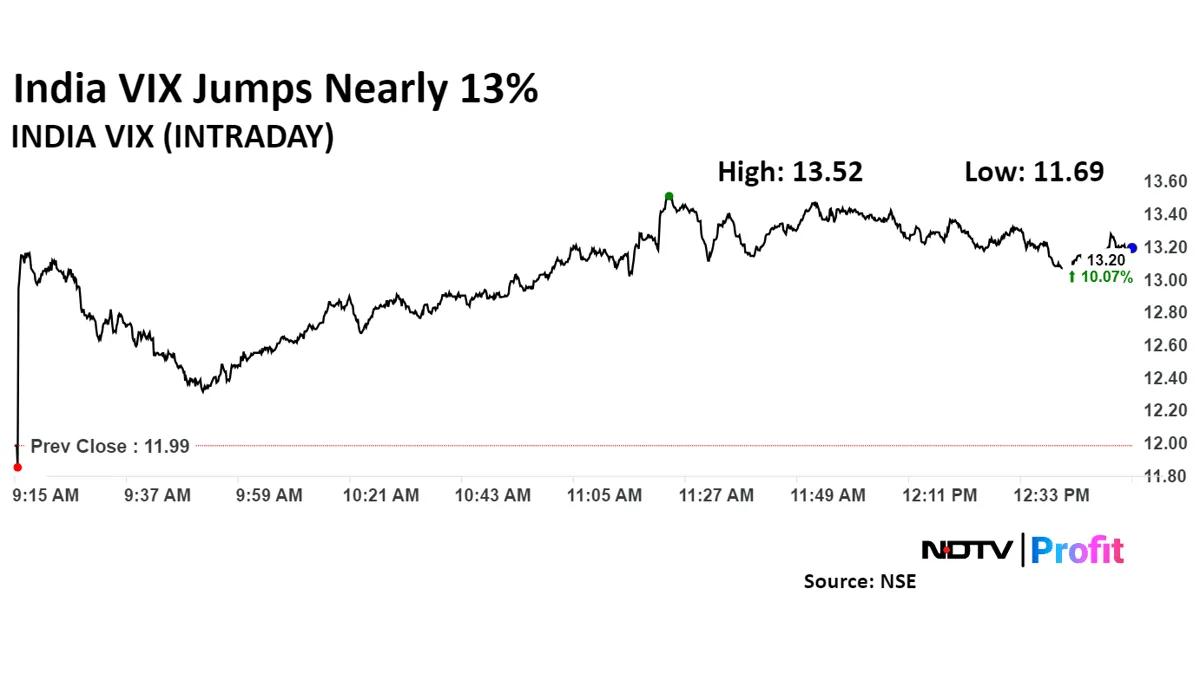

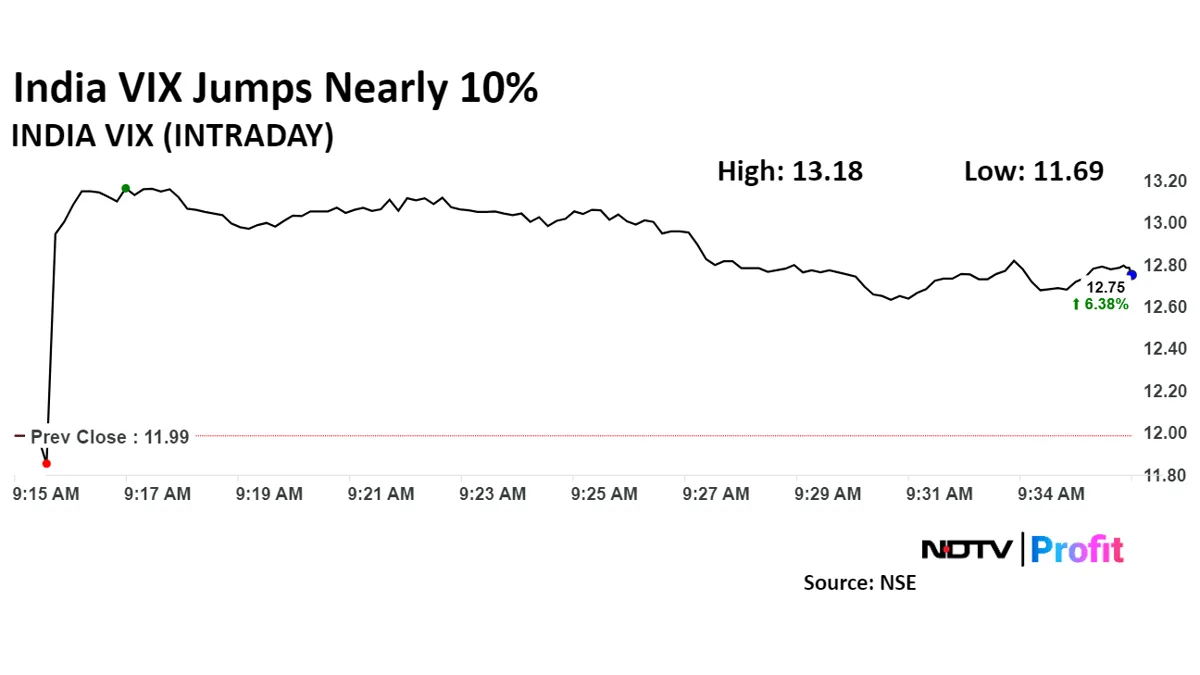

Stock Market Live: Indian Markets' Volatility Increases Further

The NSE India Volatility Index rose 12.76% to 13.52 on Thursday. It was trading 10.47% higher at 13.24 as of 12.56 p.m.

Stock Market Live: Nifty Realty Index Declines For Four Sessions As DLF, Phoenix Mills Plunge

The NSE Nifty Realty index declined 3.58% to 1,57.55, the lowest level since Sept 19. DLF Ltd., and The Phoenix Mills share prices were the biggest dragger in the index. The index has been declining for four consecutive sessions.

Business Update Q2: REC

REC Ltd.'s total loan disbursed rose 13.7% to Rs 47,303 crore, it said in an exchange filing.

PM Narendra Modi Inaugurates GAIL's Plant

Prime Minister Narendra Modi inaugurated GAIL (India) Ltd.'s compressed bio gas plant in Ranchi, it said in an exchange filing.

The NSE Nifty Auto index declined 2.29% to 26,462.75, the lowest level since Sept 20. Tata Motors Ltd., and Maruti Suzuki India Ltd. share prices dragged the auto index the most.

Most stocks in the index declined on Thursday.

Real Estates Sector Sees 11% Drop In Sales During Q2, Says Anarock Chairman

July–September has shown 11% drop in real estate sales. Monsoons and election overhang impacted during the quarter, said Anarock Group Chairman Anuj Puri said.

Overhang of the inventory continues to go down. Price rise is continuing but it is coming to the inflation levels. Anarock is hoping to see a bounce back in the festive season, Puri said.

This calendar year will the best year for India in terms of office leasing, Puri said. India needs more developers to cater the demand.

India's Coal Production Rises 32% In September

India's coal production rose 32% on the year to 13.74 million ton from 10.40 million ton. Coal Dispatch rose 47% on the year to 14.27 million ton compared to 9.68 million ton, said the Ministry of Coal in a press release.

Coal dispatch rose 34% on the year to 87.86 million ton from 65.37 in the second half of the financial year 2024–25. The coal production rose 32% on the year to 79.72 MT from 60.52 MT.

Stock Market Live: Know Five Reasons For Thursday's Plunge

The NSE Nifty 50 and BSE Sensex plunged 1% during the opening hours as the Securities Exchange Board of India introduces curbs to regulate Futures & Options trade. To know five reasons behind the benchmarks fall on Thursday click here.

J Kumar Infraprojects Gets LoA Worth Rs 1,848 Crore

J Kumar Infraprojects Ltd. received a Letter of Acceptance for design and construction project worth Rs 1,848 crore from MMRDA. The order is to be executed within 48 months, it said exchange filing.

KPI Green Energy Gets CEI Permit For 5 Megawatt Solar Power Project

KPI Green Energy Ltd. received Chief Electrical Inspector's nod for 5 Megawatt of Solar Power Project under Captive Power Producer Segment, it said in an exchange filing.

Hinduja Global Solutions Launches Global CX Hub In South Africa

Hinduja Global Solutions Ltd. launched Global CX Hub in Cape Town, South Africa. It launched Global CX Hub to support international clients with next generation customer experience, it said in an exchange filing.

Transformers & Rectifiers Gets Order Worth Rs 565 Crore

Transformers & Rectifiers (India) Ltd. received orders of Rs 565 crore from Power Grid Corp, it said in an exchange filing.

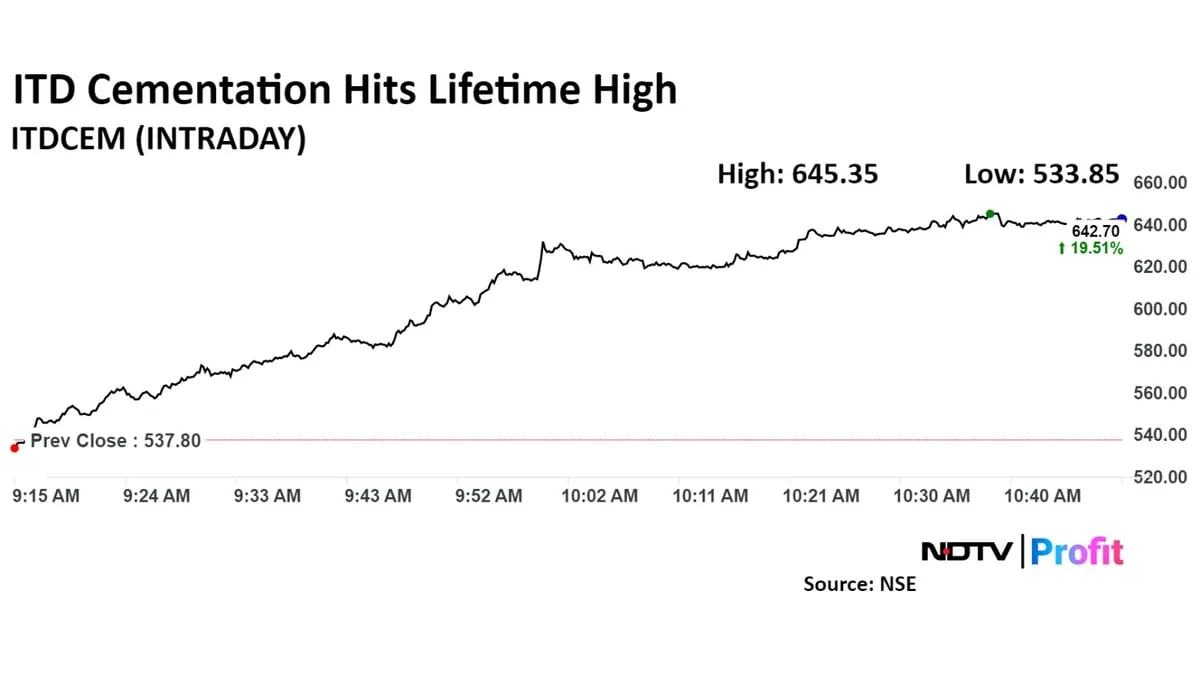

ITD Cementation India Ltd. share price surged 20% to life high Thursday after it got a new contract for constructing a multistoried commercial building worth Rs 1,937 crore, it said in an exchange filing.

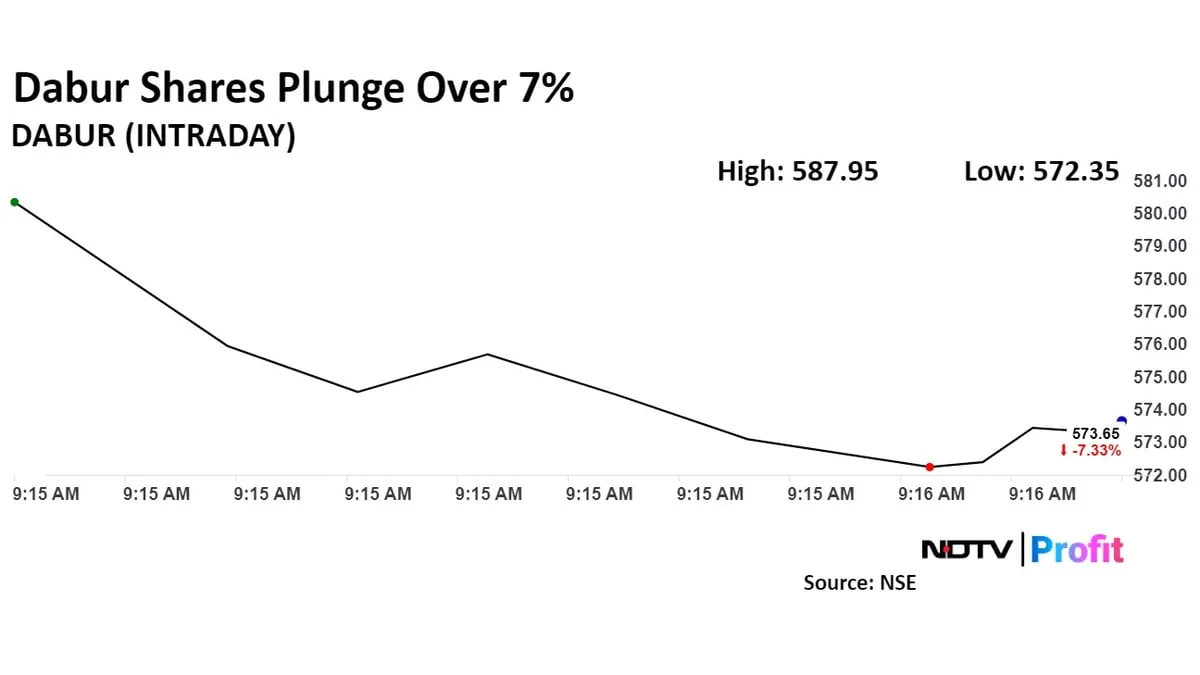

Stock Market Live: Dabur India Share Price Falls On Brokerages' Bearish View

Dabur India Ltd. share price declined over 7% on Thursday as brokerages expects the company to suffer significantly in the Sept–Nov due to bad weather condition and proactive inventory correction strategy.

Business Update Q2: Punjab National Bank

-

Domestic Advances rose 11.8% on the year at Rs 9.05 lakh crore.

-

Global Advances rose 13% on the year at Rs 9.42 lakh crore.

-

Domestic Deposits rose 10.9% on the year at Rs 12.7 lakh crore.

-

Global Deposits rose 11.4% on the year at Rs 13.1 lakh crore.

-

Domestic Business rose 11.3% on the year at Rs 21.8 lakh crore.

-

Global Business rose 12.1% on the year at Rs 22.5 lakh crore.

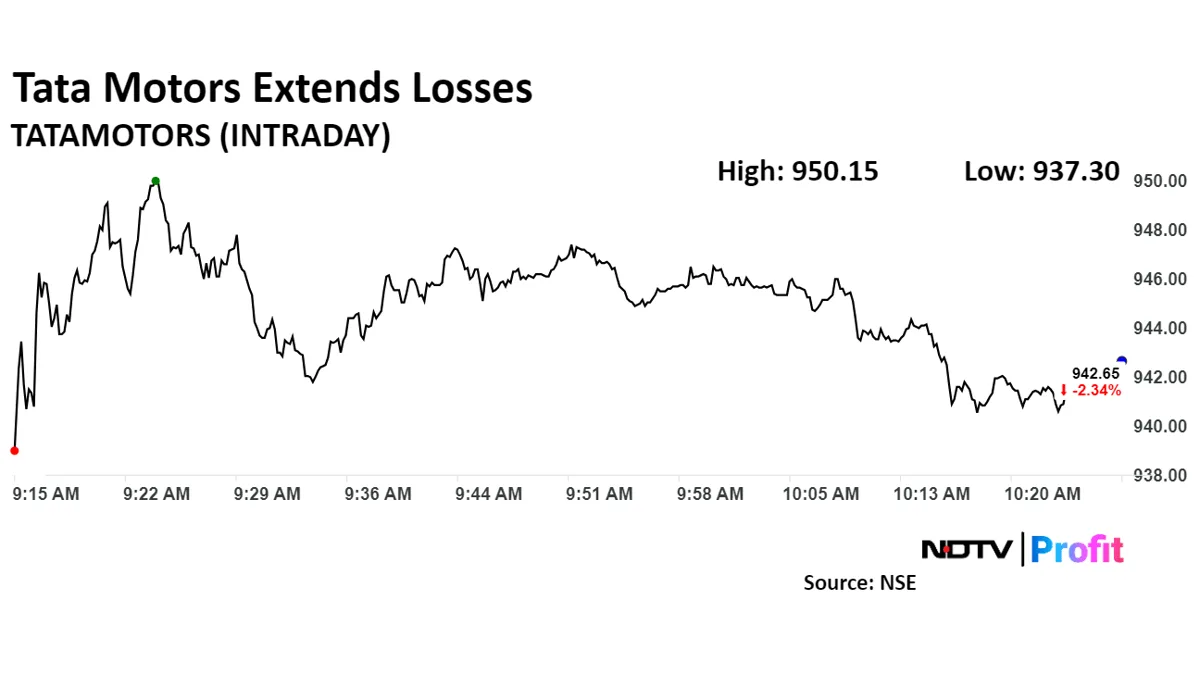

Stock Market Live: Tata Motors' Sales Decline More Than Expected In September

Tata Motors Ltd.'s total domestic car sales declined 15% on the year at 69,694 units in September. Its total commercial vehicle sales dropped 23% on the year to 30,032 units against 34,465 units estimate for the month.

Tata Motors' electric vehicle sales fell 23% on the year 23% to 4,680. The Passenger Vehicle sales declined 9% on the year to 41,313 units.

After its September sales number, Tata Motors share price extended losses. It declined 2.89% to Rs 937.30 apiece.

After its September sales number, Tata Motors share price extended losses. It declined 2.89% to Rs 937.30 apiece.

Tata Motors’ Car Sales Slump 9% In September As EVs Find Fewer Takers

KRN Heat Exchanger & Refrigeration Ltd. listed at Rs 480 on the National Stock Exchange compared to issue price of Rs 220. The company listed at a premium of 118.2% on NSE.

KRN Heat Exchanger & Refrigeration listed at Rs 470 BSE Vs issue price Of Rs 220. It listed at a premium of 113.6% on BSE.

KRN Heat Exchanger Share Price Closes At 117% Premium Over IPO Price

New Factory In Chennai Will Commercialize Production In Q4 FY25, Says Dixon Technologies MD

New factory in Chennai will commercialize production in Jan–March in financial year 2024–25, said Dixon Technologies (India) Managing Director Atul Lall said in an interview to NDTV Profit.

Festive season is the most important for consumer durable industry as well as Dixon Technologies. The contribution of festive period to revenue between July to October is around 38-40%, Lall said.

Dixon Technologies operates at similar margins to global players. Lall sees I-phone growth impacting sales of android brands that the company service. Mobiles is largest revenue contributor for Dixon Technologies.

Q2 Review: Dixon Tech Revenue Rises By 28% Year-On-Year

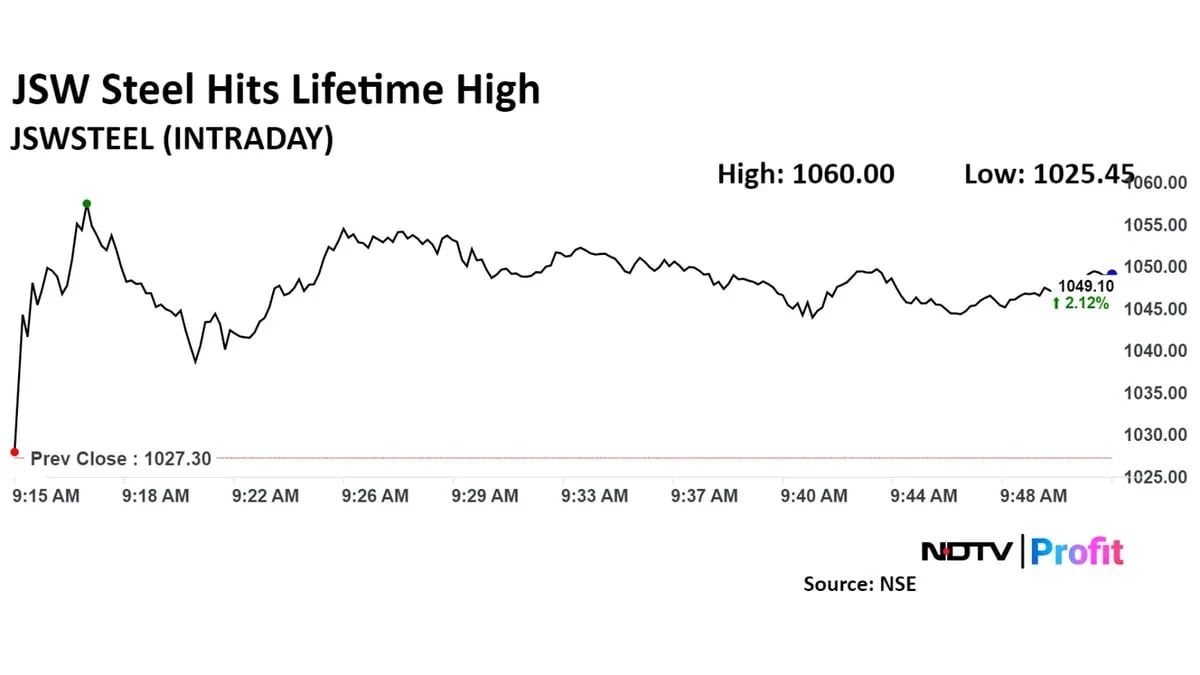

JSW Steel Ltd. share price rose to record high on Thursday after Nomura began coverage of the company with a buy rating. It gave a target price Rs 1,220, which implied 22% upside from Tuesday's closing price.

Jindal Steel, JSW Steel Share Prices Rise After Nomura Initiates Coverage With ‘Buy’

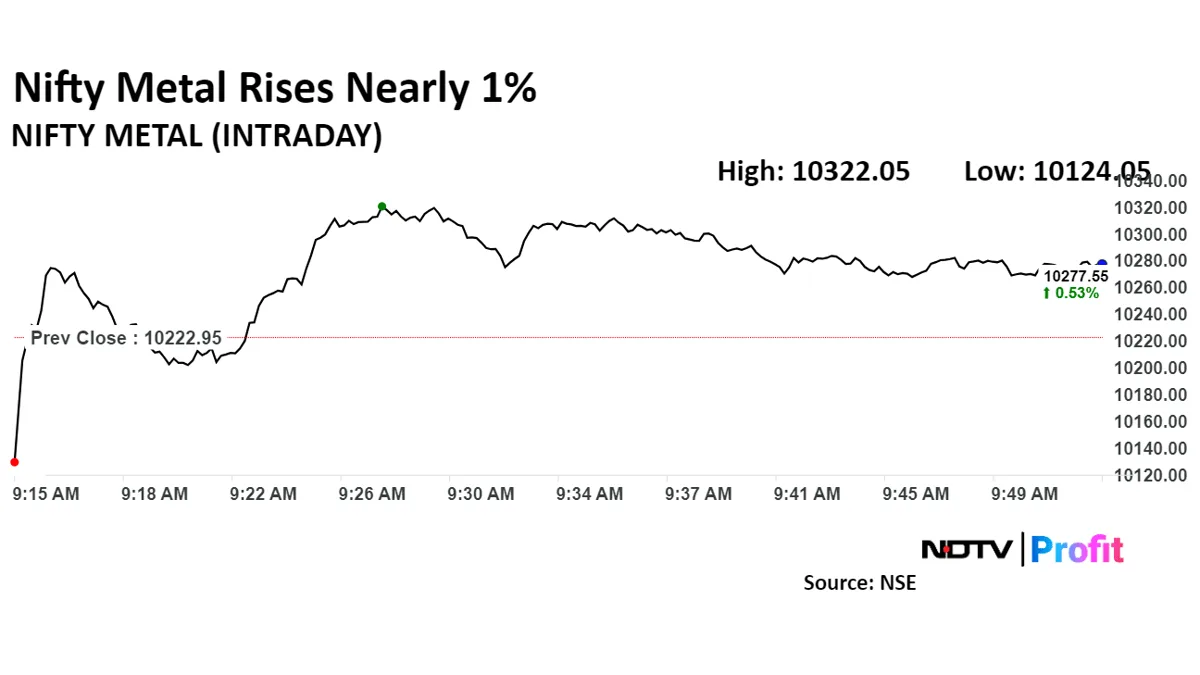

Stock Market Live: Nifty Metal Lead Gainer Among Sectoral Indices

The NSE Nifty Metal index rose 0.97% to 10,322.05 as JSW Steel Ltd., and Tata Steel Ltd. led. The index was trading 0.46% higher as of 09:52 a.m., as compared to Nifty 50 index.

Spartan Capital Doesn't See Oil Prices Gaining Higher From Current Level, Says Chief Market Economist

Spartan Capital Securities doesn't see oil prices gaining higher from current level, said Chief Market Economist Peter Cardillo. The key question is whether Iran and Israel will see a full scale war. Full scale war of Iran- Israel could engage oil producing countries in the region.

The oil market has not responded very highly to the Iran- Israel tensions. Oil traders are keeping in mind that the Organization of Petroleum Exporting Countries has enough spare capacity, Cardillo said.

US inventory data has reversed after 5-6 weeks of consecutive drops. The oil market is a wait and see situation right now, he said.

Stock Market Live: Volatility In Indian Markets Soars

The India NSE Volatility Index rose 9.91% to 13.18. The index was trading 6.55% higher at 12.78 as of 09:18 a.m.

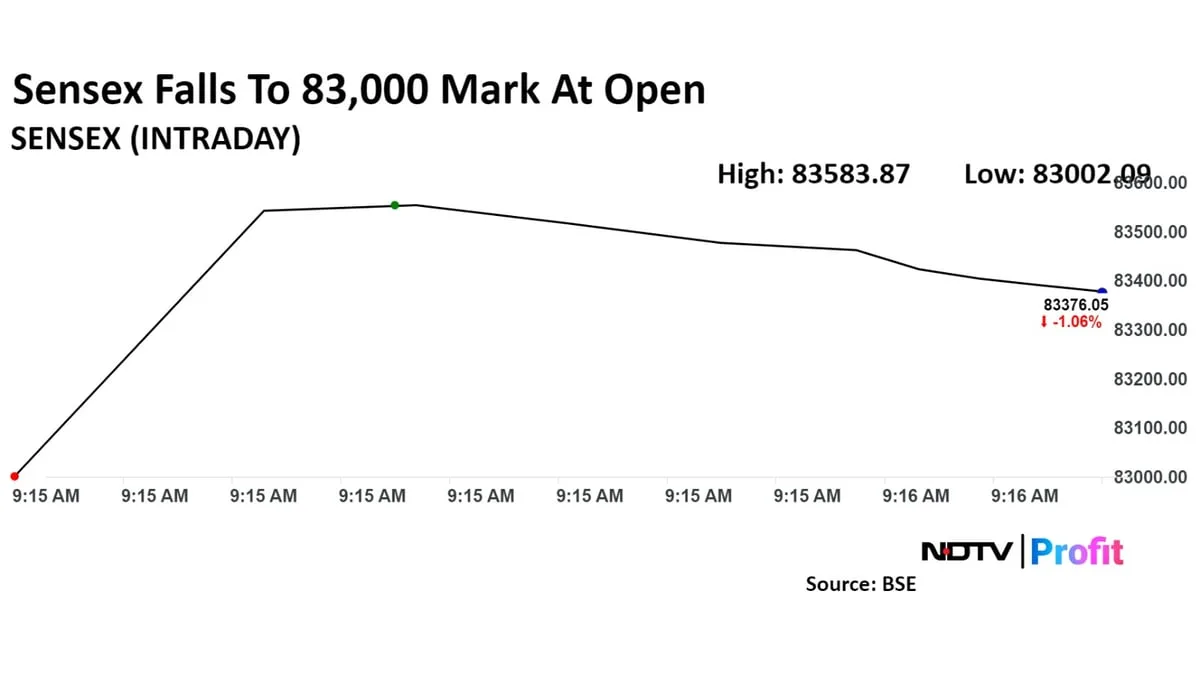

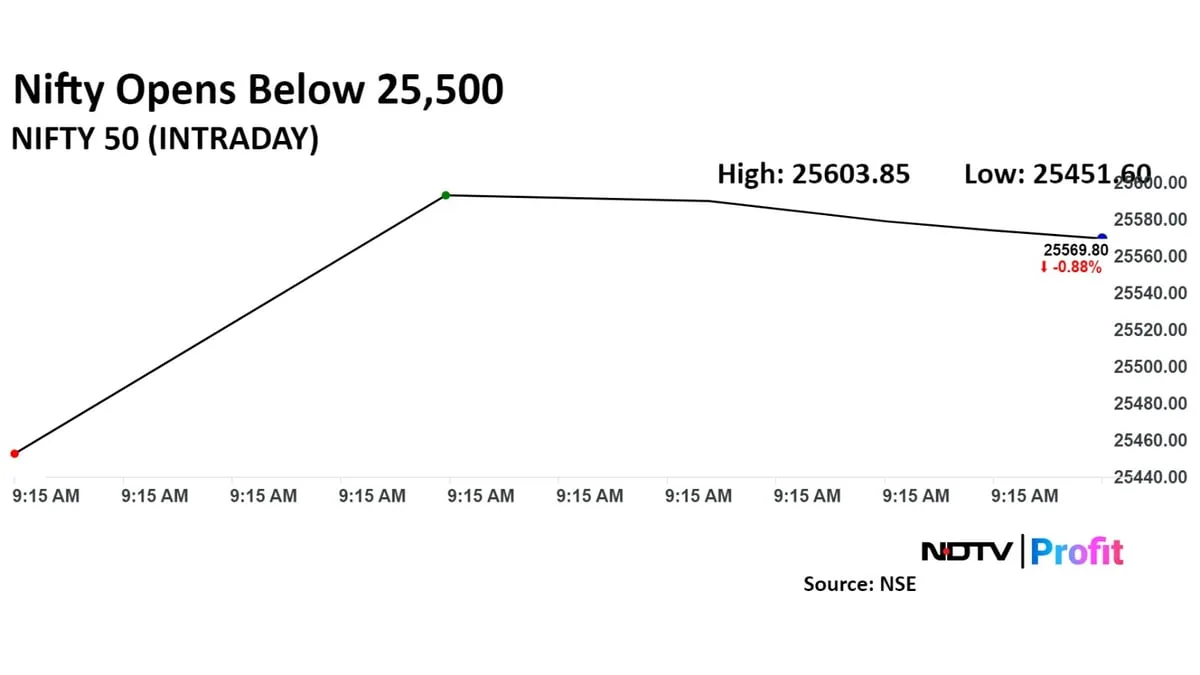

Stock Market Live: Nifty, Sensex Slump 1% At Open Post SEBI's F&O Curbs

The NSE Nifty 50 and BSE Sensex declined 1% at open on Thursday as investors' mood soured after the Securities Exchange Board of India introduced several curbs to regulate Futures and Options trade. Reliance Industries Ltd., and Infosys Ltd. were the top dragger in the Nifty 50 index.

As of 09:21 a.m., the Nifty 50 was trading 247.40 points or 0.96% down at 25,549.50, and the Sensex was 821.05 points or 0.97% down at 83,445.24.

Kotak Securities recommended strategy is to consider a contra bet by going long if the indices form a reversal formation after reaching 25,500/83,200 the 20-day SMA support. Keep a stop loss at 25,300 on a closing basis. Reducing weak long positions at resistance levels around 25,800/25,900 is also advisable, said Shrikant Chouhan, head equity research.

Infosys Ltd., Reliance Industries Ltd., ICICI Bank Ltd., Nestle India Ltd., and Mahindra & Mahindra Ltd. weighed on the index.

JSW Steel Ltd., Oil and Natural Gas Corp Ltd., Hindalco Industries Ltd., UltraTech Cement Ltd., and Tata Steel Ltd. added to the index.

On NSE 11 sectors declined and one advanced out of 12. The NSE Nifty Auto declined the most, and the NSE Nifty Metal was the top gainer.

Broader markets declined in line with the benchmarks. The BSE Midcap and Smallcap indices were trading 0.79% and 0.69% lower, respectively.

On BSE, 18 sectors advanced, and two declined out of 20. The BSE Consumer Discretionary was the top loser, while the BSE Metal rose the most.

Market breadth was skewed in favour of buyers. Around 2,162 stocks declined, 959 stocks rose, and 112 stocks remained unchanged on BSE.

Yield On The 10-Year Bond Advance

The yield on the 10-year bond advanced 2 bps higher to 6.75%. It closed at 6.73% on Tuesday, according to data on Bloomberg.

Stock Market Live: Nifty, Sensex Lower At Pre-Open

At pre-open, the NSE Nifty 50 was trading 1.33% down at 25,452.85, and the BSE Sensex was 1.50% down at 83,002.09.

Rupee Weakens Against US Dollar

Rupee weakened by 8 paise to open at 83.90 against the US dollar. It closed at 83.82 on Tuesday, according to data on Bloomberg.

Stock Market Live: Business Update Q2: Adani Ports & SEZ

-

Handles 37.5 million ton Cargo in September, up 14% YoY

-

Growth In September Cargo Primarily Driven By Container Volume [GU] 31% YoY

-

Liquids & Gas Volume In September Increased By 11% YoY

-

Handled Highest Ever H1 Cargo Of 219.8 million, up 8.5% YoY

-

Mundra Port Achieved A Significant Milestone By Crossing 100 MMT Mark In 181 Days

Source: Exchange Filing

Adani Ports’ Handled Cargo Rose 14% In September, On Track To Deliver FY25 Guidance

Disclaimer: NDTV is a subsidiary of AMG Media Networks Limited, an Adani Group Company.

Business Update Q2: Yes Bank

-

Total Loans & Advances rose13.1% on the year at Rs 2.36 lakh crore

-

Total Deposits rose 18.3% on the year at Rs 2.77 lakh crore

-

CASA Ratio At 32% Vs 30.8% QoQ

-

Liquidity Coverage Ratio At 131.9% Vs 137.8% QoQ

-

Loan to deposit ratio falls 130bps QoQ to 85.3%

Source: Exchange filing

Jefferies On India Consumer Sector

-

Dabur's Q2 revenue down on high GT inventory, unfavorable weather

-

Dabur to maintain marketing spend despite challenging environment

-

Industry interactions suggest moderate demand with no major uptick expected

-

Brokerage notes ongoing debate on impact of e-commerce and other new channels, presenting challenges and opportunities for FMCG cos like Dabur

-

Cites inventory management concerns at Honasa

-

Advises caution on possibility of market corrections in FMCG companies

Nuvama On Dabur India

-

Maintains buy with target price of Rs. 760, which implied a 23% upside

-

Consolidated revenue is likely to decline 5% on the year

-

EBITDA is likely to clock 15% on the year decline

-

Q3 shall be slightly better than Q2

-

Expects consolidated revenue/EBITDA to fall 5%/15% on the year

-

Gross/EBITDA margin to fall 82bp/213bp YoY to 47.5%/18.5%

-

Expects A&P as percentage of sales at 7%. Q3FY25 can be better

Nomura on Metals: Indian Steel Producers At A Sweet Spot

-

Indian steel majors have structural reasons to continue trading at higher valuations

-

Structural reasons: Higher ROE, higher domestic demand

-

Global liquidity cycle is turning favorable for metals

-

Steel cos could have lower cost of equity as deleveraging continues

-

Believe Indian steel majors are among the best placed globally

-

Cost drivers to partially offset moderation in realizations

Stock Market Live Today: Signature Global Launches New Project

Signature Global India's arm launched a new project, Daxin, Gurugram’s X Factor in Gurugram, it said in an exchange filing.

Watch India Market Open At NDTV Profit

Jefferies On SEBI Norms

-

Circular broadly in-line with discussion paper, impacts ~35% of industry premiums

-

Lot size and margin hike lower than expected

-

Phased implementation to lead to calibrated tightening

-

Focus now moves to participant behavior post implementation

-

Discount brokers can be most impacted, followed by exchanges (BSE)

-

AMCs, Wealth Managers, Depositories remain unaffected

Biocon Biologics Refinances $1.1 Billion Long-Term Debt

Biocon Biologics refinances $1.1 billion long term debt through dollar bonds and new syndicated facility, it said in an exchange filing.

Asia FX Update: Yen Weakens After Ishiba's Comments

The Japanese yen declined against the US dollar after Prime Minister Shigeru Ishiba said that the economic condition of the country do not support rate hikes. The yen was 0.29% lower at 146.90 a dollar as of 08:12 a.m.

Most Asian currencies declined on Thursday as the dollar index rose to three-week high after data showed private sector employment increased in the world's largest economy more, weighing on hopes of more rate cuts.

The Australian dollar declined 0.16% against the greenback, while the Malaysian Ringgit fell 0.90% against the greenback.

The dollar index, which measures the strength of the greenback against major currencies, was trading 0.12% higher at 101.80, the highest level since Sept 12. The index was trading 0.09% higher at 101.76 as of 08:18 a.m.

NDTV Profit Explainer: Get To Know What SEBI F&O Framework

The Securities Exchange Board of India in its latest Futures & Options Framework said that bourses will monitor intraday position four times a day. To understand the new framework in detail click here.

Stock Market Live: Crypto Prices Erase Losses

Bitcoin prices erased losses in Asian trade. The prices declined as much as 0.78% to $60,430.98 earlier. As of 07:53 a.m., bitcoin price was 0.40% higher at $61,146.29.

NDTV Profit Exclusive: Trading Volumes Could Drop Up To 50% As SEBI Regulations Kick In

Trading volumes could drop as much as 50% after Sebi regulations kick in. Around 50-60% of traders will drop out as a result of higher contract sizes

No clarity is yet on which benchmark will be selected by NSE for weekly expiry. Regulator could take more action if trading volumes in derivatives are not impacted.

Stock Market Live: Gold Prices Eases As Traders Asses Geopolitical Risk

Gold prices erased early gains as investors monitor the developing situation in the Middle East Asia after Israel vowed to respond to Iran's attack earlier in the week.

The Bloomberg spot gold was trading 0.02% lower at $2658.22 as of 07:35 a.m.

Gold, Silver Or Bonds — The Best Safe Haven Asset For Equity Wary Investors

Oil Update: Prices Continue To Gain On Rising Tension In Middle East

Oil prices continued to rise in Asian trade on bleak supply outlook as geopolitical tension heightened in the Middle East after the Israel said that the country will retaliate to Iran's attack earlier in the week.

The crude oil was trading 1.04% higher at $74.67 a barrel as of 07:24 a.m.

Asia Market Update: Japan Leads Gain In Asia On Ishiba

Japan was leading gains in the Asia early Thursday following dovish remarks from the Prime Minister Shigeru Ishiba. The Japan's Nikkei 225 jumped nearly 3% on Thursday after Ishiba said that the economic condition of the country do not support rate hikes. The dovish remark came after Ishiba met the Bank of Japan Governor Kazuo Ueda.

The Nikkei 225 was trading 909.74 points or 2.41% higher at 38,718.50 as of 07:03 a.m. The S&P ASX 200 was 4.50 points or 0.06% lower at 8,193.70.

Financial markets in China are closed till Oct 8 for mid-Autumn festival. Markets in South Korea are also closed for National Foundational Day.

Japan Stocks Spike As Ishiba Calms Rate Hike Fears: Asia Markets Wrap

Stock Market Live: US Markets Close Little Change Amid Rising Middle East Tension

The US markets closed with little change on Tuesday amid rising tension in the Middle-East. The S&P 500 and Dow Jones Industrial Average ended 0.01% and 0.09% higher. The Nasdaq Composite settled 0.08% higher.

In Asian trade, US futures were trading marginally lower. The S&P 500 and Dow Jones Industrial futures were trading 0.07% and 0.06% lower, respectively.

Market participants look forward to US jobs report, scheduled for release on Friday.

The GIFT was trading near 25,800 in early morning Thursday. Nifty BSE Ltd., Coal India Ltd., HDFC Bank Ltd., and Hero MotoCorp Ltd. share prices are expected to react because of the news flow.

The GIFT Nifty was trading 0.45% or 116.50 points lower at 25,696.00 as of 08:03 a.m.

Motilal Oswal Financial Services expects the market to consolidate with stock-specific actions as result season draws close. Companies will announce pre-quarterly updates, said Siddhartha Khemka, head, research, Wealth Management.

The NSE Nifty 50 and BSE Sensex declined for a third session Tuesday tracking a fall in heavyweights HDFC Bank Ltd., Reliance Industries Ltd. The Nifty 50 ended 0.05% or 13 points lower at 25796.90 and Sensex closed 0.04% or 33.49 points down at 84266.29.

Indian financial markets were closed on Wednesday on account of Gandhi Jayanti.

Stock Market Today: All You Need To Know Going Into Trade On Oct. 3. Read more on Markets by NDTV Profit.