Table of Contents

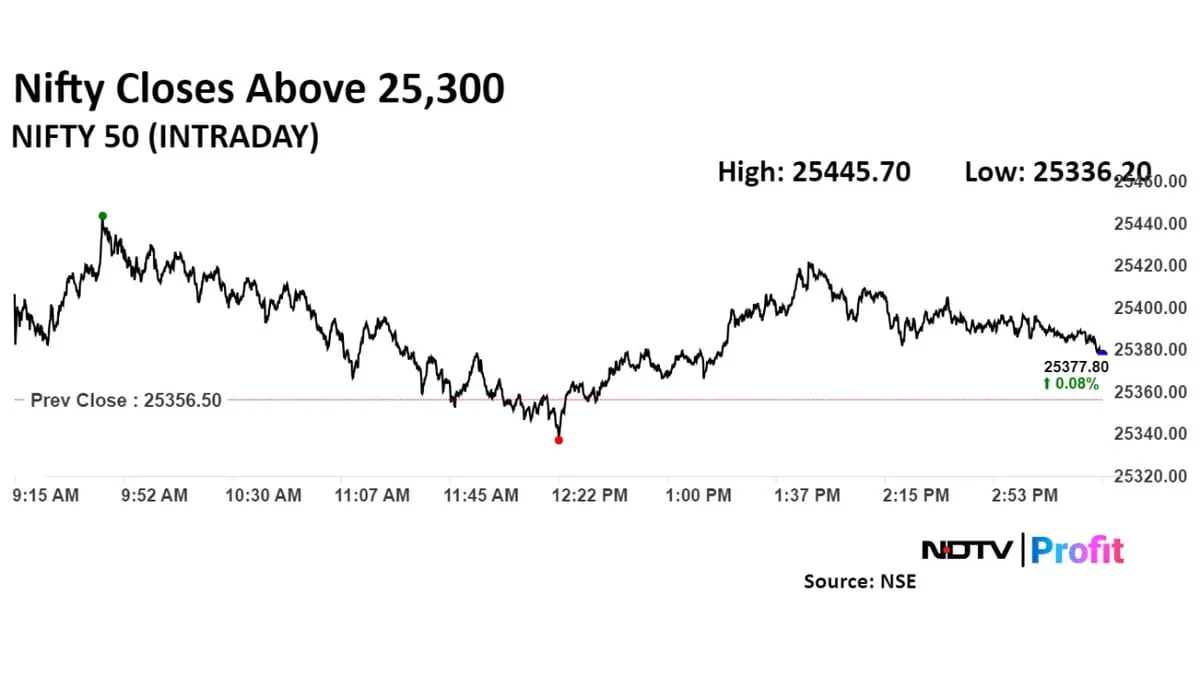

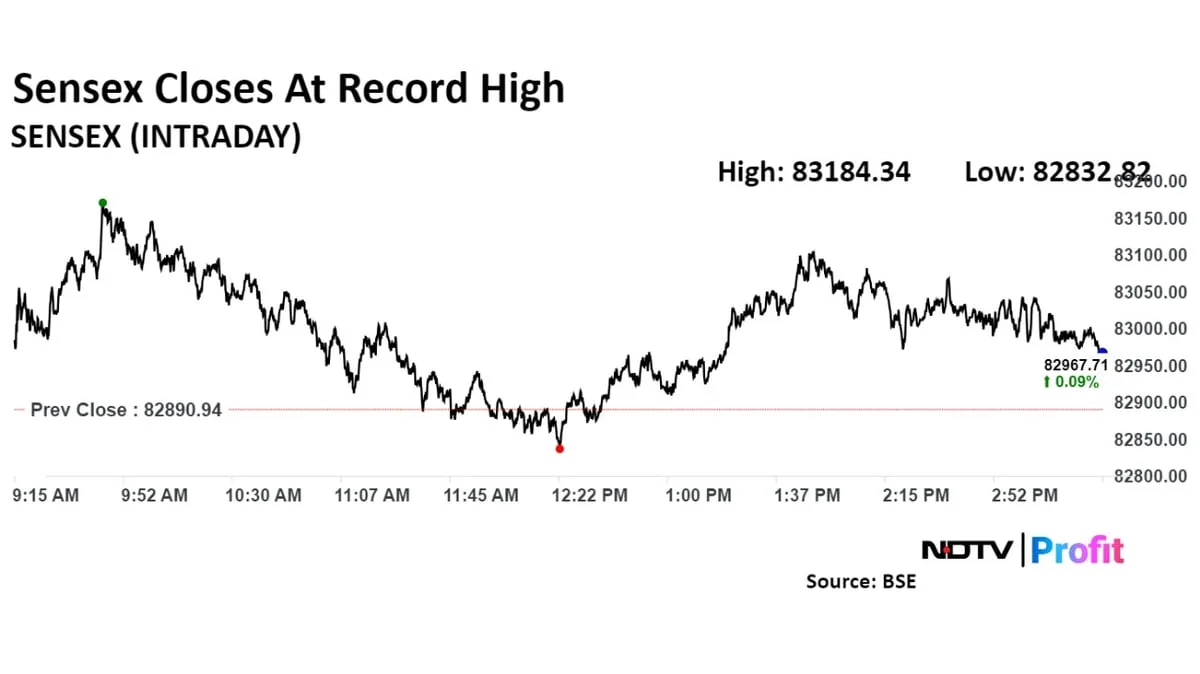

With the BSE Sensex closing at a record high, and the Nifty 50 also logging gains on Monday, analysts are of the view that the market is largely bullish but some range-bound action could be seen in the near future.

For traders, the key support zones will be 25,350-25,300 for Nifty and 82,900-82,700 for Sensex, said Shrikant Chouhan, head of equity research at Kotak Securities Ltd. The key resistance areas are seen at 25,500-25,575 and 83,300-83,600 for the two benchmark indices, respectively.

"However, below 25,300 and 82,700, the sentiment could change as traders may prefer to exit out from the trading long positions," he added.

"The larger texture of the market is bullish but we could see a range bound activity in the near future," Chouhan said.

The 21-DEMA support for Nifty is currently placed near 25,020. As long as Nifty stays above 25,000, a "buy-on-dips" strategy is advisable, with the potential for the index to test 25,600 in the short term, said Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C. Mehta Investment Interrmediates Ltd.

Sensex Closes At Record High As ICICI Bank, L&T Lead: Market Wrap

Bank Nifty, which started the day on a strong note and managed to close higher at 52,153, "could test levels of 52,800–53,000, with a medium-term target of 53,800", Yedve added.

According to Aditya Gaggar, director of Progressive Shares, Nifty appears to be forming a bullish pennant and pole formation where a strong move above 25,430 will be considered as a breakout point. In case of a breakout, the approximate target comes at 25,770, he said.

Going forward, an expected rate cut by the US Federal Reserve this week is likely to have a substantial impact on the global markets. "Hence, it is advisable to maintain a cautiously optimistic outlook and implement effective risk management strategies," said Osho Krishan, senior analyst of the technical and derivatives at Angel One Ltd.

FII/DII Activity

Overseas investors turned net sellers of Indian equities on Monday after five consecutive sessions of buying. Foreign portfolio investors offloaded stocks worth approximately Rs 1,635 crore, according to provisional data from the National Stock Exchange.

Domestic institutional investors stayed net buyers for the second consecutive session and purchased equities worth Rs 754.1 crore, the NSE data showed.

FPIs Turn Net Sellers After Five Sessions

Market Recap

The S&P BSE Sensex ended Monday's session at a record high, while the NSE Nifty 50 also closed higher, buoyed by gains in ICICI Bank Ltd. and Larsen & Toubro Ltd. Both the benchmark stock indices traded at fresh opening highs, before paring gains through midday.

The Nifty closed 27.25 points or 0.11%, higher at 25,383.75 and Sensex settled 97.84 points or 0.12%, higher at 82,988.78. Intraday, the Nifty and Sensex advanced as much as 0.35% each to 25,445.70 and 82,184.34, respectively.

The market breadth was skewed in favour of the buyers as 2,185 stocks rose, 1,927 declined and 89 remained unchanged on the BSE.

Money Market

The Indian rupee strengthened against US dollar on Monday as traders await the outcome of the Federal Open Market Committee's decision on interest rates this week.

The local currency appreciated two paise to close at Rs 83.88 against the US dollar, according to Bloomberg. It had closed at Rs 83.90 on Friday.

Disclaimer: The views and opinions expressed by the investment advisers on NDTV Profit are of their own and not of NDTV Profit. NDTV Profit advises users to consult with their own financial or investment adviser before taking any investment decision.

Rupee Closes Stronger Against US Dollar As Markets Eye Fed Rate Announcement. Read more on Markets by NDTV Profit.