Table of Contents

(Bloomberg) –The US economy bounced back from the pandemic in stronger shape than previously estimated, spurred mainly by bigger consumer-fueled growth in 2022 and 2023, according to revised government data.

The comprehensive annual update from the Bureau of Economic Analysis showed a 5.5% average inflation-adjusted increase in gross domestic product from the second quarter of 2020 through 2023. The revised figure compared with a previously published 5.1% advance.

Overall, the revisions found that the economy grew $294.2 billion more in the five years ended in 2023 than previously reported. About two-thirds of that revision was due to stronger consumer spending.

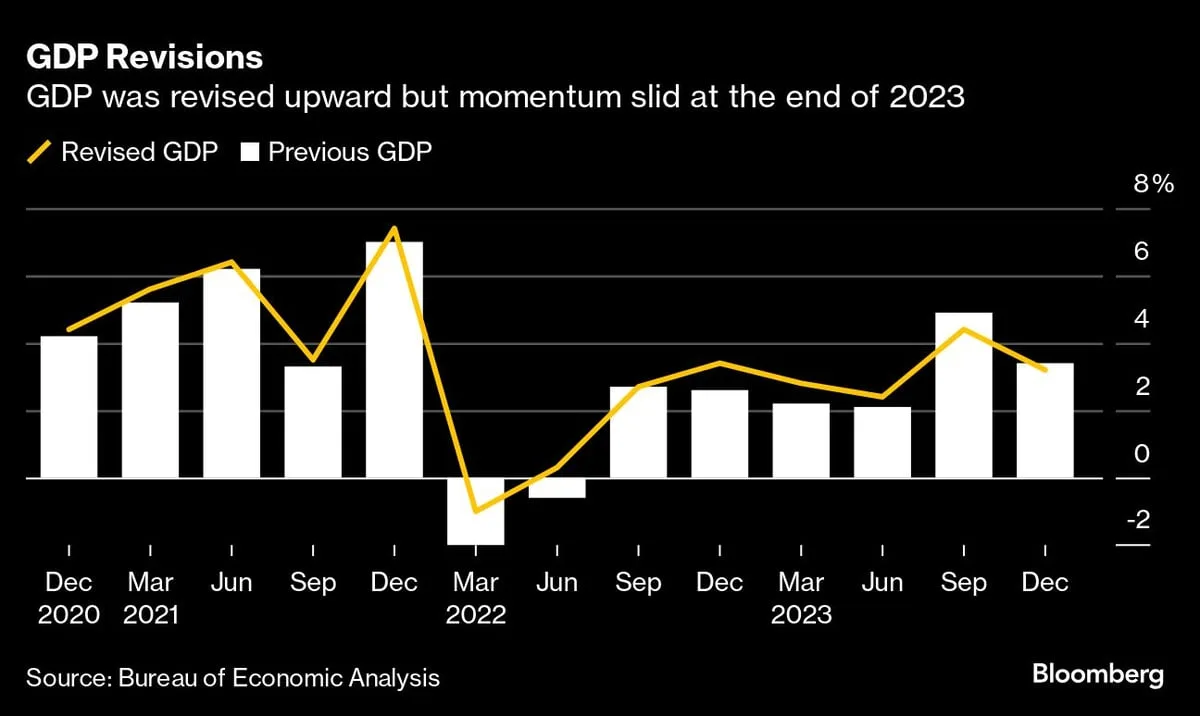

Growth last year was revised up to 2.9% from 2.5%, though the source of the adjustment was concentrated in the first half. GDP, while still robust, was revised down in the third and fourth quarters.

Real GDP advanced 2.5% in 2022, 0.6 percentage point stronger than previously estimated. Moreover, the updated figures now show that only the first quarter of that year experienced declining GDP rather than back-to-back quarterly decreases as initially reported.

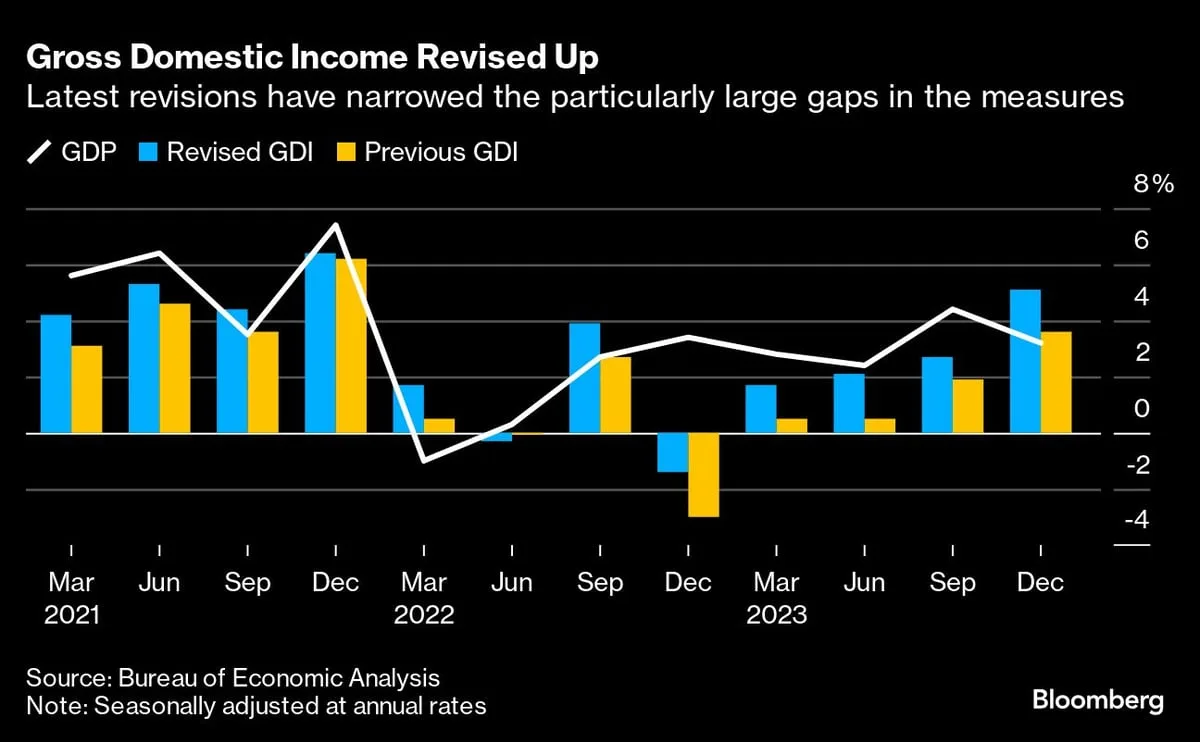

The government figures also showed an upward revision to 2023 gross domestic income, or the income generated and costs incurred from producing goods and services. Inflation-adjusted GDI growth last year was boosted to 1.7% from 0.4%.

US Consumer Confidence Falls Most In Three Years On Labor Views

Gross Domestic Product

Two things that stand out in the GDP portion of the update are the upward revision to second-quarter 2022 GDP and the modest softening of growth in the second half of last year. While still robust, growth was revised down 0.5 percentage point to 4.4% in the third quarter and 0.2 point to 3.2% in the fourth quarter of 2023 — indicating a little less momentum entering 2024.

For 2022, the government revised up second-quarter GDP to a 0.3% increase from a decline of 0.6%. Previously, the data showed consecutive quarters of declining GDP that had fit the traditional definition of a recession, but in the US it’s not official until economists at the National Bureau of Economic Research deem it so.

ADB Maintains India’s GDP Growth Forecast At 7% Amid Optimistic Outlook

Gross Domestic Income

The annual revisions bring GDI — the total income earned by all sectors of an economy, including wages, profits, taxes, and rental income, while excluding subsidies — closer to GDP. The BEA update boosted 2022 national income by $240 billion and 2023 by almost $559 billion.

In theory, GDP and GDI should be equal, but in practice, the measures can occasionally offer differing pictures of the economy. The latest revisions helped narrow the differences. In 2023, GDI growth was revised up to 1.7% from 0.4%. Growth in 2022 GDI was revised to 2.8% from 2.1% and in 2021 it was revised up half a percentage point.

The revisions show that the ancillary income some Americans receive was more robust than previously measured too. These types of personal income including interest income, dividends and proprietors’ income were marked higher in 2023. The strength may help explain why consumers were able to spend more freely than many thought possible.

The annual update also showed a sizable increase in corporate profits in the five years through 2023. Earnings were revised up $288.5 billion for 2023.

Inflation

The BEA update also showed the Federal Reserve’s preferred inflation metric — the personal consumption expenditures price index — was revised only a touch higher last year. The price gauge rose 3.8% in 2023 – up from the 3.7% previously estimated. Excluding food and energy, the so-called core PCE price index was unrevised at 4.1%.

Business Cycles

After an abrupt downturn of the economy because of the pandemic, the subsequent rebound was quite strong. That snapback reflected trillions of dollars in fiscal spending and a swift reduction in interest rates. The expansion that started in the second quarter of 2020 is so far among the best since the aftermath of World War II.

The BEA’s annual update is based on both newly available and revised data and includes revisions from the first quarter of 2019 through the fourth quarter of 2023.

US Dollar Is Close To Erasing 2024 Gains As More Fed Rate Cuts Loom. Read more on Global Economics by NDTV Profit.