Table of Contents

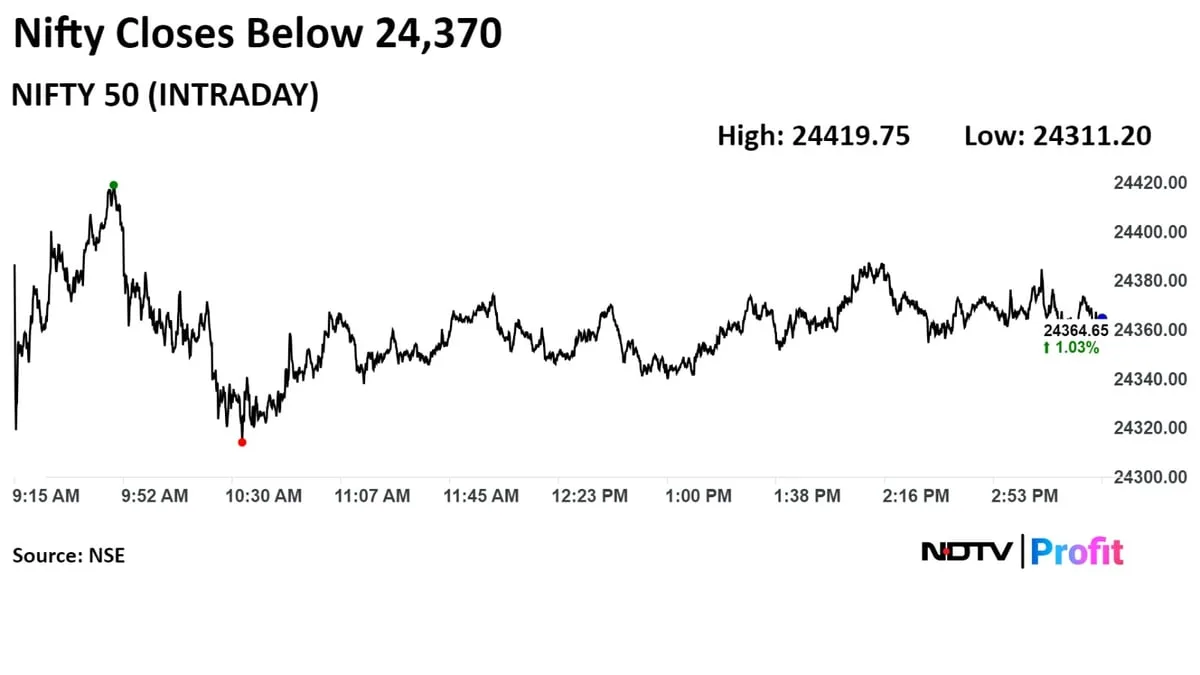

Nifty ended the week down by 1.42%, closing just above the 24,350 mark, despite a late recovery. The 24,000-level is expected to act as a significant support point moving forward, according to analysts.

On the daily charts, Nifty formed a small bullish doji-like pattern, rising above the highs of the previous four sessions. It managed to enter the down gap area of 24,383-24,687, with the potential to rise towards the 24,582-24,687 range. In the near term, 24,080 could serve as a support level, according to Deepak Jasani, head of retail research at HDFC Securities Ltd.

“The volatility index, INDIA VIX, fell by 7.5%, settling at 15.37, indicating a drop in market volatility," Jasani said.

The index is currently oscillating within a broad range of 23,970 (50DMA support) to 24,400 (bearish gap zone). A convincing move above the mentioned resistance level will help the index soar further to the 24,560 level. On the flip side, breaking the support level will drag the index down to 23,660, according to Aditya Gaggar, director of Progressive Share Brokers Pvt.

"If the index sustains above 24,420, it could trigger a fresh rally towards the 24,600-24,700 levels. A buy-on-dips strategy is advisable, with 24,000 acting as a major support level, supported by the 50-DEMA," said Hrishikesh Yedve, AVP, technical and derivatives research at Asit C. Mehta Investment Intermediates Ltd.

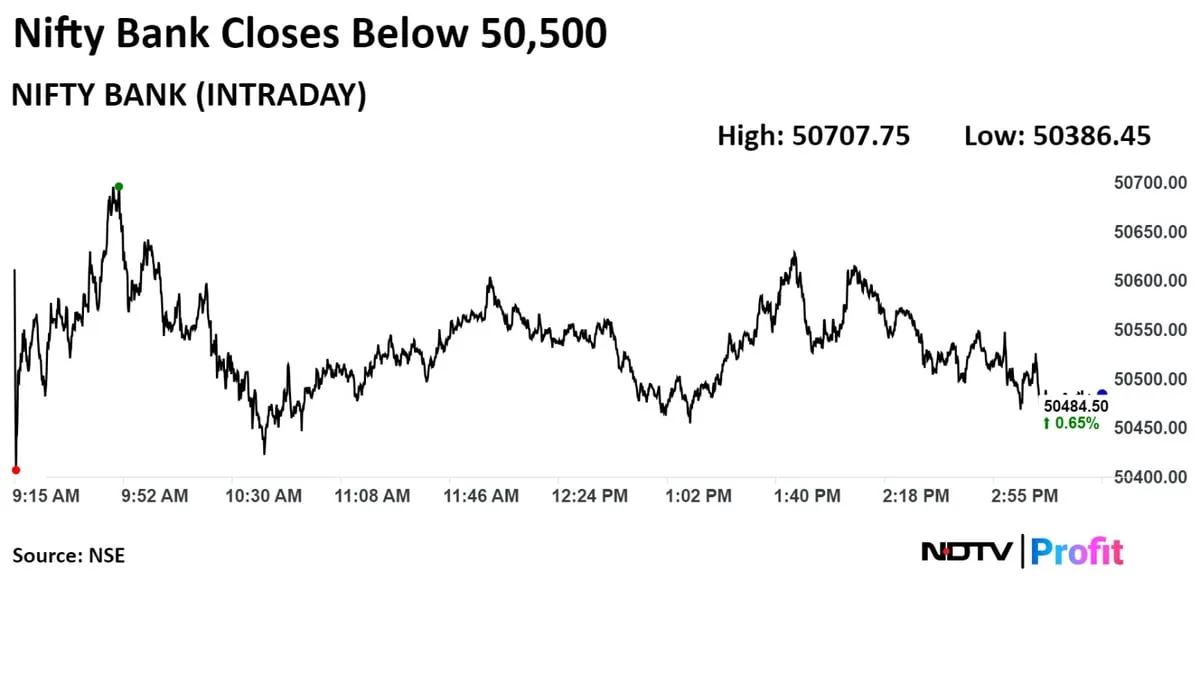

Bank Nifty opened with a gap up, but faced selling pressure near the 50,700 levels, finally closing on a positive note at 50,485.

"Technically, the index has formed a hammer pattern on the weekly scale, indicating strength. If the index sustains above 50,710, it could trigger a fresh rally towards the 51,000-51,200 levels. A buy-on-dips strategy should be adopted, with firm support at 49,650," Yedve said.

Nifty In Technical Charts: Rally Set To Continue From Aug. 5 Lows

F&O Action

The Nifty August futures are up 1.11% to 24,401 at a premium of 34 points, with open interest down by 5.14%.

Nifty Bank August futures are up by 0.75% to 50,574 at a premium of 90 points, while its open interest is down by 5%.

The open interest distribution for the Nifty 50 Aug. 14 expiry series indicated most activity at 25,000 call strikes, with 23,000 put strikes having maximum open interest.

For the Bank Nifty options expiry on Aug. 14, the maximum call open interest was at 60,000 and the maximum put open interest was at 50,000.

FII/DII Activity

Overseas investors turned net buyers on Friday after five straight days of net selling equities.

FPIs mopped up equities worth Rs 406.7 crore, while domestic investors remained net buyers for the fifth consecutive session and mopped up equities worth Rs 3,979.6 crore, the NSE data showed.

India’s Forex Reserves At Record High of $675 Billion

Market Recap

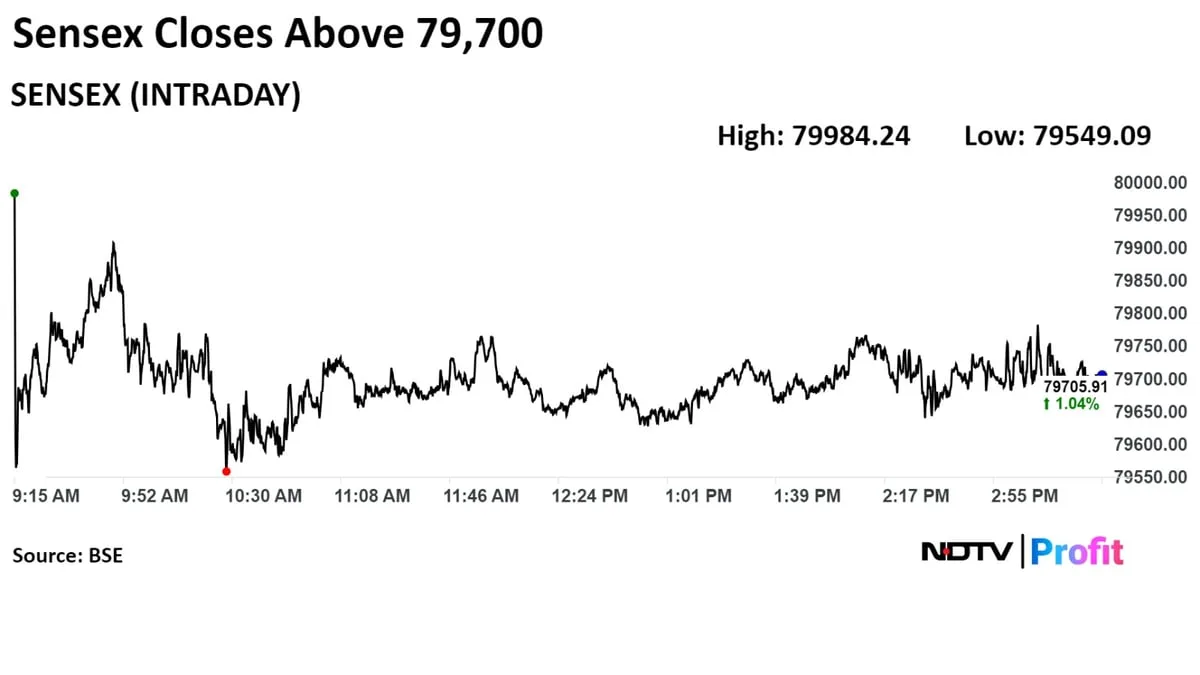

India's benchmark equity indices closed higher on Friday but logged a second consecutive weekly loss, weighed by various global and Indian macro cues, including the yen carry trade, US recession fears, and the RBI governor's hawkish commentary during policy.

However, global market sentiment improved on Friday as recession fears eased after the US registered lower-than-expected jobless claims for the week. The upward revision of the Reserve Bank of India's fiscal 2025 growth estimates also added to the positive sentiment on Friday.

The NSE Nifty 50 ended 1.03%, or 247.65 points higher at 24,364.65, and the S&P BSE Sensex closed up 1.04%, or 819.69 points at 79,705.91. Intraday, Nifty rose 1.3% and Sensex gained 1.4%.

Broader indices also ended higher, with the BSE Midcap and the Smallcap ending 1.2% and 0.79% higher on Friday.

All 20 sectoral indices on the BSE ended higher, with BSE IT gaining the most.

The market breadth was skewed in the favour of buyers. As many as 2,332 stocks rose, 1,571 fell, and 103 remained unchanged on the BSE.

Major Stocks In News

-

Mahindra and Mahindra Ltd.: The company denied media reports of a $3-billion joint venture with China’s Shaanxi Automobile.

-

ONGC Ltd.: The company received government nod to invest additional Rs 10,502 crore in ONGC Petro additions via equity. Government approved allocation of 50% of company’s annual gas production from new or intervention wells for OPaL’s feedstock support. The nod was received to invest a total of Rs 18,365 crore.

-

Atul Ltd.: US FDA inspected at unit’s Ambernath facility in Maharashtra and concluded with zero observations.

-

Anup Engineering Ltd.: The company received two orders worth Rs 100 crore.

Ola Electric To Unveil E-Bikes On Aug. 15

Money Market Update

The Indian rupee closed flat against the greenback after opening stronger on Friday, amid a weak US Dollar Index.

The currency ended flat at 83.96 after opening at 83.94 against the US dollar. It had closed at 83.96 on Thursday.

. Read more on Markets by NDTV Profit.