Shares of Trent Ltd. hit a record high for the second consecutive trading session on Monday after its profit more than doubled in the first quarter of fiscal 2025.

The company's net profit surged 134.1% year-on-year to Rs 391 crore in the quarter ended June 30, 2024, according to an exchange filing.

The retailer’s revenue rose by 56.2% to Rs 4,104 crore for the April-June quarter, as against Rs 2,628 crore in the same period last year.

Operating income, or earnings before interest, taxes, depreciation, and amortisation, rose 66.8% year-on-year to Rs 613 crore. The Ebitda margin expanded to 14.9% from 14% over the same period last year.

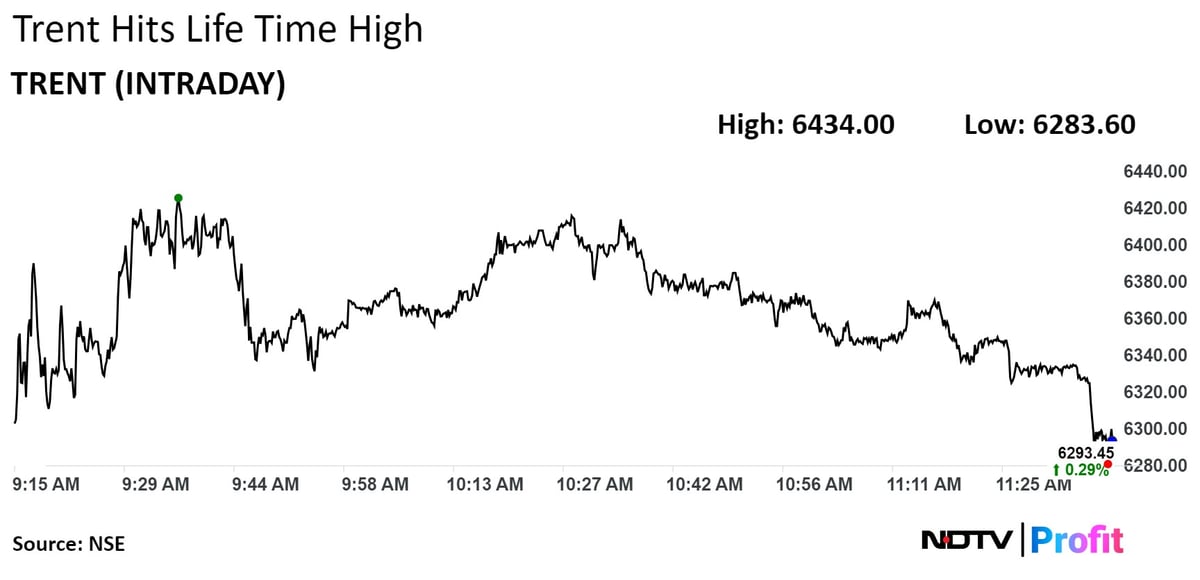

Shares of Trent rose as much as 2.53% before paring gains to trade 1.19% higher at Rs 6,349.95 apiece as of 11:27 p.m. This compares to a 0.43% rise in the NSE Nifty 50.

The stock has risen 228.20% in the last 12 months and 107.25% year-to-date. Total traded volume so far in the day stood at 4.0 times its 30-day average. The relative strength index was 70.38 indicating that the stock has been overbought.

Out of 20 analysts tracking the company, 11 maintain a 'buy', five suggest a 'hold' and four recommend a 'sell', according to Bloomberg data. The average 12-month analysts' consensus price target implies a downside of 8.1%.

Trent Q1 Results Review – Earnings Beat Continues: Motilal Oswal. Read more on Markets by NDTV Profit.