Looking ahead to Thursday's session, the NSE Nifty 50 is expected to face resistance around 25,300–25,350, with a strong support seen at the 25,100–25,080 zone, followed by the crucial 25,000 level, according to analysts.

"The recent fall could be seen as a breather with no alterations to the ongoing trend," Osho Krishan, senior analyst of technical and derivatives at Angel One Ltd., said. "An authoritative breach of the 25,300–25,350 resistance zone could open the next leg of the rally towards 25,400–25,500."

Krishan cautioned that global developments could significantly impact the intermediate trend, urging investors to proceed thoughtfully and focus on selective stock choices for superior performance.

"As long as the index holds above the 25,000–25,100 levels, a buy-on-dips strategy should be employed," Hrishikesh Yedve, assistant vice president of technical and derivatives research at Asit C Mehta Investment Intermediates Ltd. "On the upside, the index may test the 25,500–25,600 levels in the near future."

"We expect the market to remain cautious until there is a clear view on the US economic data lined up for the week," Avdhut Bagkar, technical and derivatives analyst at StoxBox. He said that despite opening 189 points lower due to weak global cues, the Nifty managed to trend higher after early volatility settled.

The domestic benchmark indices opened on a negative note on Wednesday, in line with global cues. The Nifty began the day with a gap-down and remained under pressure, ultimately closing on a negative note at 25,199 levels after a late recovery, according to Yedve.

Here’s Why Fed Rate Cuts May Not Drive India’s Equities Higher

Market Recap

The Indian benchmark indices took a breather from a record rally to close lower on Wednesday as sentiment was hit after a rout in global stocks. The closing came after Asian stocks plunged, tracking the overnight losses in the US markets, led by weak economic data and easing oil prices on weak global demand.

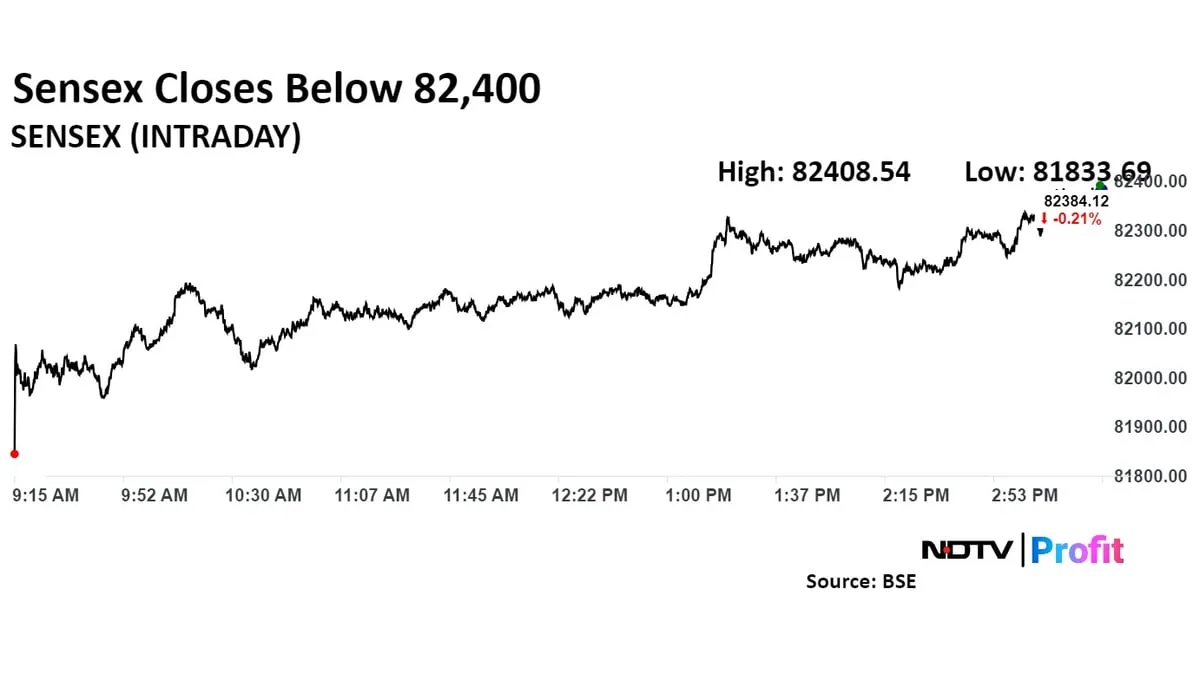

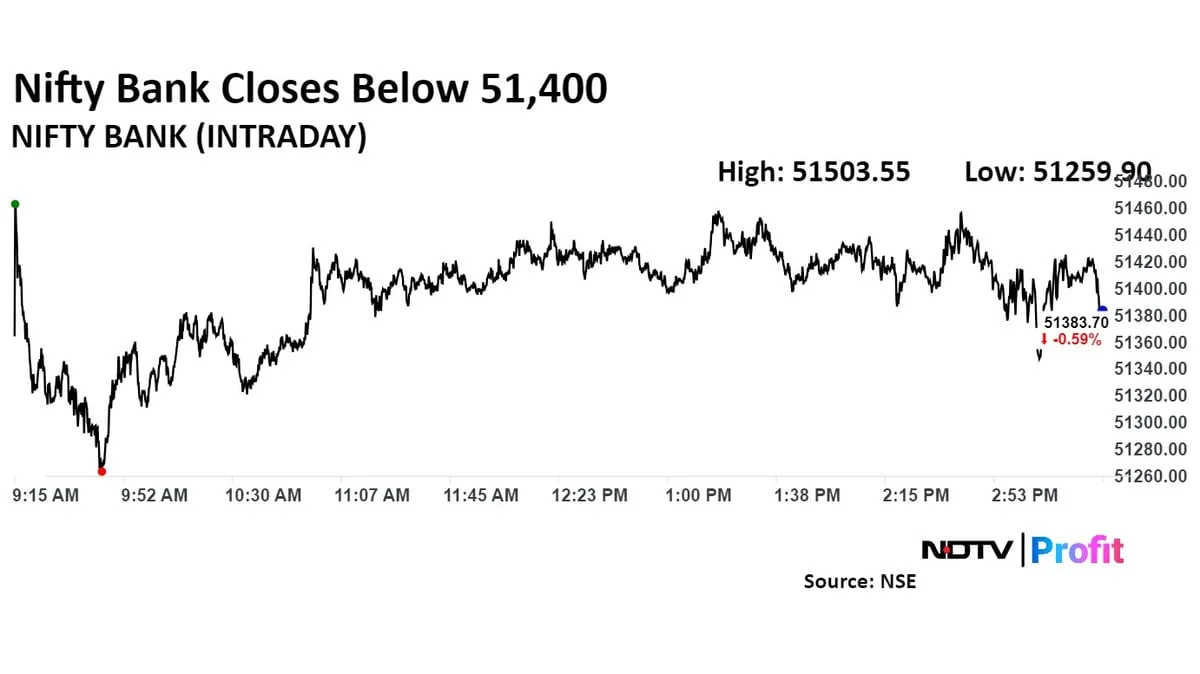

The NSE Nifty 50 ended 0.32% or 81.15 points, down at 25,198.70, while the S&P BSE Sensex declined 0.25% or 202.80 points, to close at 82,352.64. Intraday, the Nifty fell as much as 0.78% to 25,083.80 and Sensex plunged 0.87% to hit a low of 81,833.69.

SpiceJet’s Ajay Singh Plans To Offload 10% Stake In Rs 3,000-Crore QIP

Money Market

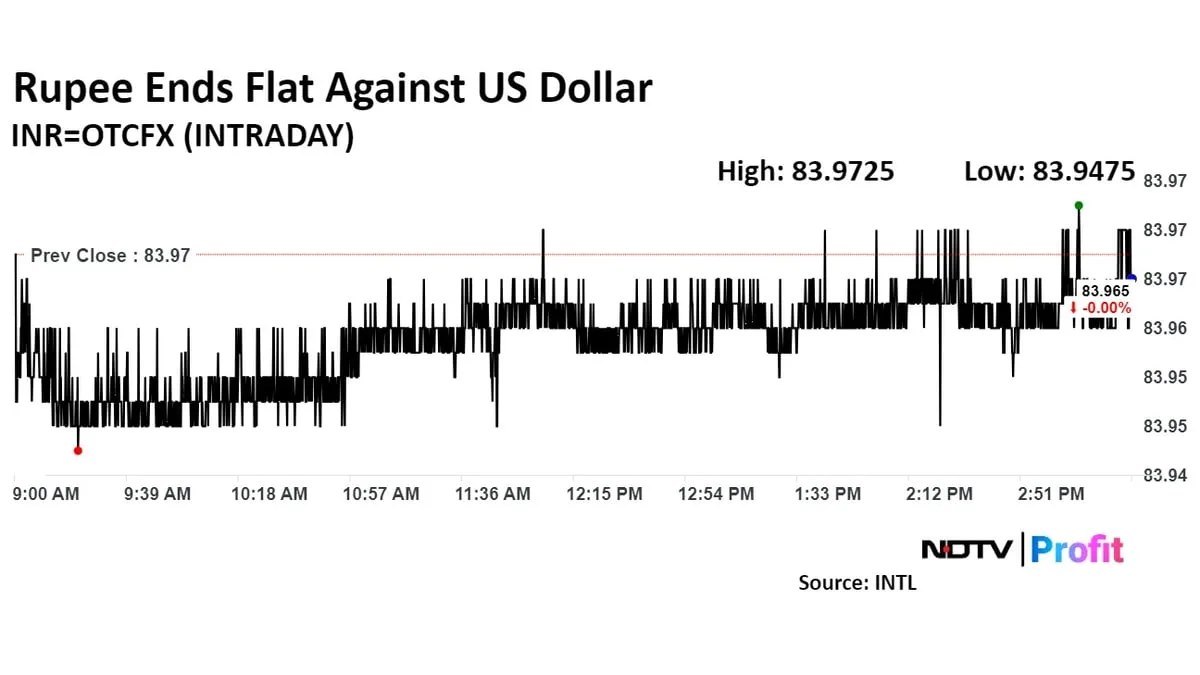

The Indian rupee closed flat against the US dollar on Wednesday as crude oil prices declined along with a weak dollar index.

The rupee closed at Rs 83.97 after opening stronger by two paise at Rs 83.95 against the US dollar, according to Bloomberg data. The domestic currency had closed at Rs 83.97 against the greenback on Tuesday.

Oil prices plunged almost 5% on Tuesday as weak global demand persisted on a possible easing of political unrest in Libya. Brent was hovering around $73 a barrel and West Texas Intermediate was below $70 for the first time since early January, according to Bloomberg.

Investors On The Rise: Uttar Pradesh Pips Gujarat In August Growth, Finds NSE | Infographic . Read more on Markets by NDTV Profit.