Table of Contents

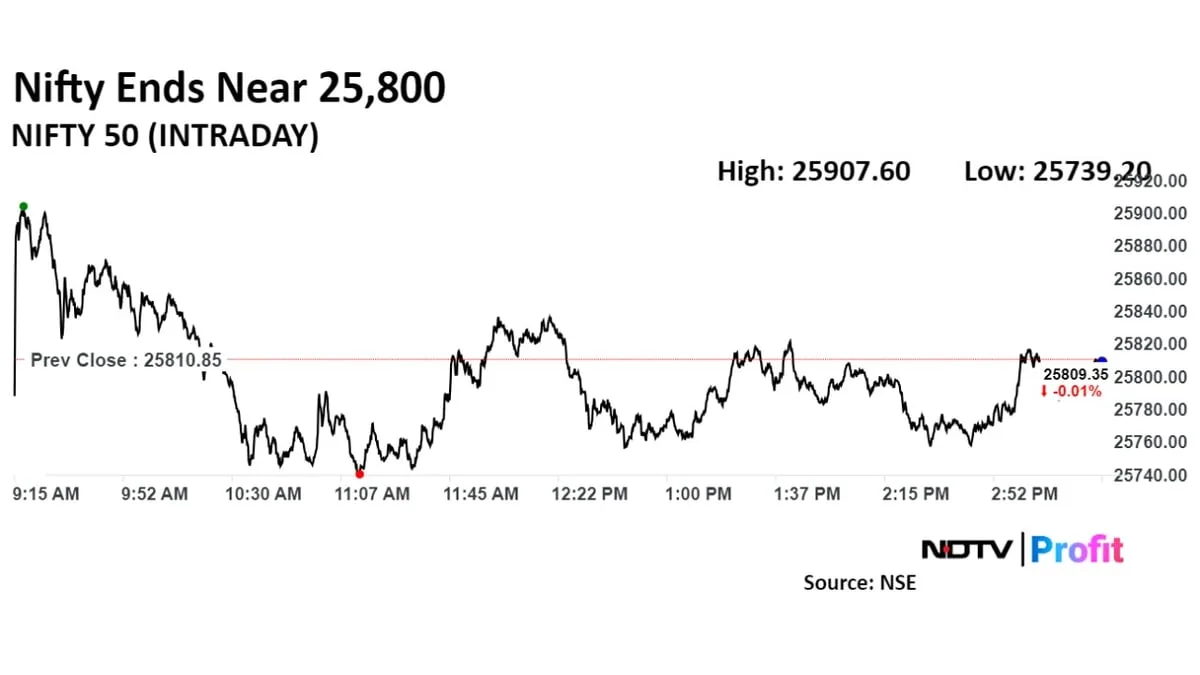

After a sharp selloff on Monday, the markets opened positively on Tuesday but remained range-bound throughout the session. The charts on Monday indicated indecisiveness between bulls and bears. However, analysts suggest that the NSE Nifty 50 may experience a pullback in the coming days.

Analysts expect 25,650 to act as a support level for the Nifty 50. They also believe that a breach above 26,000 could signal upward momentum in the near future.

"Nifty witnessed consolidation near the 25,800 zone after the two sessions of losing streak with a Doji candle formation on the daily chart and can expect for a pullback in the coming session," said Vaishali Parekh, Vice President, Technical Research, PL Capital Group.

On the other hand, Shrikant Chouhan, Head of Equity Research at Kotak Securities, noted that as long as the index remains below 25,910, weak sentiment is likely to persist. He mentioned that the markets could retest the 25,680-25,650 range, with this support level acting as a key trend indicator for bulls.

Siddhartha Khemka, Head Research, Wealth Management, Motilal Oswal, also expects the market to consolidate with stock-specific action as companies announce pre-quarterly updates and prepare for earnings season.

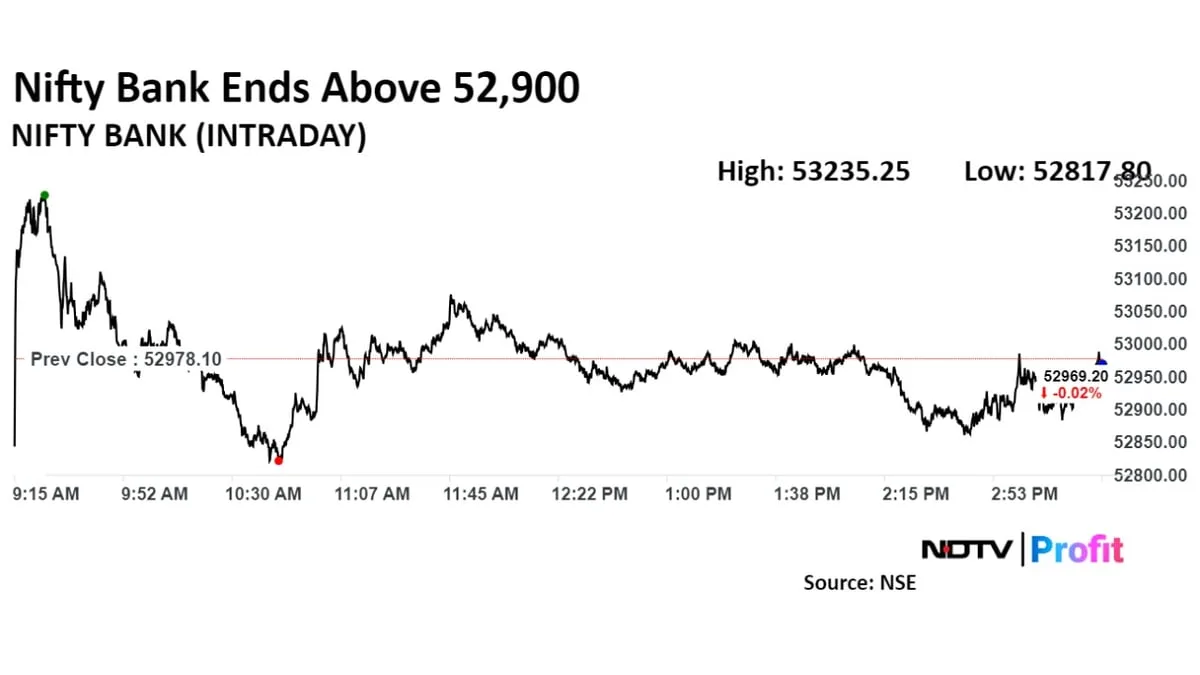

While Bank Nifty saw a flat to negative note, it managed to defend the 21-DEMA support. Bank Nifty has the crucial base near the 50EMA level of 52,000 with support level at 52,600 levels, according to Parekh. If the index can sustain at this level, then it can continue with an upward trend after a reversal in the positive trend.

Nifty, Sensex Close Flat After Volatile Session As M&M, Infosys Cap Decline: Market Wrap

F&O Cues

The Nifty October futures were down 0.05% to 25,976.9 at a no premium, with the open interest down by 2.7%.

The Nifty Bank October futures were down by 0.08% to 53,390 at a premium of 468 points, while its open interest was down by 3%.

The open interest distribution for the Nifty 50 Oct. 3 expiry series indicated most activity at 26,000 call strikes, with 23,050 put strikes having maximum open interest.

For the Bank Nifty options expiry on Oct. 1, the maximum call open interest was at 53,000 and the maximum put open interest was at 52,900.

FII/DII Activity

Overseas investors remained net sellers of Indian equities for the third consecutive session on Tuesday. Foreign portfolio investors offloaded stocks worth Rs 5,579.35 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors stayed net buyers for the seventh straight session and purchased equities worth Rs 4,609.55 crore, the NSE data showed.

Market Recap

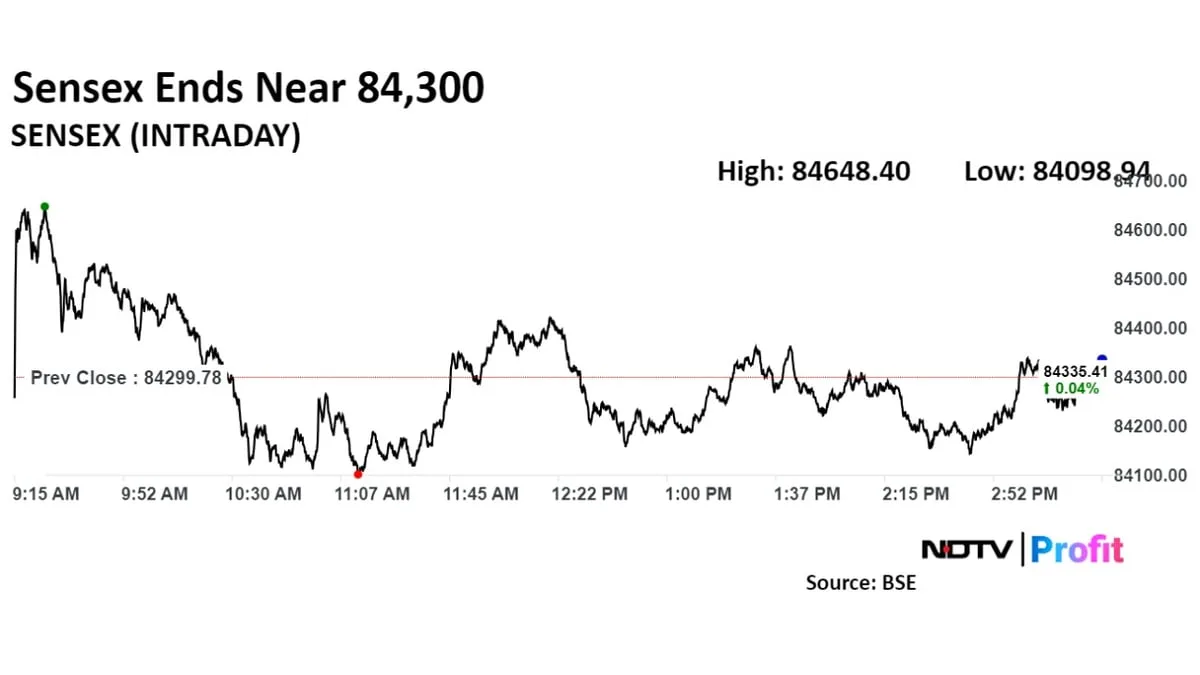

The benchmark equity indices fell for a third consecutive session, dragged down by shares of major players Reliance Industries and HDFC Bank. The Indian stock market will be closed on Wednesday in observance of Gandhi Jayanti.

The Nifty closed 0.05% lower, down 13 points at 25,796.90, while the Sensex fell 0.04%, declining by 33.49 points to finish at 84,266.29.

Top 10 Most Valued Firms Lose Rs 18,223 Crore Market Cap Led By Reliance Industries, HUL

Major Stocks In News

-

BSE, Angel One, IIFL Securities, and 5 Paisa: The brokerages and exchanges will be in focus following SEBI’s new F&O framework. SEBI has decided to increase the contract sizes in index derivatives from 10 lakhs to 15 lakhs. Additionally, weekly options expiries will now be restricted to one per exchange, meaning each exchange will offer derivatives contracts for only one of its benchmark indices. This change is likely to impact revenue for exchanges and brokers.

-

Auto Companies: Hero MotoCorp will be in focus after it reported motorcycle sales of 5.97 lakh units, reflecting a 21% year-on-year increase. Domestic sales totalled 6.16 lakh units, up 19% year-on-year, while exports rose by 22% to 20,344 units in September. Maruti Suzuki will also be in focus after it recorded total sales of 1.84 lakh units, an increase of 1.9% year on year. Domestic sales were 1.57 lakh units, down 1.2% year-on-year, while exports reached 27,728 units, up 23% year-on-year for September.

-

Dabur India: According to the company’s quarterly update, Dabur anticipates a negative impact on consumer offtake in the second quarter due to heavy rains and floods across the country, particularly affecting the beverage category. As a result, the company expects a mid-single-digit decline in consolidated revenue and a drop in operating margins to the mid- to high teens range.

SEBI F&O Framework: Upfront Premium Collection, Position Monitoring, And Expiry Day Reforms Introduced

Money Market

The rupee closed slightly weaker on Tuesday, tracking the movement of the dollar index following Federal Reserve Chair Jerome Powell’s slightly hawkish speech. However, easing oil prices limited the demand for the greenback.

The Indian currency depreciated 2 paise to close at Rs 83.82 against the US dollar. It had closed at Rs 83.80 on Monday, according to Bloomberg data.

Brent Crude Oil Price Falls Below $70 Per Barrel. Read more on Markets by NDTV Profit.