(Bloomberg) — US Treasury yields surged after resilient US economic data prompted traders to lower their expectations of aggressive Federal Reserve interest-rate cuts this year.

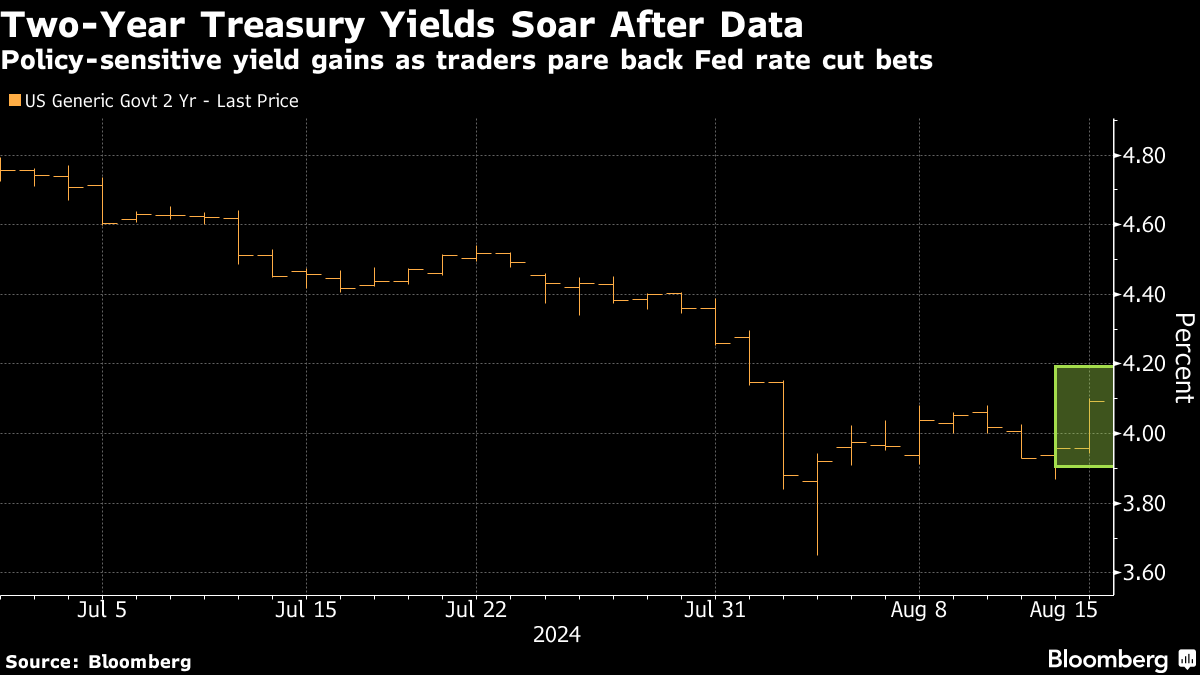

The move in Treasuries was led by the policy-sensitive two-year yield, which rose 14 basis points to 4.09% on Thursday after readings of US retail sales and jobless claims.

Traders pared back bets for a super-sized September rate reduction, pricing in less than 30 basis points of easing next month. They now see a total of 94 basis points of cuts for the remainder of 2024, down from more than 100 prior to the data.

US retail sales accelerated in July by more than forecast, suggesting consumers are resilient in the face of higher prices and borrowing costs. Initial applications for US unemployment benefits, meantime, fell for a second week to the lowest level since early July.

©2024 Bloomberg L.P.

. Read more on Bloomberg by NDTV Profit.