The Nifty displayed resilience, closing the day on a flat to negative note at 24,347 levels, which indicates that the 24,400-level would be the immediate breakout zone, according to analysts.

Railway sector stocks like Rail Vikas Nigam Ltd., Indian Railway Finance Corp., and Railtel Corp. saw significant rallies in Monday's session, driven by the government's approval of eight new railway projects.

The volatility index, INDIA VIX, saw a jump of 3.47%, settling at 15.87, indicating heightened market volatility.

Technically, the Nifty index formed a green candle with shadows on both sides on the daily chart, signaling uncertainty, according to Hrishikesh Yedve, assistant vice-president of technical and derivatives research at Asit C. Mehta Investment Intermediates Ltd. "If the index sustains above 24,480, it could trigger a fresh rally towards the 24,600–24,700 levels."

He recommends a buy-on-dips strategy, noting that the 34-day Exponential Moving Average (DEMA) near 24,240 provides crucial support, making the 24,200–24,240 range a key support zone for Nifty in the short term.

Shrikant Chouhan, head of equity research at Kotak Securities Ltd., pointed out that for the bulls, the 24,400-level would be the immediate breakout zone. A sustained move above this could propel the market towards 24,500-24,550, while a drop below 24,300 could shift sentiment, leading to a retest of the 24,200–24,170 range.

Looking ahead, investors are closely watching the release of India’s July CPI inflation data, which will be crucial for assessing inflation trends in light of the RBI's recent upward revision of the Q2 FY25 CPI forecast to 4.40%, up from the previous estimate of 3.80%, noted Vikram Kasat, head of advisory at PL Capital Ltd.

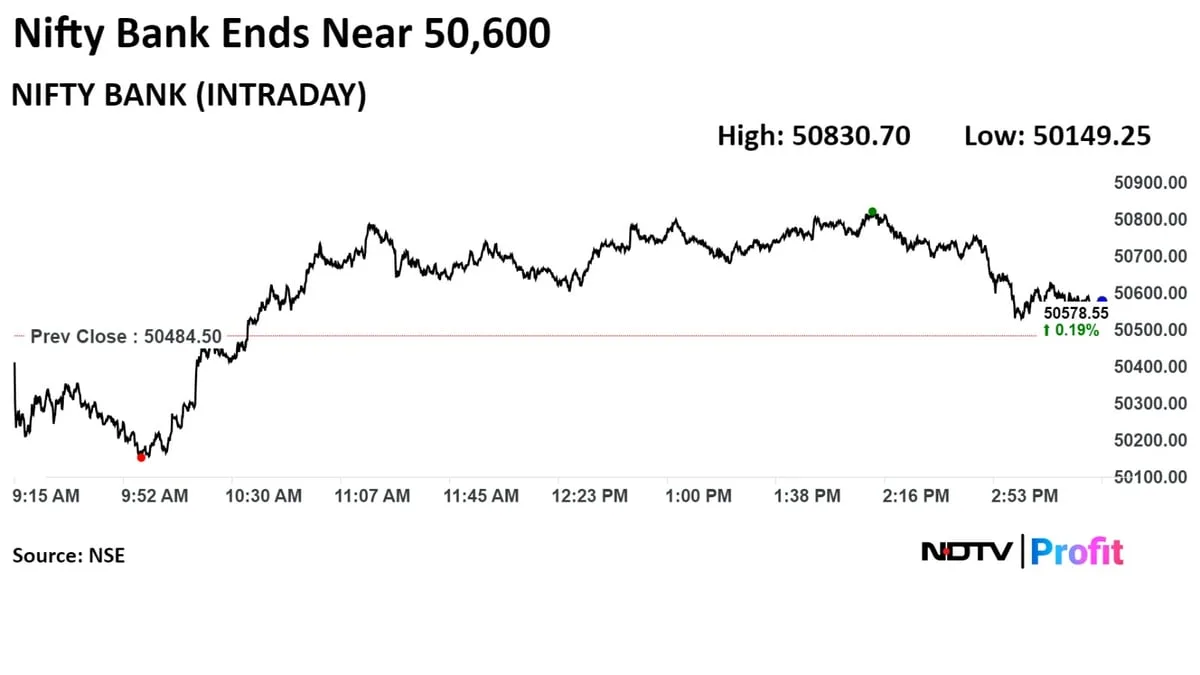

The Bank Nifty index ended the day positively at 50,578.

"The index attempted to surpass the 50,710-level but couldn't sustain above it, forming a green candle with large shadows. A sustained move above 50,710 could push the index towards the 51,000-51,200 levels<" Yedve said.

He also suggested a buy-on-dips strategy for Bank Nifty, with the 100-DEMA around 49,870 acting as a firm support level in the short term.

Market Recap

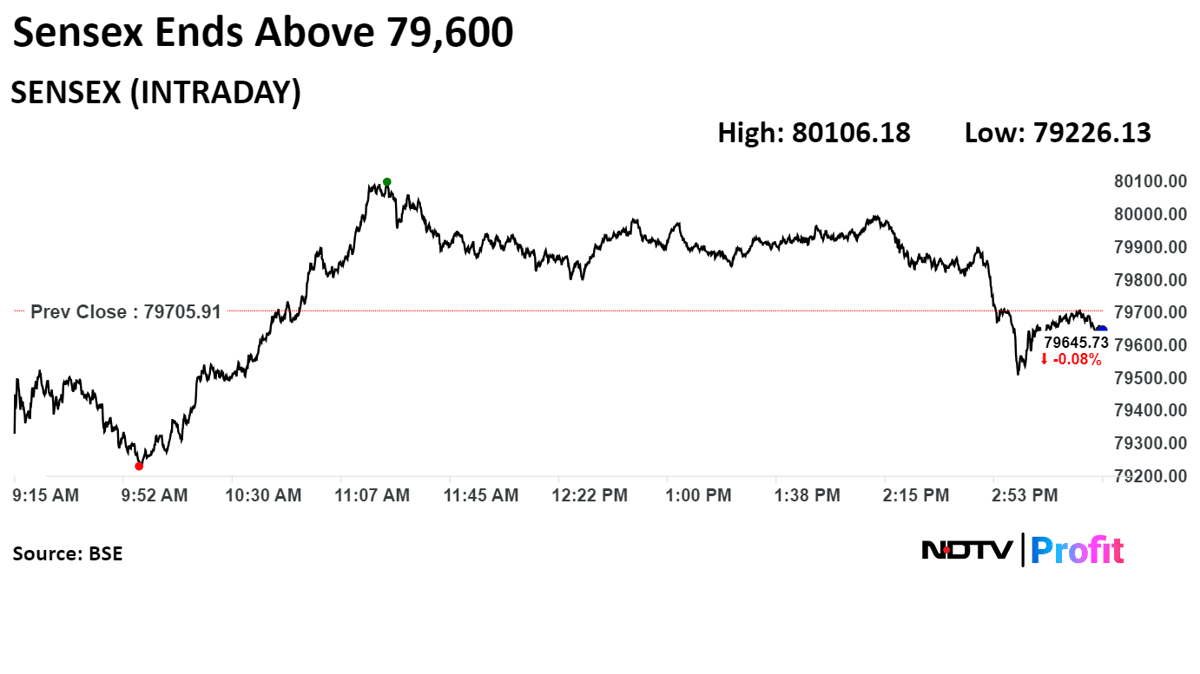

The Indian benchmark indices erased some losses to end Monday on a muted note as Infosys Ltd. and HDFC Bank Ltd. led the gains. The NSE Nifty 50 ended 20.50 points, or 0.08%, lower at 24,347, while the S&P BSE Sensex closed 56.99 points, or 0.07%, down at 79,648.92.

Of the 12 sectors on the NSE, six ended higher and the rest ended lower. The NSE Nifty Media declined the most, and the NSE Nifty Realty rose the most.

On the BSE, the broader indices were mixed as the BSE MidCap ended flat and the SmallCap closed 0.6% higher.

Five of the 20 sectoral indices on the BSE closed lower and 15 ended with gains. BSE Realty was the top gainer.

The market breadth was skewed in favour of the sellers as 2,148 stocks fell, 1,925 advanced, and 105 remained unchanged on the BSE.

Money Market Update

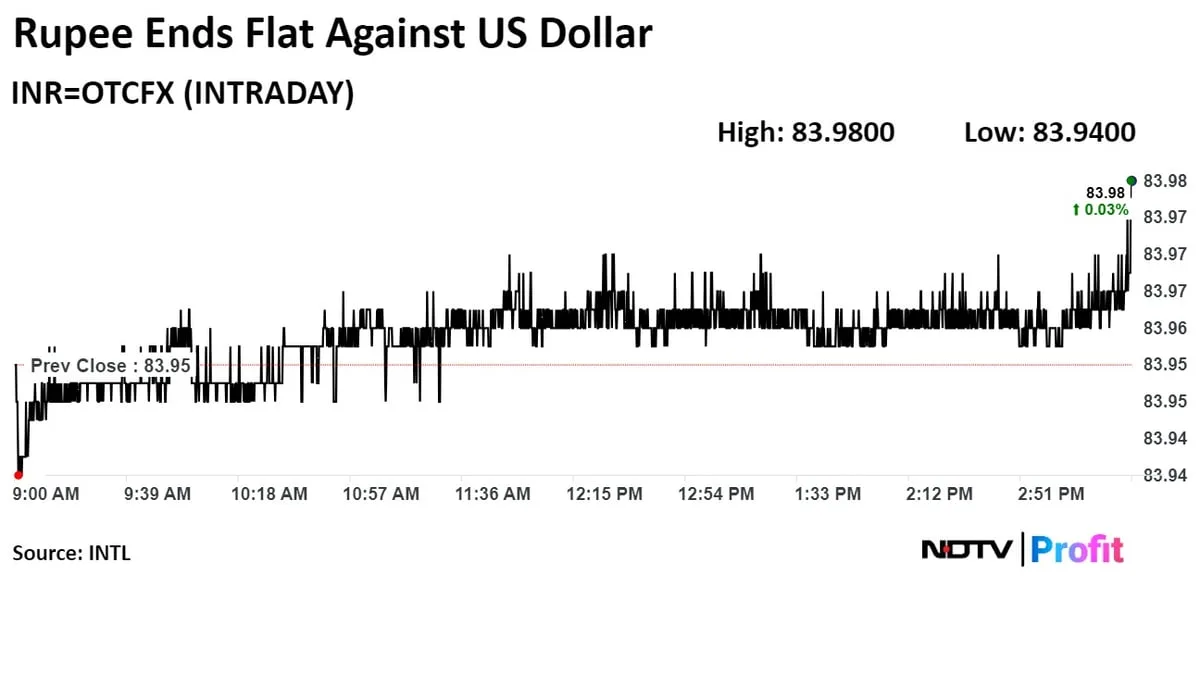

The Indian rupee closed at a record low closing against the US dollar on Monday.

The rupee closed flat at Rs 83.97 after opening little changed at Rs 83.95 against the US dollar. On Friday, it had closed at Rs 83.96.

. Read more on Markets by NDTV Profit.